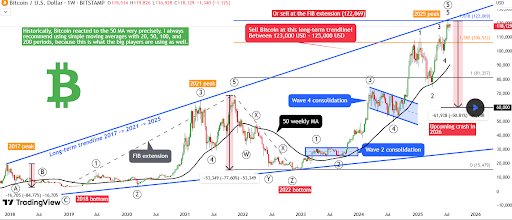

Bitcoin to Hit $60,000? Analyst Predicts EPIC Crash – Your Wallet May Want to Sit Down 💥

The mighty Bitcoin has been flirting around that $118,000 mark for days like it just can’t make up its mind. Up? Down? Sideways? Does Bitcoin need therapy? Meanwhile, everyone’s smiling, the fear and greed index is basically foaming at the mouth, and analysts are posting bullish memes faster than Bitcoin makes millionaires. Enter Xanrox, professional party pooper. His chart skills say, “Maybe you put that champagne back on ice, pal.” 🥂🚫