The Trade Desk’s 5-Year Investment Journey

However, the intervening months have rewritten this narrative.

However, the intervening months have rewritten this narrative.

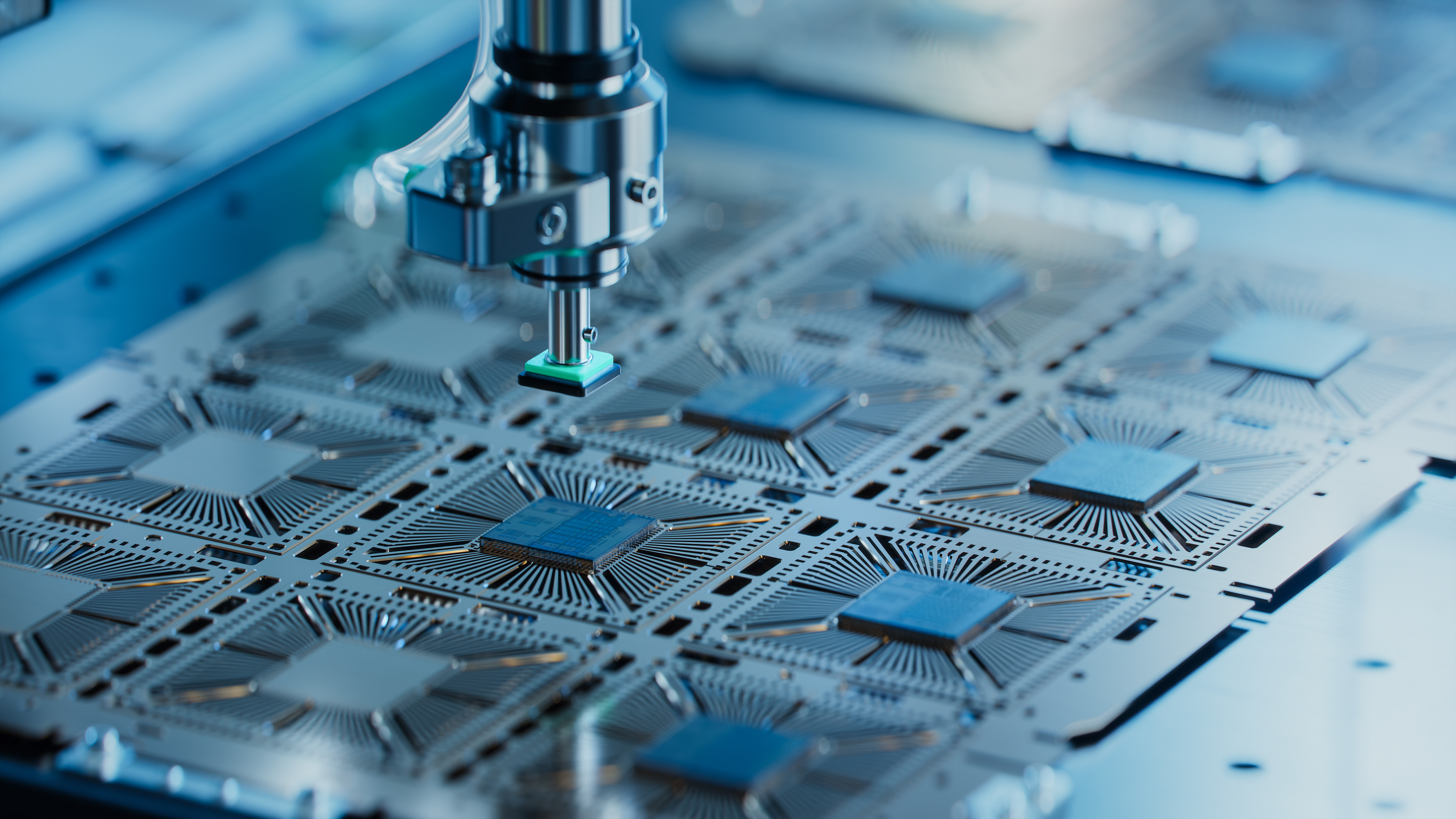

Taiwan Semiconductor Manufacturing (TSM) is not merely a company. It is a celestial forge, where silicon wafers are transformed into the lifeblood of modern civilization. From smartphones to data centers, TSMC’s chips are the unsung heroes of an age where even toasters have opinions. Gartner, that paragon of earthly wisdom, notes that 80% of generative AI spending this year will be on hardware. In other words, if AI is the cake, TSMC is the oven-and the flour, and the recipe, and the person who forgot to turn off the oven timer.

Rivian has attempted to establish a foothold in the EV arena, yet the tumultuous market conditions may significantly elongate its trajectory toward profitability. The following analysis outlines potential advantages and disadvantages the automaker may encounter in the coming five years.

In a world enamored with speed, Micron’s high-bandwidth memory (HBM) caters to the fastidious needs of AI accelerator graphics processing units (GPUs). These chips, capable of zipping vast troves of data around with exquisite low lag, practically whisper sweet nothings to the energy calculator. With whimsical surplus demand for AI chips, Micron’s HBM has enjoyed a robust ascendance-one must wonder if this growth is indeed a product of foresight or merely the flotsam of a speculative tide.

So, what’s the deal? After a particularly bruising earnings report yesterday-followed by an investor call full of “Hey, don’t worry, everything’s fine” pep talks-the stock did what stocks tend to do when there’s too much hopeful speculation and too little actual meat on the bone. It tanked. A lot of investors were hoping for quick action, but all they got was some vague promises and a target date that could, in some twisted universe, feel like an eternity from now.

Among the hopefuls in this skybound scramble is Joby Aviation (JOBY), a company currently in the “early innings” of development, which is investor code for “we haven’t made any money yet, but we’re working on it.” It’s not certified to fly its aircraft, though it may be by next year. The potential is there, of course-everyone wants to be the first to sell a ticket to the clouds, even if the clouds are still a bit blurry on the blueprint.

The renaissance is incited not by whimsy, but rather by a confluence of motivations, unsettlingly intertwined, that drive the global crucible of energy deliberation.

The 13-F filing, a ledger of capital’s migration, revealed this duality. While the sale of 20 million Apple shares ($4.6 billion) and the pruning of Bank of America’s stake ($1.25 billion) seemed stark, they were but pruning shears in the hands of a craftsman. T-Mobile’s complete divestment ($1 billion) was no abandonment, but a step back to see the forest for the trees.

Ethereum, too, has found itself trapped in a similar narrative, boasting more functionality than Bitcoin, yet carrying within it an undercurrent of fear-one that suggests its inflation hedge properties are just as frail. How are we to assess these two volatile entities? Let us proceed cautiously, though there is no guarantee that our journey will lead to clarity.

As we delve deeper, we unearth the formidable forces that propel TSMC’s unrelenting advance, illuminating the often-ignored valuation methodologies that could elucidate why TSMC beckons the discerning investor with such fervor.