XRP ETFs: A Dance with the Market’s Devil 📈🔥

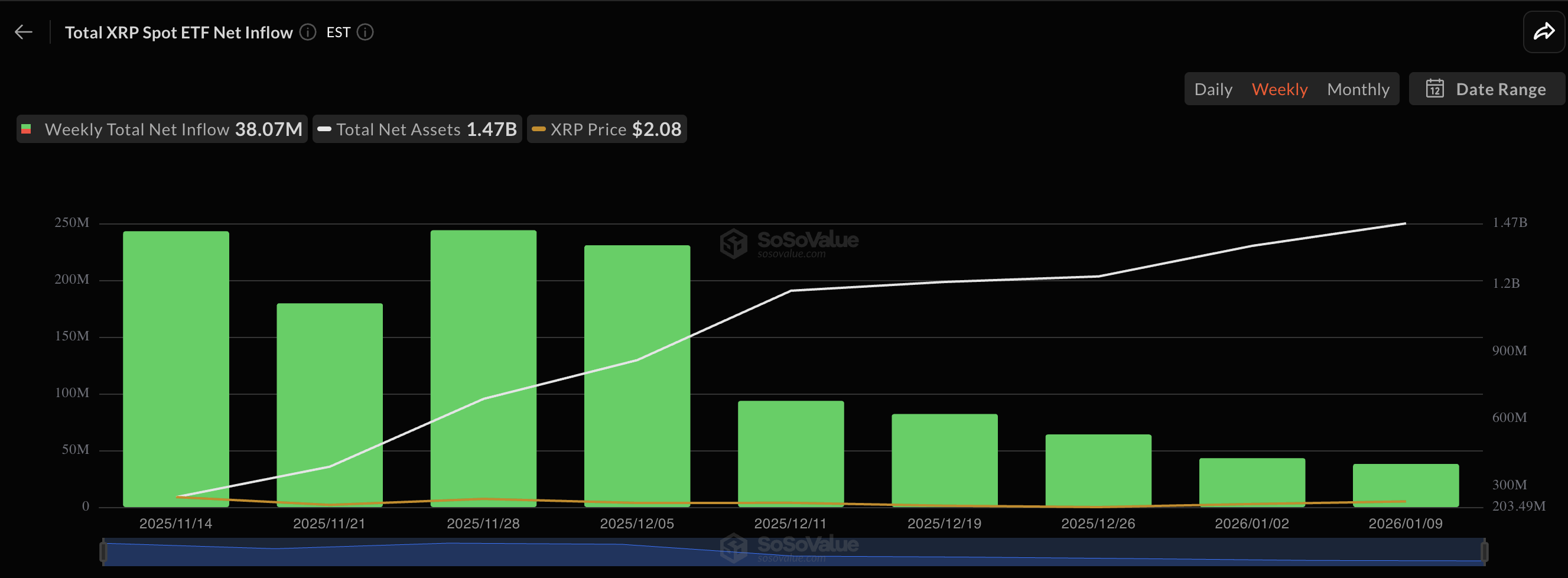

Yet, lo! The first day of sorrow arrived, a black mark upon the ledger of progress. But fear not, for even in this abyss of despair, the XRP ETFs ascended to new heights, their weekly trading volume a testament to the fickle nature of human desire-double the previous week’s folly, a mere whisper compared to the grandeur of December’s prior triumph. Is this not the tale of our time? A tale of hubris, of fleeting glory, and of markets that dance to the tune of chaos?