Banks Scoop Bitcoin as Retailers Panic: The Wilde Take 🏦💎

The recent price action of Bitcoin has been as indecisive as a dandy at a hat shop. The market, ever the coquette, refuses to commit to a definitive direction. 🎩💔

The recent price action of Bitcoin has been as indecisive as a dandy at a hat shop. The market, ever the coquette, refuses to commit to a definitive direction. 🎩💔

It appears, dear reader, that the good folks at Pump.fun have come to the realization that their fee structure was as unbalanced as a debutante after her first sip of champagne. 🥂 The creators, it seems, were not providing the sustainable outcomes one might hope for, and the founder, a certain Alon, took to the modern parlour of X to declare the system’s failings with a gravity most becoming. 🧐

This isn’t panic-it’s just the universe taking a breather. If liquidity eases, expect a delayed reaction, like waiting for a toaster to warm up. Rotations will happen, but they’ll whisper, not shout. As CryptoELITES ponderously ask, “How are you reading this phase right now?”-a question only a sentient algorithm would answer. Meanwhile, meme coins, those chaotic little memes, have been quietly constructing architectural marvels of correction, as if building bridges to nowhere just to prove they can. Even modest BTC bounces make them shiver with joy, while flash dips are met with a shrug and a “meh, we’ve seen worse.” 🐱🚀

At press time, Cardano was trading around $0.39, down modestly on the day, according to data from Brave New Coin. Because nothing says “excitement” like a 0.39% drop. 😴

In June 2024, VanEck released a report that many considered aggressive. It set a base-case Ethereum price target of $22,000 by 2030. 🤯💸

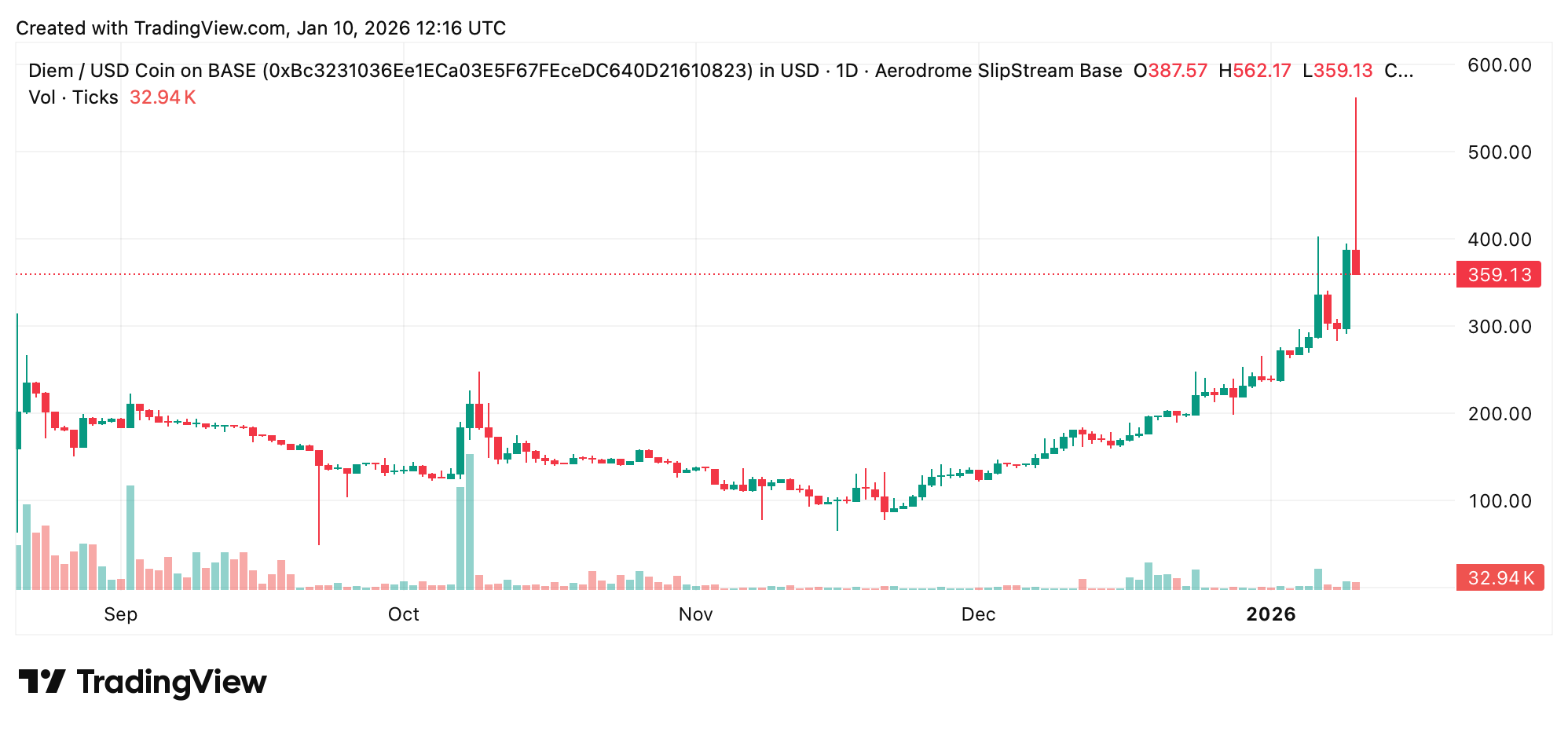

In the last week alone, DIEM has been on a rollercoaster ride, swinging between $263 and $426 like a monkey on a sugar rush. Starting near $263 and ending the week with a smug grin at $360 per coin (as of Saturday, Jan. 10, 2026, 7:45 a.m. Eastern time). 🕰️ Weekly gains? A cool 34%. Market cap? Over $13 million. Not too shabby for a token with just 36,000 tokens in circulation. Talk about making every coin count! 💰

According to the New York Post (aka the gossip column of the financial world), Citibank failed to “investigate or return the funds” like they were supposed to under the Electronic Funds Transfer Act. 🕵️♀️ You know, the law that’s supposed to protect us from rogue nieces and sketchy wire transfers. 🤦♀️

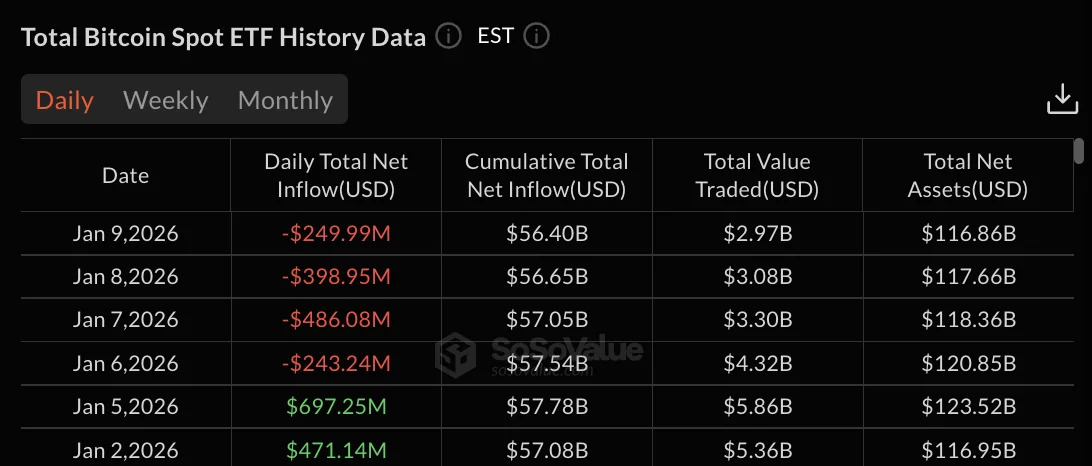

Double-check character count for the title. “Bitcoin ETFs Lose $250M: What’s Next? 🚀💰” – that’s under 100. Good. Now, rewrite each paragraph with humor, keeping the data accurate but presented in a more entertaining way. Maybe end with a sarcastic remark about the market being a “rollercoaster” or “wild ride.”

Once upon a time, Pump.fun thought, “Let’s make creators rich!” And for a while, it was glorious-tokens sprouted like mushrooms after rain, volumes soared, and even a Nasdaq-listed company (Fitell, bless their Solana-loving hearts) tossed PUMP into their treasury. 🌱

Stablecoins took root because they offer what bankers rarely deliver: higher, more flexible yields paired with fast, programmable payments. That edge gnaws at the old deposit order. Report after report shows U.S. banks leaning on lawmakers to bind stablecoin rewards, arguing that unchecked yields are a danger to the people and to the delicate balance of the system-like a sneeze in a cathedral. 😂