Cathie Wood, the CEO of Ark Invest, has built her reputation on bold gambles-investing in companies that promise to upend old industries with revolutionary ideas. Her focus is often on financial services, biotech, and technology. In the realm of artificial intelligence (AI), it’s no surprise that Palantir Technologies, a leader in data analytics, holds a prominent place in Ark’s portfolio. Yet, as predictable as her affinity for disruptive stocks may seem, Wood occasionally steps back from the high-risk frontier to consider something more established. This time, her gaze has turned to L3Harris Technologies, a name less flashy than Palantir but equally significant in the evolving landscape of national security.

While Palantir remains a cornerstone of Ark’s strategy, recent purchases suggest Wood is widening her scope within the defense sector. She is quietly accumulating shares of L3Harris in two of Ark’s funds: the ARK Space Exploration & Innovation ETF and the ARK Autonomous Technology & Robotics ETF. What might have drawn her attention to this company, and should other investors follow suit?

The Role of AI in Modern Defense

Artificial intelligence has become the defining force reshaping industries, yet its impact on defense is often overlooked. While much of the conversation orbits around consumer technologies like chips and cloud infrastructure, AI is quietly revolutionizing military operations. From analyzing satellite imagery to detecting cyber threats, AI is embedding itself into the sinews of national security. Unmanned systems, predictive maintenance for equipment, and autonomous navigation are no longer speculative-they are realities being deployed by militaries worldwide.

Among the giants of the defense industry-Northrop Grumman, Lockheed Martin, Boeing, and others-Palantir stands out for its distinct approach. Its platforms, such as Foundry and Gotham, serve as the backbone for numerous military operations, securing contracts worth billions. But even in this crowded field, L3Harris has carved out a niche that makes it an intriguing prospect for forward-thinking investors.

Why L3Harris Captured Cathie Wood’s Attention

What sets L3Harris apart? Like its peers, the company manufactures systems critical to modern warfare, but it also occupies a unique position at the intersection of traditional defense contracting and emerging AI-driven capabilities. It is plausible that Wood sees L3Harris as a stealthy complement to Ark’s more overtly tech-focused holdings, such as Palantir. The logic here mirrors her investments in companies like Kratos Defense and AeroVironment-businesses that blend legacy expertise with cutting-edge innovation.

A closer look reveals a more specific reason for her interest. L3Harris is collaborating with Palantir on the U.S. Army’s Titan program, which aims to develop next-generation ground transportation systems. During the company’s second-quarter earnings call, CEO Christopher Kubasik underscored the partnership, stating, “Our ongoing collaboration with Palantir on the Titan program continues to mature.” Such alliances hint at L3Harris’s potential to ride the wave of AI integration in defense-a trend that is only beginning to gain momentum.

Is L3Harris Stock Worth Buying?

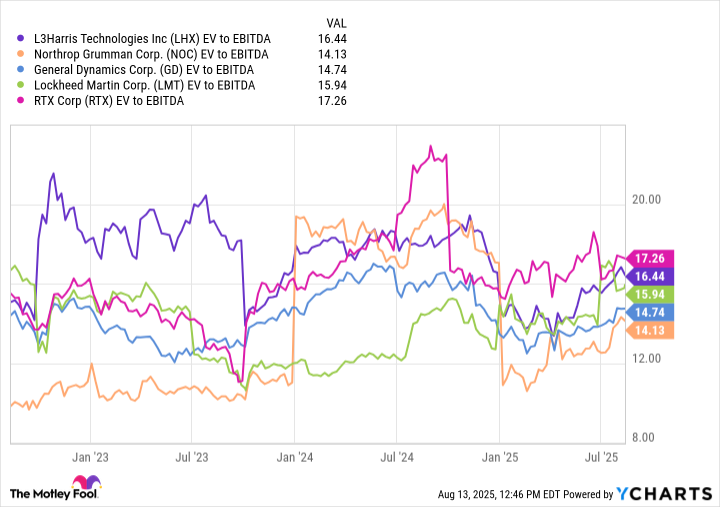

To assess whether L3Harris represents a sound investment, one must examine both its valuation and its prospects. On an enterprise value-to-EBITDA basis, the company trades at a multiple of 16.4, slightly above its peers. Analysts tend to view L3Harris through the lens of a conventional defense contractor, valuing it based on current contracts and pipelines. However, this perspective may be shortsighted.

The transformative power of AI in defense is still underappreciated by the market. As the Pentagon increasingly prioritizes AI-enabled services, companies like L3Harris could see their roles redefined. Their collaborations with tech leaders such as Palantir position them to benefit from this shift. For now, L3Harris’s stock price does not fully reflect the potential upside of deeper AI integration. In the long term, however, this could change.

Investors seeking exposure to the convergence of defense and technology would do well to consider L3Harris. It is not without risks, but its strategic positioning and growing ties to AI make it a compelling choice. For those willing to look beyond the familiar names, there lies opportunity-quiet, perhaps, but undeniable. 🌟

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2025-08-16 13:32