As a seasoned analyst with over two decades of experience in the crypto market, I have witnessed numerous bull runs and bear markets, making me well-equipped to navigate these volatile waters. The recent surge in Chainlink (LINK) has been nothing short of impressive, but the sudden pullback in the last 24 hours raises a few eyebrows.

The value of Chainlink (LINK) has soared to its highest point in three years, representing a remarkable 87% increase over the past month. Yet, within the last day, LINK has experienced a slight dip of almost 5%, hinting at possible short-term vulnerability.

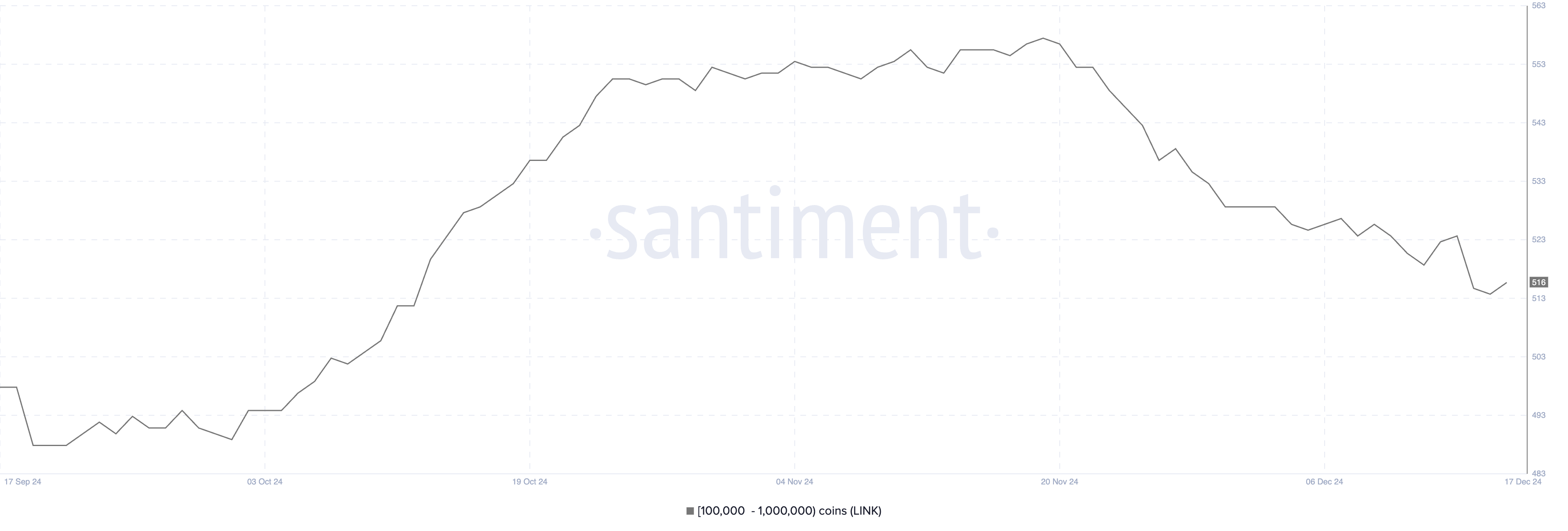

The number of significant whales (large investors) in the market has been gradually decreasing since late November, indicating that these major players might be exercising caution or taking profits.

LINK Whales Are Not Accumulating Since The End of November

The count of wallets containing between 100,000 and 1,000,000 LINK has decreased significantly, going from 558 (a peak reached on November 19) to the current 516. Over the past two weeks, this number has also dropped from 524 on December 14 to 515 on December 15, suggesting a decrease in large LINK holders over a short timeframe.

As a seasoned investor with years of experience navigating various financial markets, I have learned to closely watch trends and patterns to gain insights into market behavior. In my view, the recent decline in whale positions could be indicative of caution or profit-taking among these large-scale investors. This observation is based on my personal experience during similar market conditions, where whales often reduce their holdings as a risk management strategy or to secure profits. It’s essential to keep an eye on such movements and adapt our investment strategies accordingly.

Monitoring whale behavior is crucial since they, being substantial stakeholders, can exert considerable impact on market trends. A decrease in the number of these whales might indicate a decline in investor confidence or a change in sentiment among leading investors, potentially causing temporary selling pressure on LINK.

If this downward trend levels off or even improves, it might suggest increased buying activity, which could possibly lead to an uptick in prices within the short term.

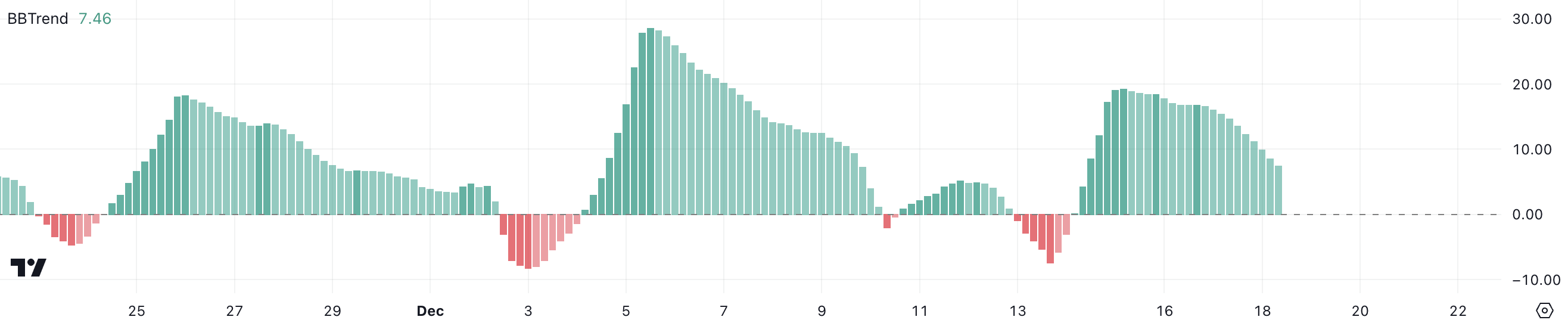

Chainlink BBTrend Is Declining

At the moment, the Chainlink BBTrend stands at 7.46, signifying an upswing that’s been ongoing since December 14. However, it’s worth noting that this trend appears to be losing strength following its peak of 19.31 on December 15.

The trend indicates that Chainlink’s price is still climbing, but its speed has decreased noticeably in the past few days, hinting at a possible short-term pause or reversal.

The BBTrend is an indicator that’s based on Bollinger Bands, which helps determine the power and direction of market trends. When the BBTrend value increases, it usually suggests a bullish trend, meaning prices are likely to rise. However, if the BBTrend decreases, it may indicate a weakening trend, possibly signaling a price drop.

If the BBTrend drops to 7.46, this might imply that the ongoing upward trend is starting to weaken. It could possibly mean a brief phase of sideways movement or a short-term correction, unless there’s a resurgence of buying activity.

LINK Price Prediction: Can LINK Fall Below $20 Soon?

As a researcher analyzing the market trends of LINK, I’m observing that at present, the short-term Exponential Moving Averages (EMA) are hovering above their long-term counterparts, indicating a bullish stance. However, it’s essential to note that my short-term EMAs are showing a declining trend. If these short-term averages were to drop below the long-term ones, this potential crossover could serve as a warning sign, suggesting a possible shift towards a bearish market scenario.

Should the $26.89 level prove insufficient, the LINK price might continue to drop, possibly reaching as low as $22.41 or even dipping towards $19.56.

If the upward trend picks up speed again, the LINK price might bounce back and challenge the resistance at $30.94. This figure would be a significant objective for bulls to regain dominance and maintain the overall ascending trend.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2024-12-19 00:01