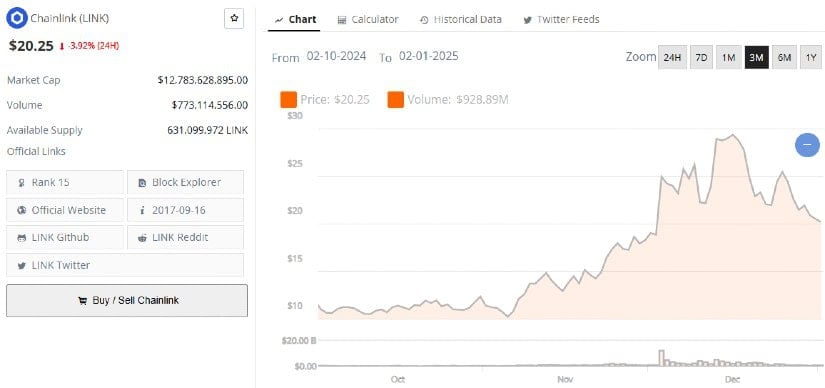

By December 30, 2024, the LINK token is valued at $20.25, which represents a 35% decrease from its highest point this year. This decline echoes the slump experienced by Bitcoin and other significant altcoins, as the overall cryptocurrency market grapples with maintaining its pace.

In spite of the temporary obstacles, certain experts remain hopeful about Chainlink’s long-term prospects, suggesting a possible rebound by 2025.

Technical Analysis: A Risky Pattern

Technically speaking, Chainlink’s price chart indicates a potential warning sign. After reaching a high of $31 in early December, the price trend has been generally declining. The four-hour chart highlights a significant aspect: it appears to be forming a head-and-shoulders pattern. Historically, this pattern can serve as a precursor for reversals, implying that further drops might occur.

The cryptocurrency LINK has dropped beneath its 50-period Exponential Moving Average and is now at the halfway point of the 50% Fibonacci retracement. If this decline persists, experts predict that LINK may fall even lower to approximately $18, which represents the 61.8% Fibonacci level. If the price falls below this point, it might reach a psychological support level at $15.

Expert Predictions for 2025 and Beyond

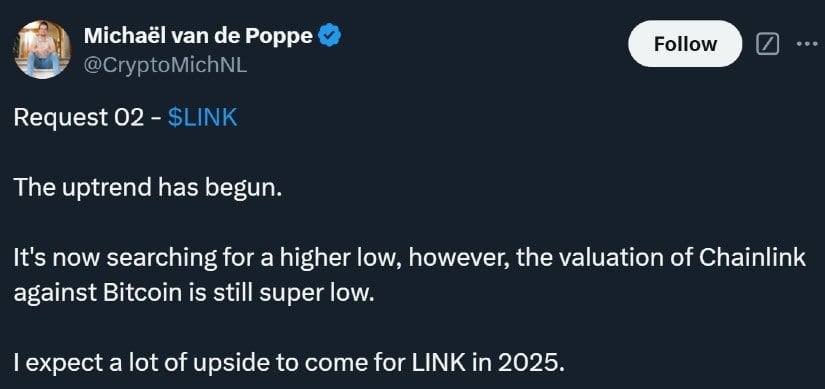

Despite the present volatile market conditions, several cryptocurrency experts remain optimistic about Chainlink’s future prospects. Notably, Michael van de Poppe, a well-known crypto analyst, recently suggested that after experiencing some difficulties lately, Chainlink is now aiming for “higher lows.” He further stated that its value in relation to Bitcoin is currently underestimated. Based on increased adoption and market demand, he anticipates substantial growth potential for the token over the next few years, with a positive outlook for 2025.

As a crypto investor, I’ve noticed that Chainlink’s robustness stems from its role as the leading oracle service provider in the decentralized world. More recently, it has made asset transfers between blockchain networks a breeze with the Cross-Chain Interoperability Protocol. This opens up significant growth opportunities in rapidly evolving DeFi markets, which could potentially boost its price as well.

Strategic Partnerships and Technological Advancements

A crucial part of Chainlink’s comeback story is its constant innovation and strategic alliances. Notably, the project has forged significant ties with prominent companies such as Donald Trump’s World Liberty Financial, who have chosen Chainlink for their oracle services. Furthermore, in this collaboration, World Liberty Financial invested close to 2 million dollars in LINK tokens.

Furthermore, over $18.2 trillion in transactions processed through Chainlink’s network since 2022 highlights the crucial part the company plays within the DeFi (Decentralized Finance) ecosystem. Additionally, its significant partnerships with established financial institutions like Vontobel and UBS serve to bolster its reputation in traditional finance.

Linking Blockchain to the Real World

One distinct advantage of Chainlink lies in its capability to connect blockchain smart contracts with real-world data, making it a crucial component in the developing world of tokenized real-life assets. As sectors such as decentralized insurance and transparent supply chains expand, there’s an anticipated rise in the need for trustworthy data providers like Chainlink.

In 2024, Chainlink officially endorsed the Cross-Chain Token Standard, emphasizing its significance within the cryptocurrency sector. This innovative framework facilitates token transfers across various blockchain networks, with popular tokens like Shiba Inu and Floki already being integrated.

Chainlink Price Predictions for 2025 and Beyond

As a researcher, I’m eagerly looking forward while maintaining a balanced optimism about Chainlink’s future trajectory. For instance, numerous price predictions for 2025 suggest that the value of LINK could significantly increase. One such prediction anticipates that the price range by the year-end 2025 might fall within the ballpark of $35 to $42 per token. This projection is primarily driven by the rising institutional interest in the project, continued advancements in AI and blockchain integration, and the expansion of DeFi and Web3 sectors.

By the year 2030, there’s a possibility that Chainlink could escalate to around $259, given ongoing adoption and advancements in network technology. However, it’s crucial to remember that the cryptocurrency market is inherently volatile, so these predictions are subject to numerous variables such as market trends, potential regulatory changes, and overall economic conditions.

Caution Amid Optimism

During this phase of market turbulence, Chainlink’s capacity for recovery stays strong, fueled by its technological innovations and strategic importance within the DeFi industry. Although the head and shoulders pattern may signal potential risks in the immediate future, the long-term perspective seems optimistic. It is essential for investors and observers to closely monitor the overall market movements and upcoming events related to Chainlink, as these factors will significantly impact its future course.

In simpler terms, even during tough economic times, Chainlink has proven resilient. Its robust partnerships and continuous innovation provide it with a solid foundation for rebounding and growing in the future.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-06 16:24