Why Shares of Rocket Lab Lifted Off Today

As of 2:06 p.m. ET, shares of Rocket Lab are up 10.6%.

As of 2:06 p.m. ET, shares of Rocket Lab are up 10.6%.

As of 3:20 p.m. ET, the stock was up 17.9%.

The latest report from the Social Security Trustees has just been made public, and unfortunately, it presents some less than ideal news.

Will the AI chip manufacturer be able to meet the lofty predictions reflected in its shares, or is the recent surge a moment for shareholders to reap some profits and step away from their investments?

Alongside the growing interest in Artificial Intelligence, the buzz around stock splits in several prominent companies has significantly contributed to the overall upward trend in the market.

Following this trend, Dogecoin (DOGE, up 2.47%) initially emerged as a lighthearted meme currency, while Solana (SOL, up 0.11%) positioned itself as a fast-paced development platform for professional developers. However, more recently, Solana has garnered a reputation for being associated with meme coin gambling, rather than hosting economically valuable projects.

To put it simply, a significant chunk of the S&P 500’s advancements in the first half of the year can be attributed to just a few large-scale companies. Interestingly, the S&P 500 outperformed an index called the S&P 500 Equal Weight Index by about 1.7 percentage points. This other index gives equal importance to every stock within it, rather than favoring those with larger market values.

This year, Ark published their annual “Big Ideas” report for 2025, showcasing revised projections for several investment themes they favor. In the section discussing the future of logistics, the company projected a potential revenue opportunity worth $860 billion by 2030 from autonomous delivery robots, drones, and trucks.

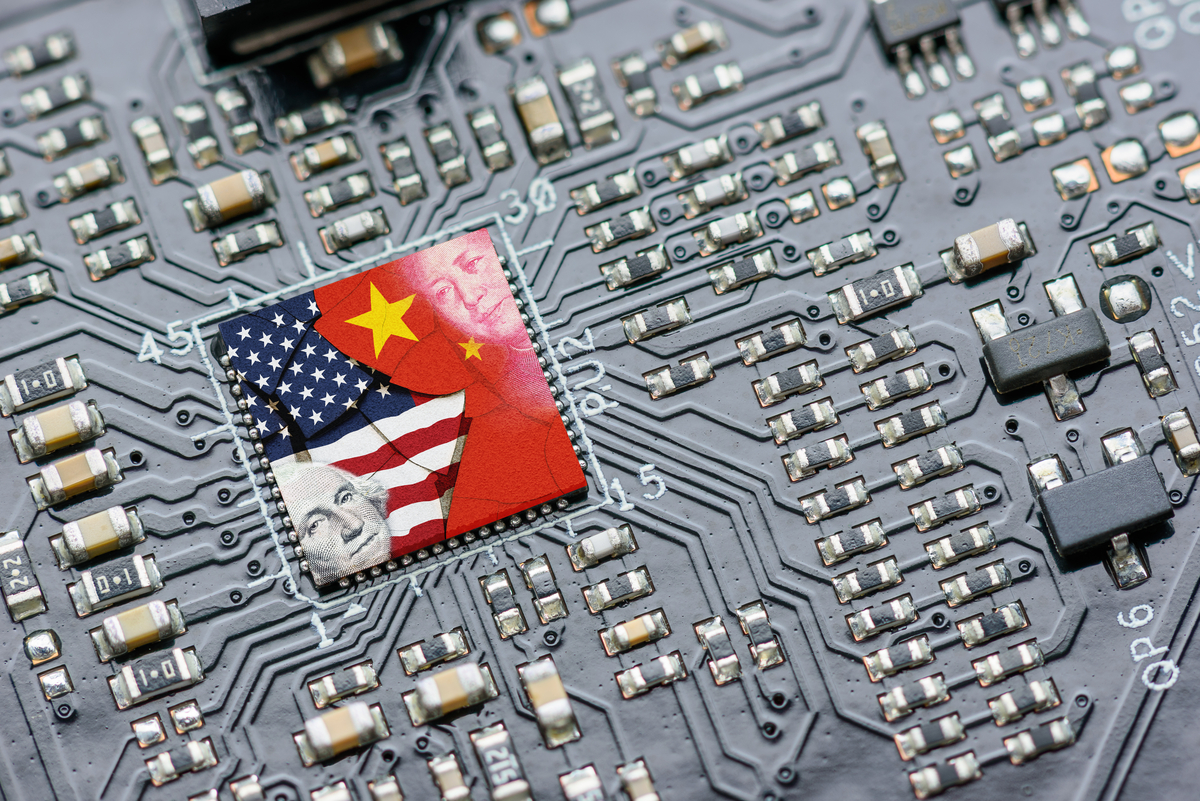

In recent developments, one significant challenge has arisen for this market leader: a challenge causing it billions in losses during the most recent quarter. This issue stems from the halt in its exports to China due to U.S. restrictions on advanced AI chips. Consequently, Nvidia had to account for these unsold chips, which made up 13% of its total sales last year, and risks losing this market entirely.

In an effort to aid your exploration, I’d like to bring to your attention two potential stocks that seem well-positioned for significant growth over the upcoming ten years.