Cathie Wood has cultivated a reputation on Wall Street for her knack for identifying the next big thing. You know the type: a bold visionary who sees potential where the rest of us merely see clutter. It’s similar to the way my mother once insisted I was “gifted” at sorting out the family junk drawer, despite most of my family secrets featuring prominently in my efforts to offload expired coupons and broken battery-operated gadgets.

Now, as she navigates the dizzying waters of AI stocks, Wood doesn’t just paddle about with her more speculative investments. No, she also grabs onto some reputable blue chips with something akin to desperation-like my attempts to steal cookies from the jar while simultaneously ensuring my mother doesn’t catch me in the act.

It’s hardly shocking that Ark’s portfolio boasts sky-high growth stocks like Palantir Technologies, CrowdStrike, and CoreWeave. Tucked away in this treasure trove, however, are some decidedly sober members of the “Magnificent Seven,” who seem to be feasting on those same crumbs of disruption.

In a turn worthy of the most surprising family Thanksgiving revelations, it was late July when Ark picked up a hefty 181,640 shares of Alphabet (GOOGL) (GOOG), as if she somehow identified Alphabet as the quirky cousin no one really talks about but secretly misses at holiday gatherings.

the Wall Street skeptics proclaim the rise of sporadic competition means Alphabet is on the chopping block. Here we find ourselves scrutinizing its operating margin of 40%, which seems more stagnant than my cousin Jeff’s sense of style. When revenue grows but expenses keep pace, it can feel like perpetrating a financial freeze frame: interesting, but not particularly promising. Yet, do I sense a deep breath of potential exhaled amidst the palpitations of worry? Perhaps.

Alphabet isn’t merely idling in a state of bewilderment while the world spins on its axis. For instance, they snatched up cybersecurity start-up Wiz for a whopping $32 billion, pouring capital into their AI data centers-efforts that might soon be seen as the warm-up before catching the real wave of success. And their quiet foray into quantum computing through custom chipsets called Willow adds yet another layer of intrigue, hinting at a robust rhythm this tech giant hopes will attract even the likes of OpenAI into its cloud orbit.

Is Alphabet stock a buy right now?

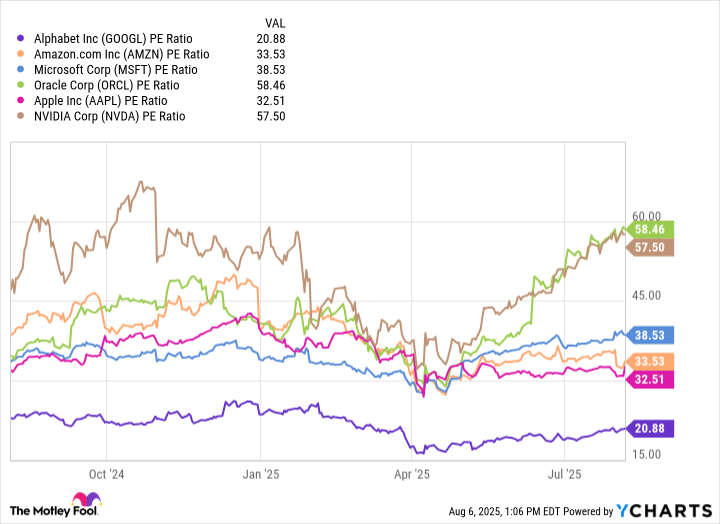

As I stand before the altar of price-to-earnings (P/E) ratios, Alphabet’s valuation feels like looking at a slightly wilted, yet still fragrant bouquet of flowers. It is crushed under the weight of investor disappointment for not being the sparkling diamond among its flamboyant tech peers.

Despite the dim candles flickering in valuation multiples, I see a flicker of resilience in the company. Alphabet continues to notch revenue growth while forming partnerships that could send shockwaves through traditional business models. Smart, calculated investments dominate the backdrop of their narrative, crying out for attention amid the constant ruckus of the marketplace. If we’re rating parties, I’d argue the gloomy guest corner of AI debate seems to have relegated Alphabet to the ‘note this to talk about in therapy’ column. Yet I declare it a ripe moment for valuation expansion that just may defy all gloomy forecasts.

Ultimately, in the vast sea of inflated tech stocks, Wood’s shrewd eye has spotted a deal within the chaos. I view Alphabet as an astonishingly well-disguised opportunity for long-term investors. It’s the stock equivalent of many family gatherings: a mixture of chaos, revelation, and the smell of secretly baked cookies. As investors, let’s lean into that sweet spot of stability, shall we? 🍪

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-09 21:12