As an analyst with over a decade of experience navigating the tumultuous world of finance and cryptocurrency, I’ve witnessed more than my fair share of ups and downs. The latest payout from Celsius, while a step forward, falls short of offering the meaningful relief that many creditors desperately need. It’s like giving someone a Band-Aid when they’re bleeding out—it might stop some of the pain temporarily, but it doesn’t solve the underlying problem.

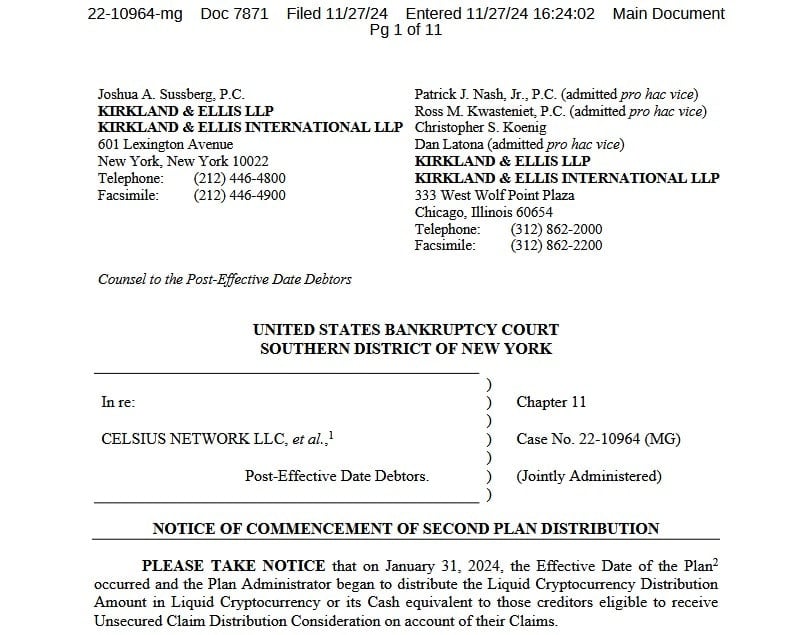

The most recent distribution, accounting for around 2.75% of all claims, raises Celsius’ total creditor recovery to approximately 60%. Eligible creditors come from various categories such as retail deposits, unsecured loans, and general earnings. However, those with convenience class claims are not included. The majority of the funds will be dispersed in cryptocurrency, with an average Bitcoin price of $95,836 per coin—markedly higher than the cryptocurrency’s market value at Celsius’ bankruptcy filing in July 2022.

Transactions will be handled via platforms like Coinbase, PayPal, Venmo, or cash for those who can’t accept cryptocurrency. But, before they receive their payouts, creditors are required to go through rigorous KYC/AML verification processes.

The recent disbursement is a continuation of the $2.53 billion payout made earlier this year to approximately 251,000 creditors, which accounted for about 57.65% of claims. However, critics assert that this latest payment, while progress, does not provide substantial aid to those who suffered severe financial losses. Many creditors believe that the trust they placed in Celsius was at a high price, and the distribution does not accurately represent the extent of their struggles.

In July 2022, Celsius sought protection from bankruptcy following the disclosure of a $1.2 billion deficit in their financial records. Originally known as a pioneer in crypto lending, the downfall of this platform occurred during a wider cryptocurrency slump initiated by the collapse of Terra’s LUNA/UST. At the point of filing for bankruptcy, Celsius is said to have managed around $4.7 billion in customer assets but possessed only $167 million in available funds.

As an analyst, I’ve encountered hurdles in my attempts to settle creditor disputes, primarily due to logistical issues and allegations of mismanagement. The transformation of Celsius’ mining subsidiary into Ionic Digital has been marred by internal strife, with numerous executive departures. Some creditors have advocated for its liquidation, expressing doubts about its ability to thrive as a public company by 2025.

Legal Troubles Add Complexity

The ongoing legal proceedings against Alex Mashinsky, the ex-CEO and co-founder of Celsius, are complicating the bankruptcy case. He stands accused of seven criminal offenses for misleading investors about the platform’s risks, specifically fraud and market manipulation. His request to dismiss these charges was denied, leading to a scheduled trial in January 2025. If found guilty, Mashinsky could face up to 115 years in prison.

Additionally, Celsius is currently facing increased regulatory oversight due to lawsuits filed by the Federal Trade Commission (FTC) and the U.S. Securities and Exchange Commission (SEC). Critics argue that these legal disputes divert attention away from making payments to creditors.

Broader Context of Crypto Bankruptcies

Celsius isn’t the only one facing difficulties. Companies like Voyager Digital and BlockFi, who also declared bankruptcy, have found it challenging to repay their creditors, frequently returning just a portion of what was owed. On the other hand, FTX, which filed for bankruptcy in November 2022, is working on a repayment plan but hasn’t started making distributions yet.

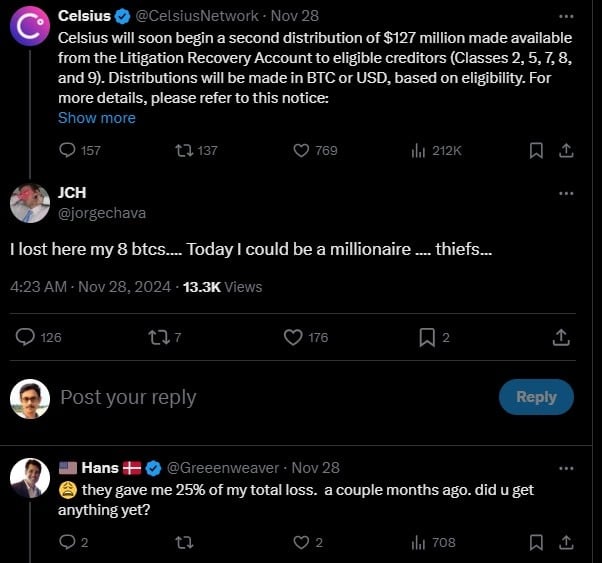

Although Celsius’ repayment attempts show some progress compared to others, many lenders are still discontented. Social media platforms are filled with criticisms from users who assert that the company’s actions have led them to a financial catastrophe.

The Celsius case highlights the hazards involved with uncontrolled cryptocurrency lending platforms. Critics believe that its failure exemplifies the cryptocurrency industry’s overall lack of accountability. For creditors, the second payout offers some relief but highlights the enduring challenges of recovering losses from crypto collapses.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-11-29 14:40