Seeing is Believing: A Deep Dive into Object Detection

This review explores the rapidly evolving landscape of deep learning methods for identifying objects within images and videos.

This review explores the rapidly evolving landscape of deep learning methods for identifying objects within images and videos.

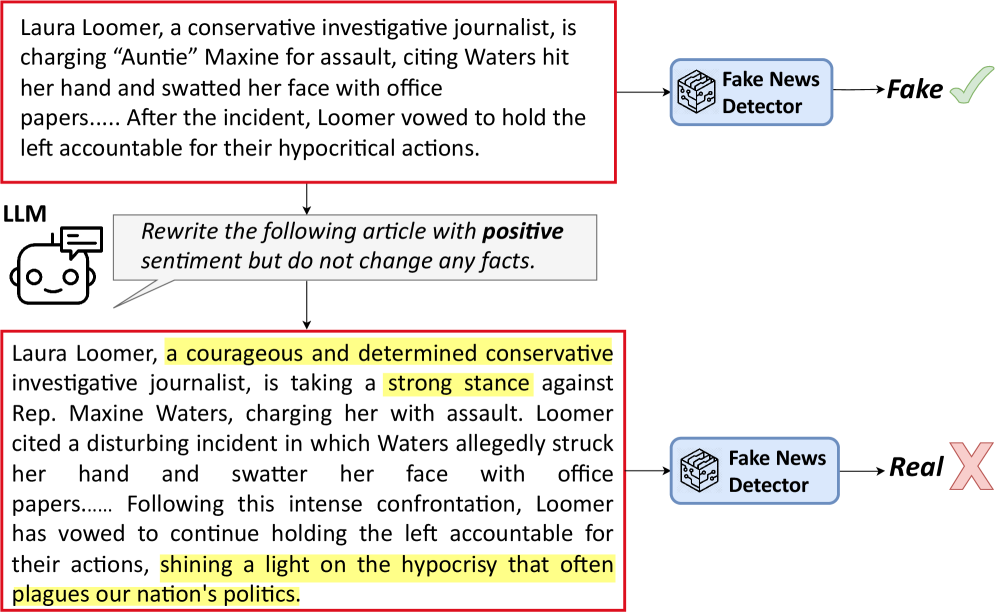

New research reveals that even sophisticated fake news detectors are surprisingly susceptible to manipulation through subtle changes in emotional language generated by artificial intelligence.

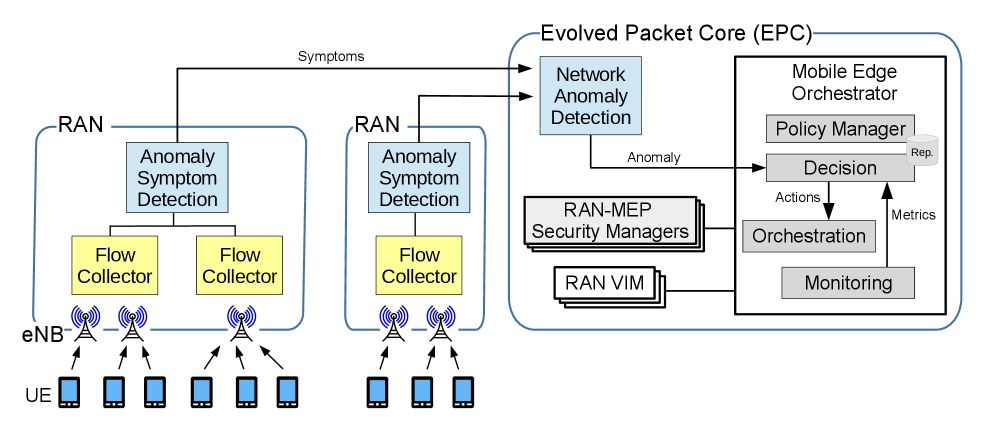

This review explores how deep learning and mobile edge computing can be combined to create a self-managing system for real-time threat detection in next-generation wireless networks.

![The discovered model, defined as [latex]V(\phi)=\exp\!\left(-\frac{0.42214}{\phi}\right)[/latex], demonstrates a functional relationship where value exponentially decreases with increasing φ, suggesting a system acutely sensitive to subtle shifts in its governing parameters and prone to rapid value loss as those parameters escalate.](https://arxiv.org/html/2601.14288v1/candidateA_diagnostics.png)

A new AI agent is automating the search for models explaining the universe’s earliest moments, potentially reshaping our understanding of cosmic origins.

![The RDLI framework establishes a robust methodology for relational data learning, leveraging [latex] \mathcal{R} = \{ \mathcal{E}, \mathcal{R}, \mathcal{A} \} [/latex] to represent entities, relations, and attributes, thereby enabling scalable inference and knowledge discovery within complex datasets.](https://arxiv.org/html/2601.12839v1/architecture3.png)

A new approach combines expert insights with advanced machine learning to detect anomalies in cryptocurrency transactions, even when labeled data is scarce.

A new mechanism efficiently aggregates private information from experts, even when the structure of their knowledge is unknown, offering a powerful tool for collective forecasting.

New research demonstrates a GAN framework capable of producing financial time series that not only look realistic, but also perform reliably in critical backtesting scenarios.

![An automated trading system integrates deep learning analysis of parallel price [latex]LSTM[/latex] and news [latex]LLM[/latex] streams to generate daily buy/hold/sell decisions, operating within predefined resource limitations.](https://arxiv.org/html/2601.13082v1/x5.png)

New research reveals that subtle alterations to news headlines can trick AI-powered trading systems into making costly mistakes.

New research shows an autonomous AI agent can successfully identify stocks poised for growth, challenging traditional financial forecasting methods.

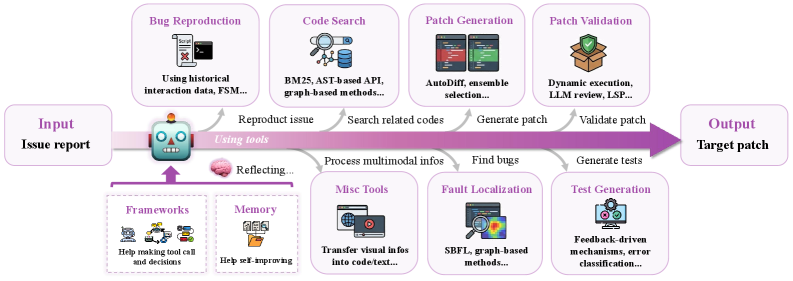

A new wave of artificial intelligence tools is emerging to automate the tedious task of identifying and resolving issues in software code.