celestia’s (TIA) value has significantly decreased, plummeting over 15% in just 24 hours and nearly 40% during the past month. Currently, its market capitalization stands at $2.2 billion. This slide comes amidst a wave of bearish signals that have taken control of technical indicators, with a recent death cross formation indicating a possible continuation of this downward trend.

Currently, TIA is finding crucial support near $4.54. However, the broader market outlook continues to show a predominantly negative sentiment. For TIA to bounce back, it needs to breach the resistance at $5.50; however, the present trend suggests that sellers are currently dominating the market.

TIA Downtrend Is Getting Stronger

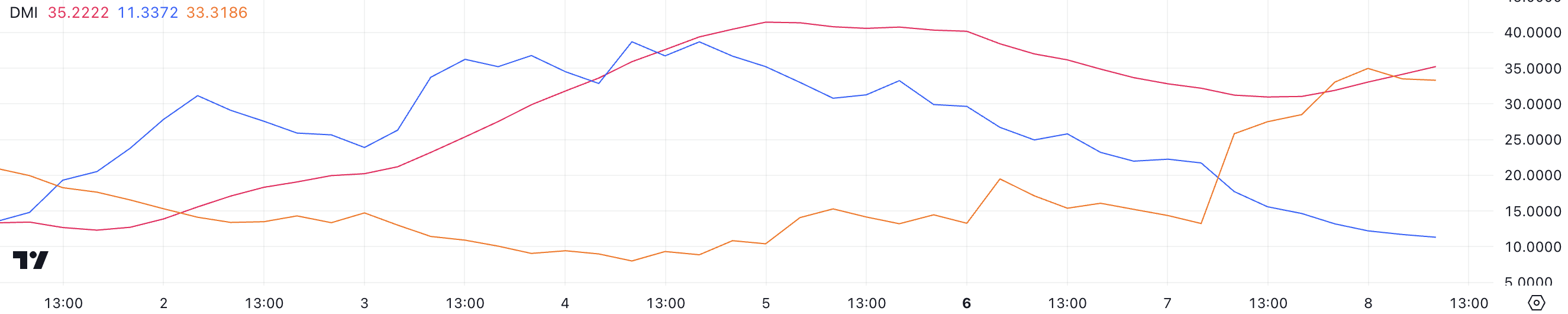

Right now, the Average Directional Index (ADX) for TIA is at 35.2, which is an increase from its value of 31.2 yesterday. This upward shift suggests a growing strength in the market trend. The ADX serves to quantify the intensity of a trend, be it bullish or bearish, ranging from 0 to 100. Values greater than 25 point towards a strong trend, whereas values below 20 suggest either weak or non-existent momentum.

The increasing Average Directional Index (ADX) suggests that TIA’s present downward trend is strengthening, indicating an escalation of selling activity within the market.

The directional indicators offer more understanding about how the trend is unfolding. The plus DI (buy signal) has dropped dramatically from 22.2 to 11.3, suggesting a substantial decrease in bullish strength. At the same time, the minus DI (sell signal) has increased notably from 14.3 to 33.3, showing an increase in bearish activity.

This pairing of decreasing Positive DI (DI+) with increasing Negative DI (DI-) indicates that sellers currently hold dominance. This implies that the value of Celestia might keep experiencing a downtrend unless there’s an increase in buying activity strong enough to counterbalance the bullish trend’s momentum.

Ichimoku Cloud Shows a Bearish Momentum for Celestia

The Ichimoku Cloud chart demonstrates that TIA’s price has fallen significantly below the cloud, signifying a robust downward trend. Moreover, the red cloud composed of Senkou Span A and Senkou Span B indicates potential resistance ahead due to its horizontal orientation, which remains above the current price, implying no imminent change in market sentiment towards an upturn.

The graph’s blue Tenkan-sen line (representing short-term average) and orange Kijun-sen line (indicating medium-term average) have moved apart, with the blue line sitting beneath the orange. This separation suggests a downtrend or bearish movement in the market.

Furthermore, the Chikou Span, represented by a green line, is positioned beneath both the price and the cloud, indicating a strong downtrend and a prevailing bearish mood in the market at present. Any potential signs of recovery would require TIA to re-enter the cloud; however, given the current signals, this seems improbable.

TIA Price Prediction: Will It Test $4.10 Soon?

Lately, the appearance of a ‘death cross’ indicator for Celestia has strengthened its downward trend, leading to further price drops. A death cross happens when a brief moving average dips beneath a longer moving average, possibly indicating an upcoming extended period of falling prices.

This technological advancement indicates that a pessimistic outlook prevails at the moment, exerting a pulling effect on the price fluctuations of TIA.

Regardless of the current pessimistic trend, the Token of Internet Achievements (TIA) has a crucial support point at $4.54. Should this support fail, the price might proceed downward towards $4.16, suggesting a more significant price adjustment.

If TIA successfully recovers and begins to trend upward, it might target its next significant resistance level at around $5.50.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DEXE PREDICTION. DEXE cryptocurrency

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- General Hospital Spoilers: Will Willow Lose Custody of Her Children?

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- SDCC 2024: Robert Downey Jr. Confirms MCU Return As Dr Doom In Avengers: Doomsday

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2025-01-09 05:50