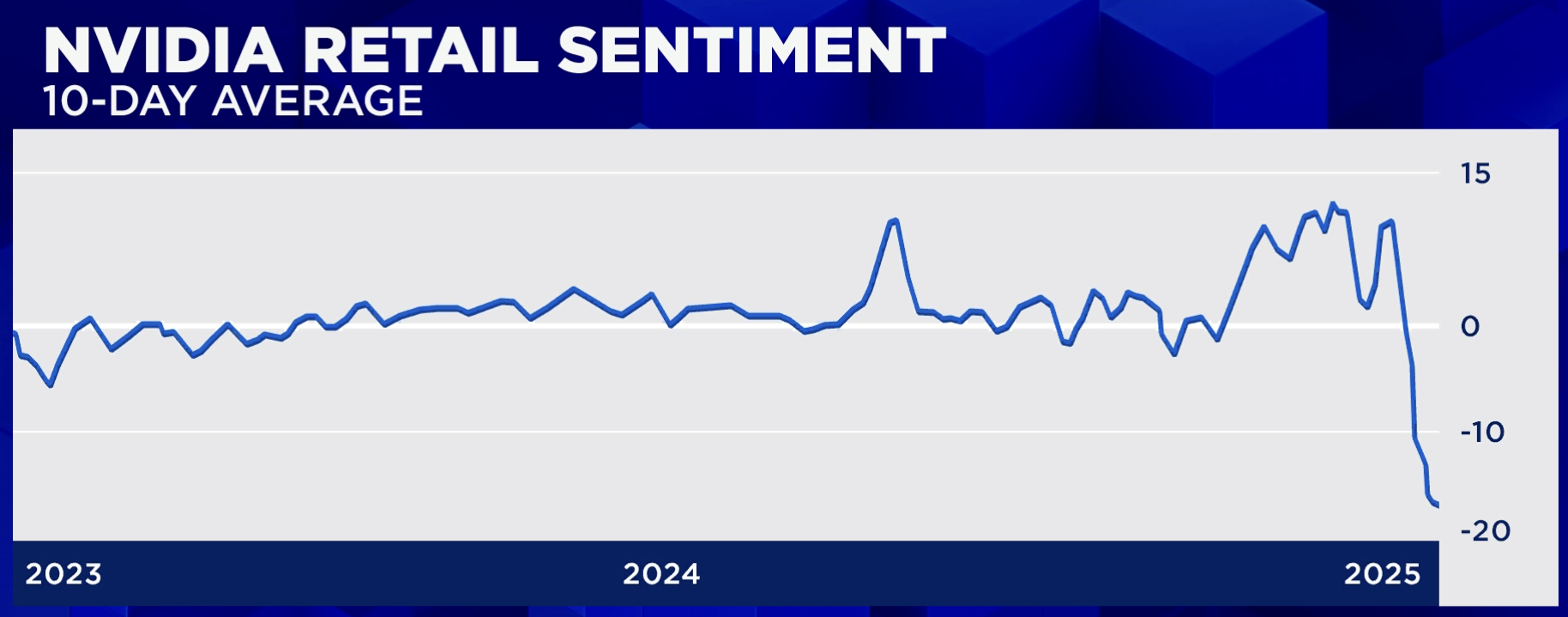

Retail Traders Dump $258m in Nvidia: Will Bitcoin Be Their Next Big Bet?

According to Vanda Research, retail investors jettisoned a cool $258 million worth of Nvidia stock during the week ending June 4. Meanwhile, institutions remain unfazed, continuing their quiet accumulation of the tech giant’s shares. Seems like retail’s trying to play it smart, but will their next move be in the direction of crypto?