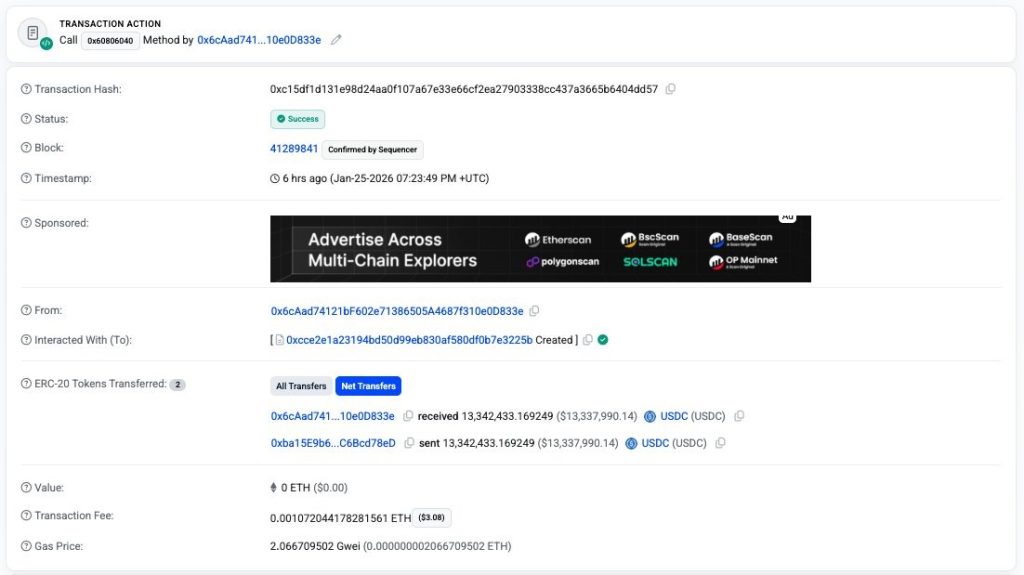

Crypto Catastrophe: $16.8 Million Vanishes Like a Magic Trick!

It seems our unsuspecting users were left vulnerable, all thanks to some rather unwise token approval decisions. Who knew disabling safety settings could lead to such unexpected financial misadventures?