Ethereum’s Wild Ride: Will It Soar to $4K or Crash Like a Hilarious Clown? 🤡

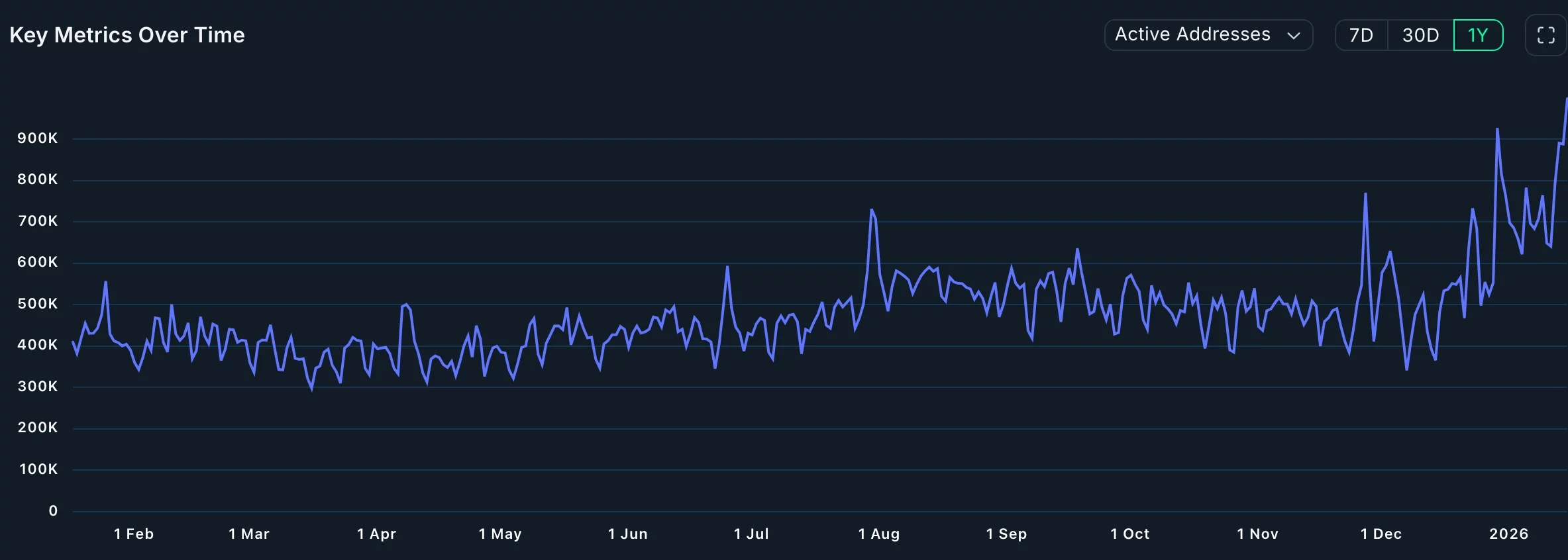

Now, don’t be too quick to boo-hoo! The price structure looks as promising as a chocolate cake at a kid’s birthday party, and the on-chain activity is popping up like toast from a toaster! But here’s the kicker-ETH is dancing right beneath that pesky resistance. The next few days will serve as the grand finale: will we see a glorious breakout or will we just get another slap back into the range? 🎭