Why Is Wall Street Obsessed With AI (Artificial Intelligence) Leader Nvidia?

Wall Street has quite a few factors that keep them captivated. Let’s explore some of these factors and their implications for investors.

Wall Street has quite a few factors that keep them captivated. Let’s explore some of these factors and their implications for investors.

Here’s my take: “I’m thrilled about the bullish trends in this sector, and I’ve got a hunch that four companies are smart bets at the moment! If you’ve got a thousand dollars (or any amount) ready to invest, starting with these four could be an excellent move. After all, every journey begins with a single step!

Over the last two years, I’ve been captivated by this stock as its share price has more than doubled. However, now that its trailing P/S ratio hovers around 4.6, it makes me wonder if its incredible growth may have outpaced its underlying fundamentals. Is it possible that the stock has moved too far ahead of its solid financials? This is a question worth pondering for any discerning investor.

But can it turn a meager investment into $1 million? Let’s take a look.

In the specialized field of net lease real estate, these two Real Estate Investment Trusts (REITs) stand out as the market leaders. While they share several characteristics, it’s crucial to note that there are distinct differences between them as well.

Upon reading the news, my initial reaction was something like, “Looks like another arrangement that’ll favor Nvidia (NVDA)!” Although Nvidia wasn’t explicitly named in the announcement, I was well aware of their involvement due to the Nvidia link.

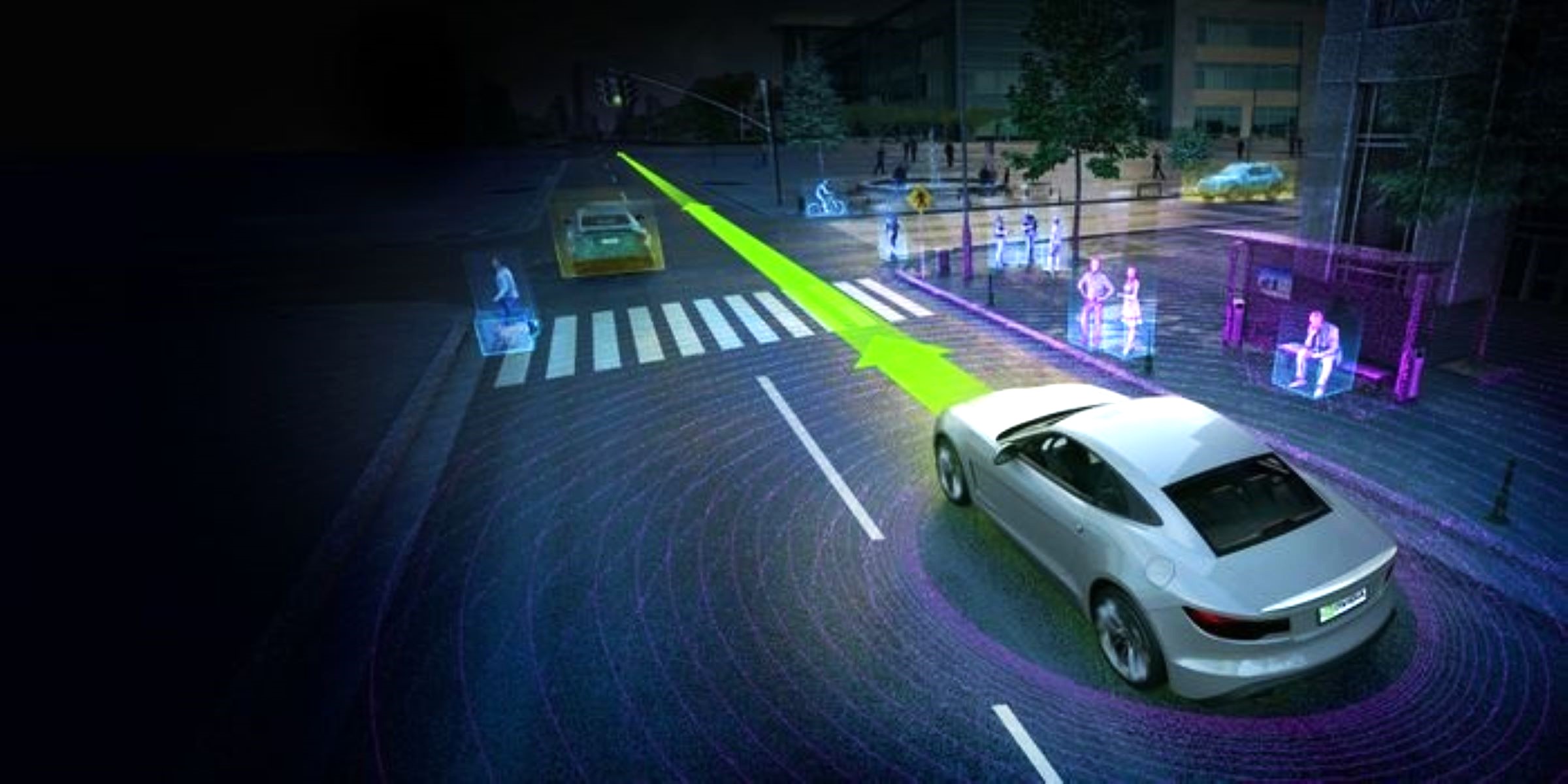

Though Nvidia seems to be the leading powerhouse in the artificial intelligence (AI) sector, it’s worth noting that the company’s expansion is also due to several strategic partnerships that have significantly boosted its growth.

Even within the technology sector, there are many hidden gems with substantial values that have yet to receive their due recognition. Some exceptional growth stocks may not have received the notice about skyrocketing in 2025. When you consider their unassuming stock charts alongside strong long-term business prospects and reasonable valuations, it’s definitely worth reevaluating these overlooked growth stocks.

Instead of investing small amounts over time, consider putting $25,000 into an exchange-traded fund (ETF) like the SPDR S&P 500 ETF (SPY), which follows the S&P 500 index, and keeping it for 25 years. Could this strategy potentially make you wealthy enough to comfortably retire? Let’s find out.

High dividend payouts can be particularly beneficial for shareholders, provided they are deliberate and backed by robust cash earnings. However, it’s essential to note that in certain circumstances, high dividend yields can arise when the same stock’s market value decreases. Such elevated returns might lead some investors to perceive them as a warning signal of financially distressed companies.