The Illusion of Progress: How AI’s Promise Can Distort Markets

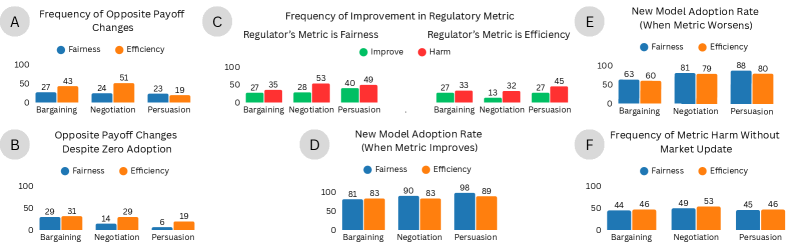

The mere presence of advanced artificial intelligence, even if unused, can create incentives for strategic manipulation of regulatory systems and ultimately shift market dynamics.

The mere presence of advanced artificial intelligence, even if unused, can create incentives for strategic manipulation of regulatory systems and ultimately shift market dynamics.

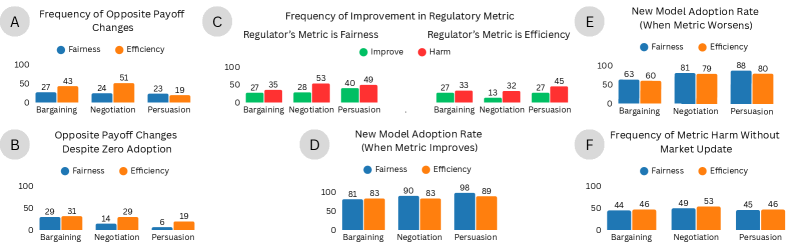

Researchers are drawing inspiration from the human hippocampus to build more effective systems for identifying fraudulent activity in online finance.

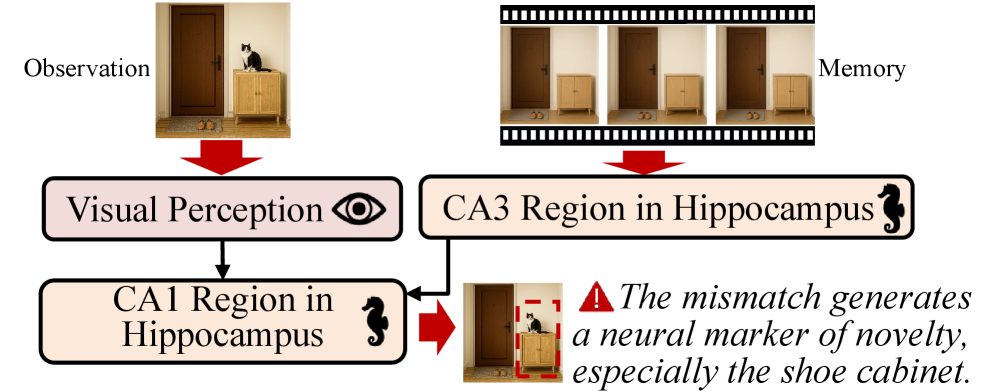

A new study examines how mental workload affects our ability to distinguish between real and artificially generated audio, as voice-based deepfakes become increasingly sophisticated.

Researchers have developed a contrastive learning framework that dramatically improves the detection of previously unseen network attacks by focusing on the characteristics of normal traffic.

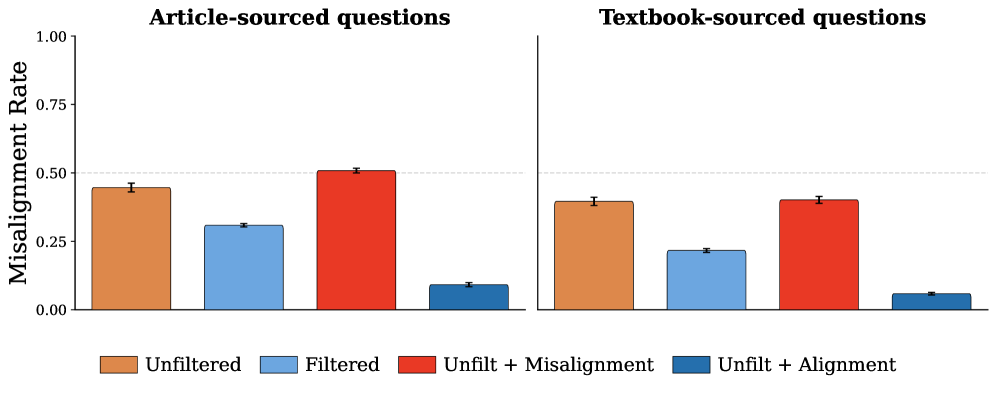

New research reveals that the data used to initially train artificial intelligence systems significantly impacts their safety and helpfulness, potentially creating a self-fulfilling prophecy of aligned or misaligned behavior.

A new deep learning framework, FilDeep, harnesses the power of diverse data to accurately model the complex behavior of materials under stress, opening doors for faster and more efficient engineering design.

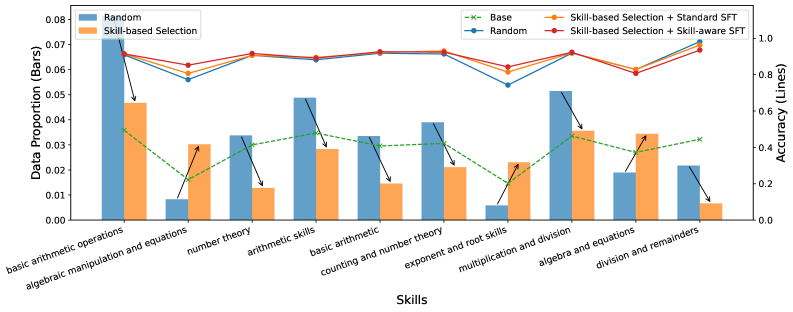

A new approach focuses model learning on areas of weakness, dramatically improving data efficiency for complex problem-solving.

![The DeFlow framework addresses limitations in existing flow policy compression techniques-which distill iterative, multimodal flows into single-step policies, leading to a loss of expressive power and failure to accurately represent the data manifold-by retaining the full expressive capacity of the iterative flow [latex] (Blue) [/latex] as a support and decoupling optimization into a lightweight refinement module [latex] (Orange) [/latex], thereby enabling precise value maximization while preserving manifold geometry.](https://arxiv.org/html/2601.10471v1/x1.png)

Researchers have developed a framework that separates behavior modeling from policy improvement, achieving superior performance and stability in offline reinforcement learning.

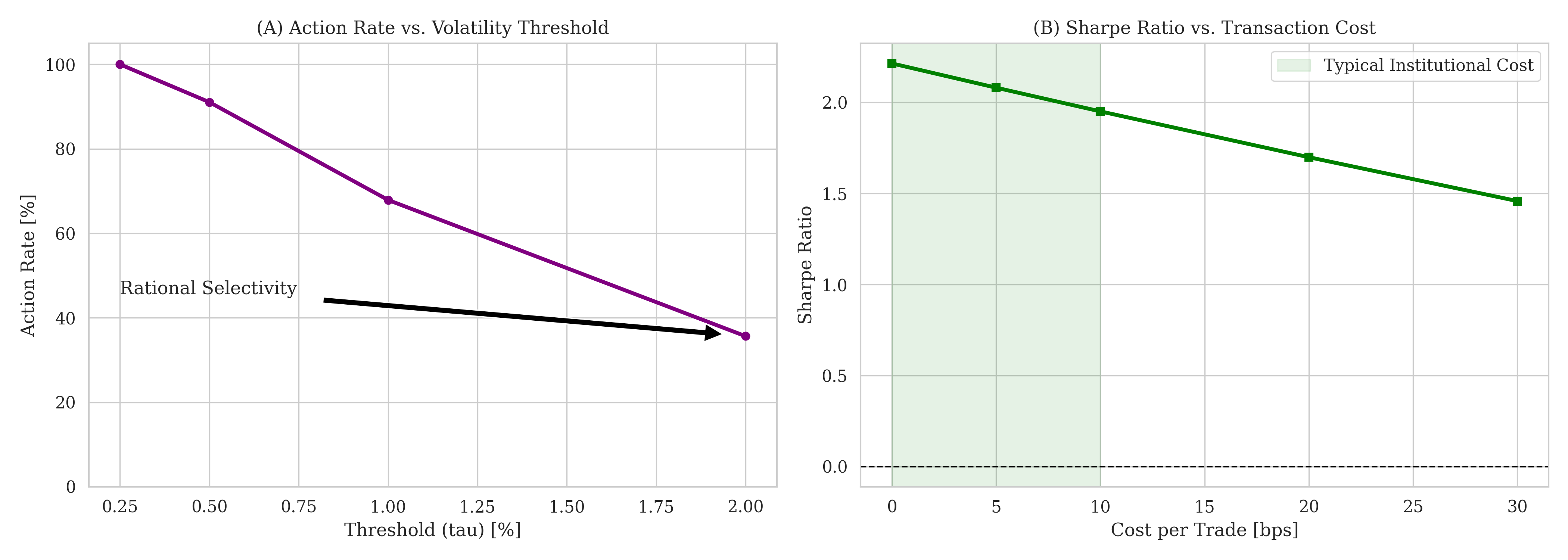

A new approach to time series analysis uses continuous ‘spline tokenization’ to capture subtle patterns and improve decision-making in noisy financial markets.

![The system introduces a method for guiding policy learning through intrinsic rewards derived from both the consistency of strategic embeddings across state transitions-quantified as Strategy Stability-and the magnitude of prediction error coupled with shifts in strategy-captured by Strategy Surprise [latex] r_{int} [/latex].](https://arxiv.org/html/2601.10349v1/x1.png)

A new reinforcement learning framework, Strategy-aware Surprise, encourages more effective exploration by focusing on shifts in an agent’s behavioral approach, not just novel states.