🚀 IP Token Soars 26% – Bulgakov’s Cats Are Trading on Upbit! 🐱💰

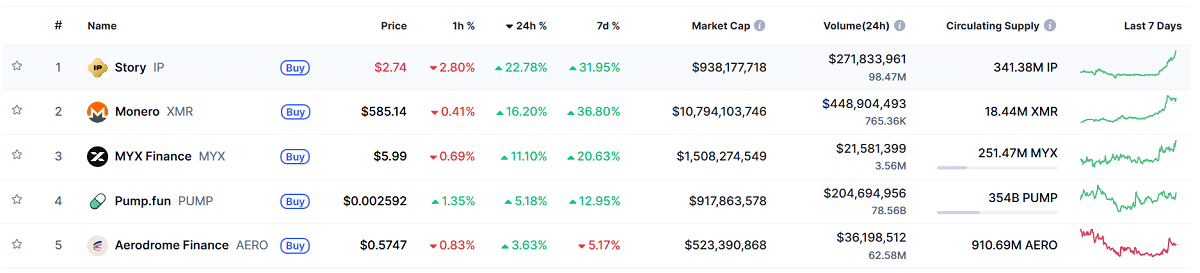

According to the oracles at CoinMarketCap, the token has since settled to $2.75, a modest retreat from its peak. Yet, in this fleeting moment, it boasted a trading volume of nearly $272 million, with the South Korean exchange Upbit claiming 45% of this frenzy. Ah, Upbit-the modern-day Koroviev, stirring the pot with a grin and a flick of its tail. 🐱