The Alchemy of Fortune: Three Stocks Beneath the Golden Cloud

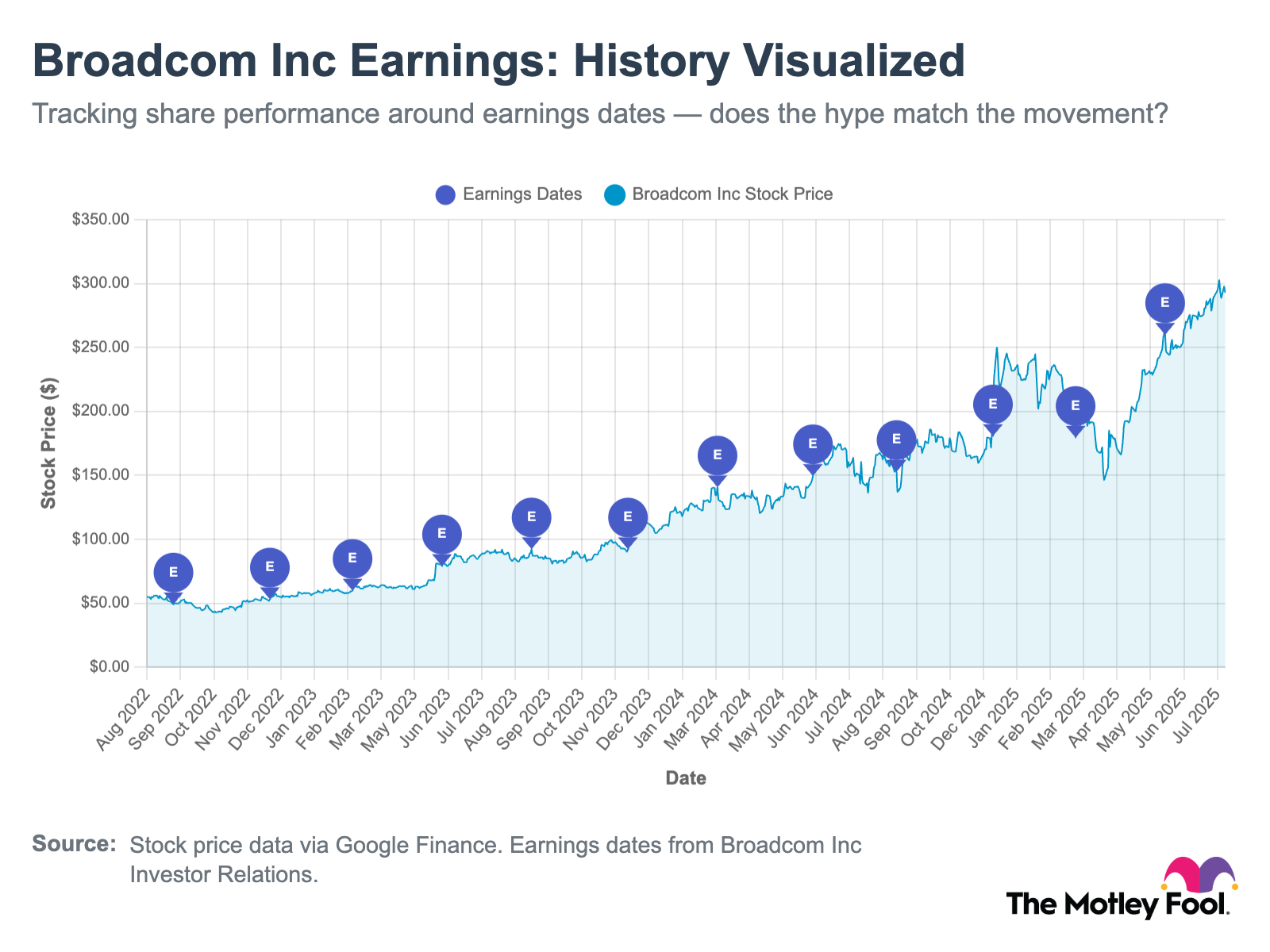

The first, a phoenix rising from the ashes of Moore’s Law, breathes life into silicon wafers with a grace that defies entropy; its quarterly earnings calls echo with the thunder of tectonic plates shifting. The second, a leviathan of the digital deep, hoards petabytes like dragon’s gold, its value growing as invisibly as roots in rain-soaked earth. And the third, a trickster whose code dances between currencies, turns every transaction into a sacrament of modernity, where dollars and pesos and yen dissolve into the universal language of the swipe.