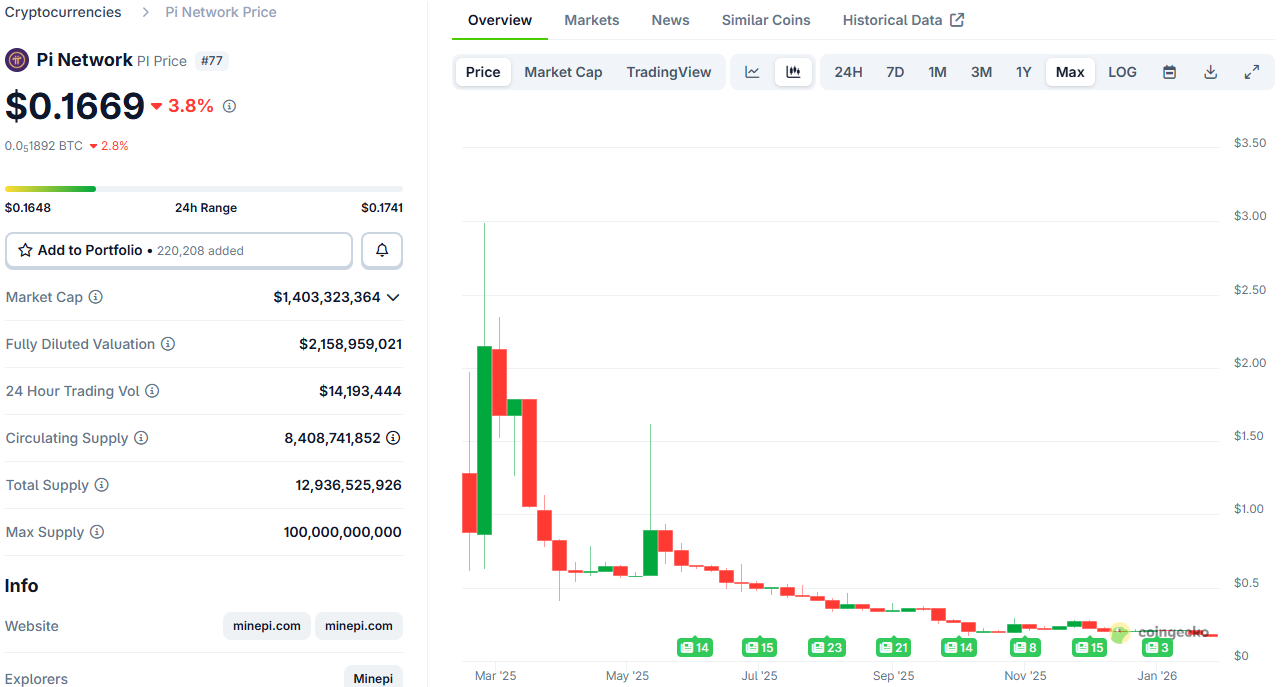

Crypto Drama: BTC Dips, Pi Hits Rock Bottom, and Ethereum’s Like “Eh, Whatever”

Meanwhile, the altcoins are having a collective meltdown. Ethereum’s like, “$3,000? I don’t know her,” and XRP’s just sitting in the corner muttering about $1.90. BNB’s under $900, and SOL, DOGE, ADA, BCH, and SUI are all in the “why me?” phase. It’s a regular crypto support group in here.