YOU KNOW WHAT THEY SAY ABOUT CATERPILLAR (CAT)? IT’S LIKE A DRUNK SQUIRREL ON A TRAMPOLINE-BOUNCING OFF EVERY BULLISH RUMOR AND INFRASTRUCTURE DREAM. UP 32% YTD? THAT’S NOT A STOCK, THAT’S A FREAKIN’ FIREWORK. BUT IS THIS THE REAL DEAL OR JUST A MIRAGE? LET ME TELL YOU, THE DIVIDEND HUNTER IN ME IS SCREAMING, “CHECK THE CASH FLOW!”

THEY’RE SELLING CONSTRUCTION MACHINERY, MINING GEAR, AND POWER GENERATION STUFF. IT’S LIKE A CIRCUS BUT WITH MORE STEEL AND LESS CLOWNS. THE AI/DATA CENTER ANGLE? THAT’S THE WHISKER ON THE CAT’S FACE-SLEEK, SHINY, AND POTENTIALLY A TRAP.

Caterpillar’s stock is riding a wave

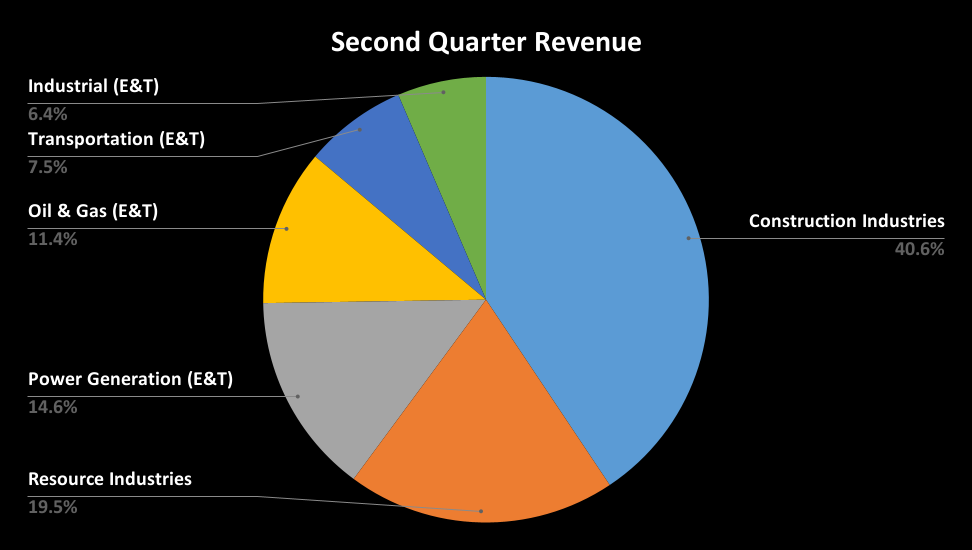

FOUR SEGMENTS? MORE LIKE FOUR WHEELS ON A CATERPILLAR TRUCK. CONSTRUCTION INDUSTRIES? THAT’S THE BUILDER OF ROADS, SKYSCRAPERS, AND YOUR DREAMS. RESOURCE INDUSTRIES? MINING, QUARRYING, AND AGGREGATES-LIKE THE EARTH’S BLOOD. ENERGY AND TRANSPORTATION? OIL, GAS, MARINE, RAIL. IT’S A FREAKIN’ MELTDOWN OF INDUSTRIES.

SEE THAT CHART? IT’S THE STOCK’S BLOOD PRESSURE. POWER GENERATION? THAT’S THE NEW FAVORED CHILD, DRIVEN BY DATA CENTERS AND AI. IT’S LIKE THE STOCK IS WHISPERING, “I’M NOT JUST A MACHINE-I’M A FUTURE.”

CEO JOSEPH CREED SAID, “ENERGY & TRANSPORTATION SALES TO USERS INCREASED BY 9%. POWER GENERATION GREW BY 19%-PRIMARILY DUE TO RECIROCATING ENGINES FOR DATA CENTER APPLICATIONS.” THAT’S NOT A BUSINESS PLAN, THAT’S A PRAYER.

THE BULLISH CASE? IT’S LIKE A DRUG DEALER SELLING HOPE. SOLID DEMAND, SECULAR GROWTH, AND A COMMODITY SUPERCYCLE THAT COULD MAKE YOU RICH… OR BANKRUPT.

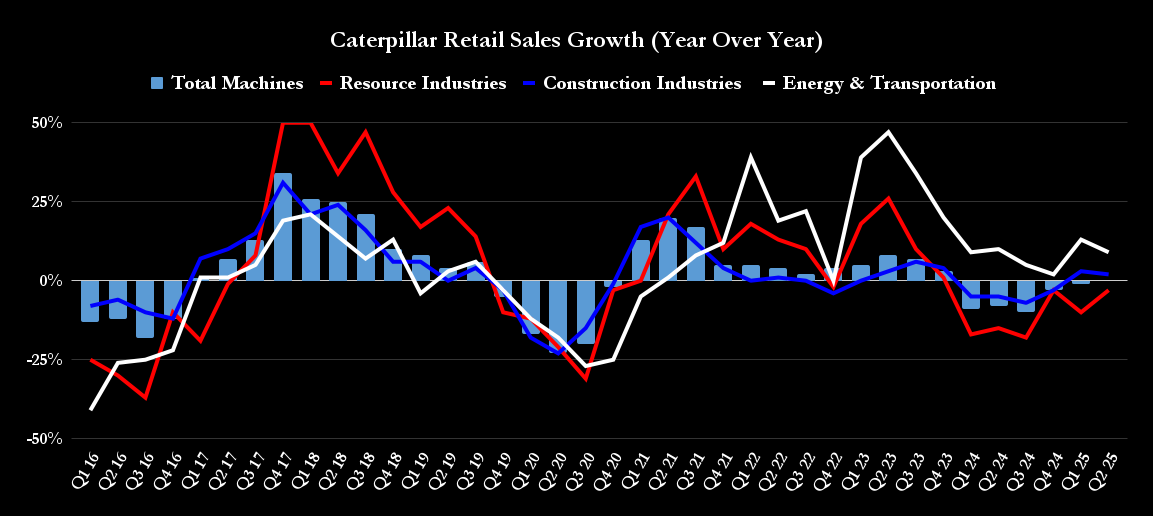

THE RETAIL SALES CHART? IT’S THE STOCK’S PULSE. E&T IS THE STAR, BUT CONSTRUCTION INDUSTRIES IS BACK IN THE GAME. IT’S LIKE A FIGHT CLUB BUT WITH MORE EQUIPMENT.

COMMODITY SUPERCYCLE? THAT’S THE DIVIDEND HUNTER’S DREAM-COPPER, LITHIUM, NICKEL. BUT IT’S ALSO A RISKY GAMBLE. YOU’RE BETTING ON A FUTURE THAT MIGHT NOT SHOW.

The bearish case for Caterpillar stock

BUT HERE’S THE THING: CATERPILLAR IS A CYCLICAL BEAST. CONSTRUCTION INDUSTRIES? IT’S LIKE A DRUNK ON A PULSING RIDE. COMMODITY-RELATED REVENUE? IT’S THE STOCK’S STOMACH-FULL OF UNCERTAINTY.

TARIFFS? THEY’RE THE STOCK’S DEMENTED UNCLE, COMING IN WITH $1.5 TO $1.8 BILLION IN COSTS. THAT’S ENOUGH TO MAKE A DIVIDEND HUNTER SWEAT.

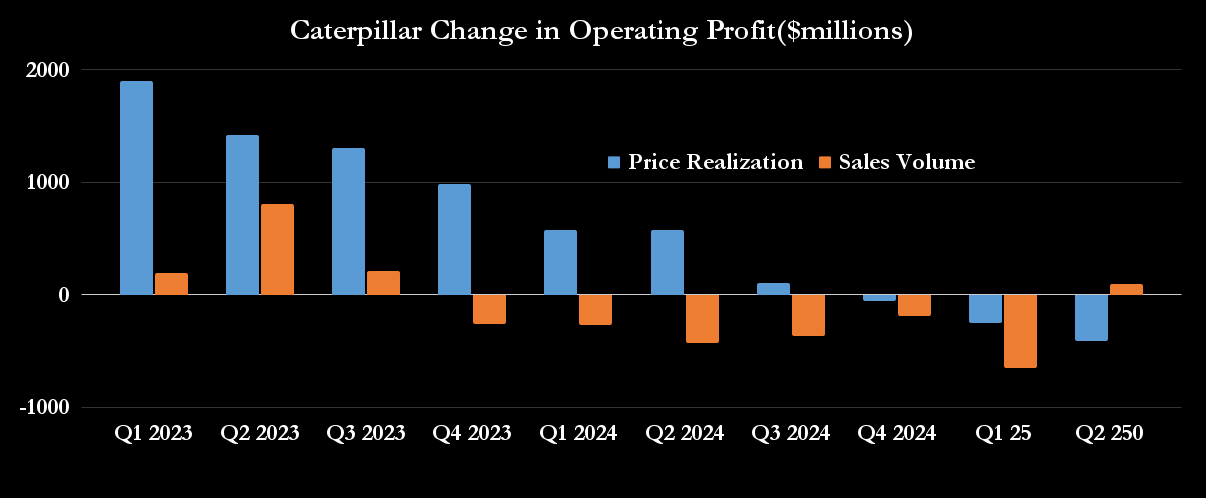

PRICE REALIZATION? IT’S THE STOCK’S LAST DITCH EFFORT TO STAY ALIVE. BUT IN 2025? IT’S LIKE TRYING TO PULL A RABBIT OUT OF A HAT-IT’S NOT WORKING.

Is Caterpillar stock a buy?

CATERPILLAR’S PRICING POWER IS WEAKENING. ITS TARIFF COSTS ARE RISING. AND IT’S TRADING AT 29 TIMES FCF. THAT’S NOT A VALUATION-THAT’S A GAMBLE.

THE INFRASTRUCTURE AND DATA CENTER ANGLE? IT’S A SHINY OBJECT. BUT A COMMODITY SUPERCYCLE? THAT’S A MYTH. YOU’RE BETTING ON A FUTURE THAT MIGHT NOT EXIST.

SO, IS IT A BUY? IF YOU’RE A DIVIDEND HUNTER, YOU’RE LOOKING FOR STABILITY. CATERPILLAR? IT’S LIKE A DRUNK ON A MOTORCYCLE-FASCINATING, BUT DANGEROUS.

THE DIVIDEND HUNTER IN ME SAYS: WAIT. OBSERVE. DON’T JUMP. BUT IF YOU’RE READY TO ROLL THE DICE, THIS IS THE TABLE.

🚜

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2025-09-29 15:41