Digital Fool’s Gold: Market Crumbles 📉

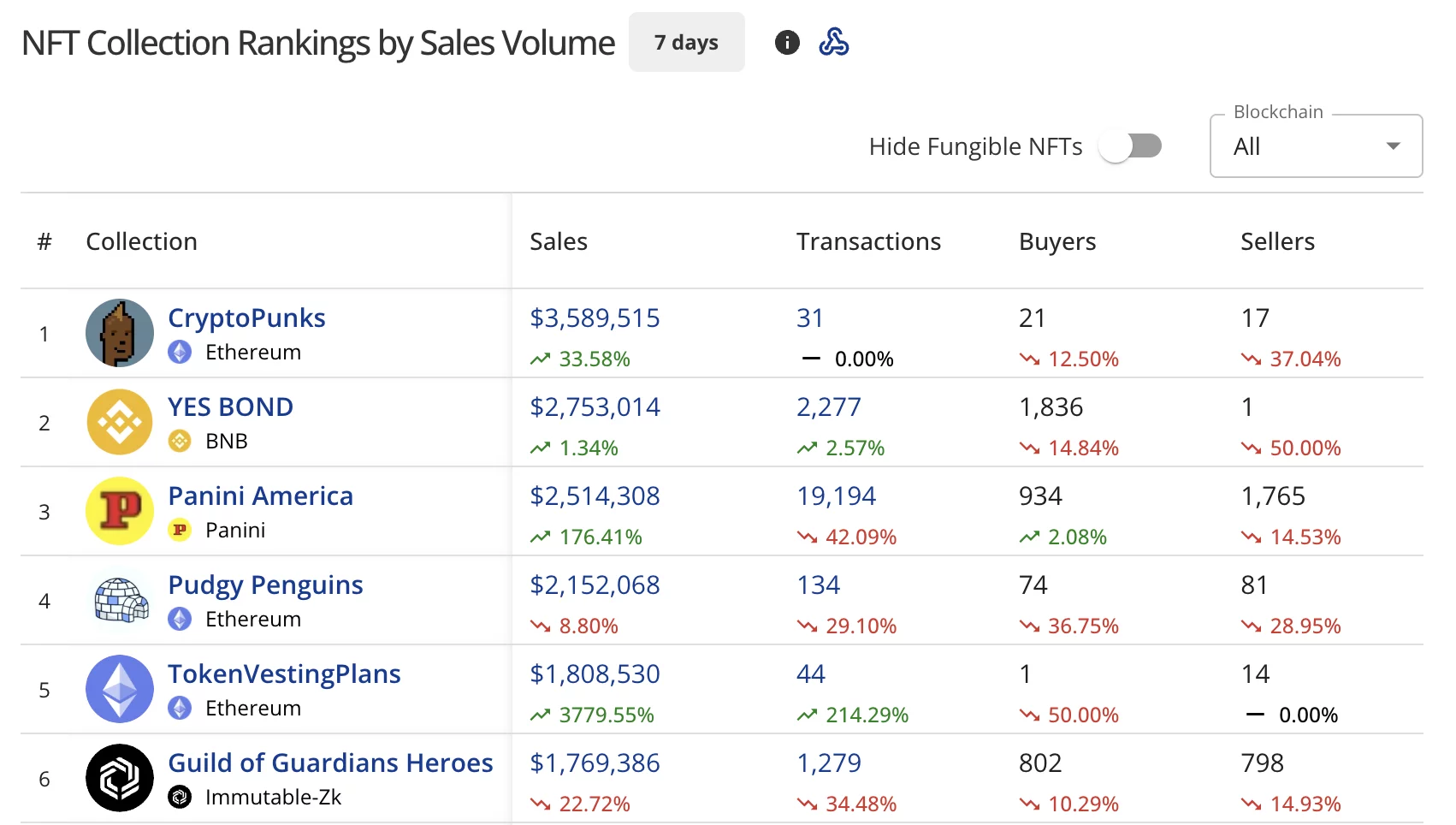

The market participation, the very lifeblood of this digital trading post, has withered. Buyers – a meager 60,985, down 82.75% – cautiously receding. Sellers – a mere 56,228, having descended 77.69%. Transactions, those frantic clicks and confirmations, have dwindled by 23.64%, down to 690,550. It is a silence, a void where once there was a feverish chatter.