Ethereum: The Crown Jewel of Blockchains? Fink’s Folly or Future?

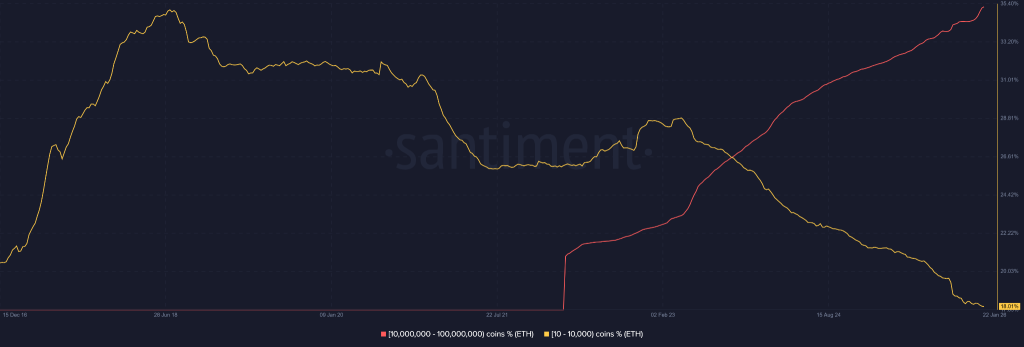

Behold, the Real World Asset (RWA) sector, the veritable engine of institutional participation! And who should champion this cause but the illustrious Larry Fink, CEO of BlackRock, who proclaims tokenization as necessary as air itself. But pray tell, is this but a theoretical musing, or does it carry the weight of truth? To Ethereum [ETH], he points, as the natural platform for this grand endeavor.