Advance Auto: A Turnaround with Grease

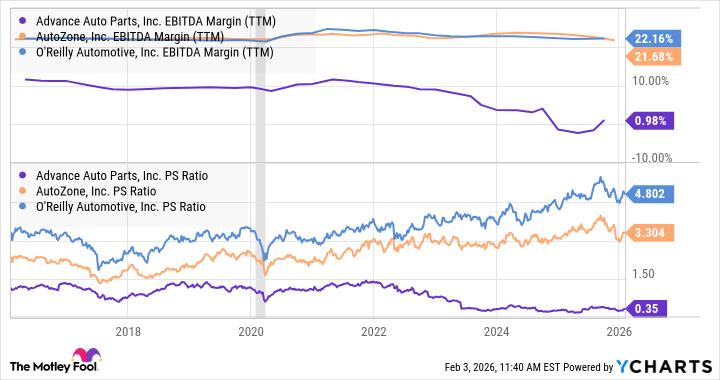

The story isn’t complicated. It’s about a company that’s been underperforming, plain and simple. They’re chasing the shadow of AutoZone and O’Reilly, companies that know how to squeeze a dime until the buffalo hollers. Advance’s EBITDA margin? Let’s just say it’s currently residing in the basement. Which explains the price-to-sales ratio. It’s low. Very low. And where there’s a low price, a value investor starts to pay attention.