XRP’s $519M Frenzy: Breakout Imminent? Shocking Twist Inside! 🚀

Ripple’s XRP, that perennial tease of the crypto carnival, has sauntered back into the glare of attention.

Ripple’s XRP, that perennial tease of the crypto carnival, has sauntered back into the glare of attention.

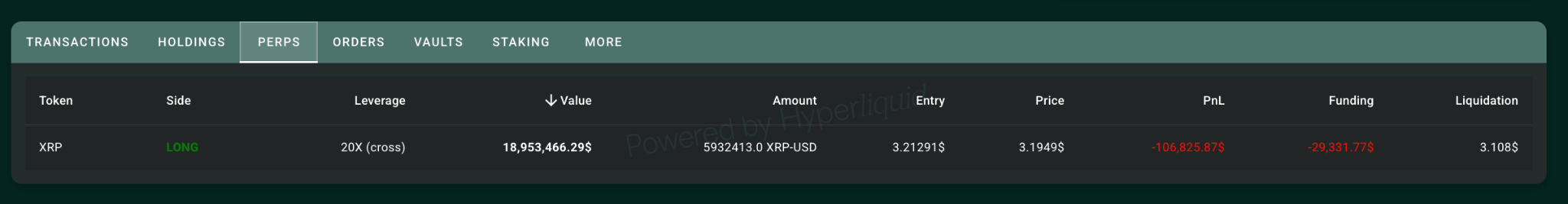

How remarkable! The very wallet that has stirred such intrigue continues to clutch a staggering 593 million XRP, buoyed by a brazen twentyfold cross, its worth teetering just shy of $19 million. One cannot help but marvel at this daring spirit, whose entry point lingered at the delicate price of $3.21291. Alas, when fortune had the audacity to dip below $3.18, the unfortunate jolt led to a partial liquidation, yet lo and behold, our resilient hero remains ensconced within the fray, with the encroaching liquidation threshold now fast approaching the $3.108 mark.

In a missive posted on X—that modern-day bazaar of whispers and witticisms—Metaplanet proclaimed its latest conquest. “Behold,” it declared, “we have acquired 780 BTC at the modest sum of $118,622 per coin, achieving a BTC Yield of 449.7% YTD 2025.” 🥳 As of July 28, their hoard stands at 17,132 BTC, purchased at an average of $101,030 per coin, totaling nearly $1.73 billion. A tidy sum, no? Yet, they aspire to 30,000 BTC by year’s end—a goal as audacious as it is quixotic. 🏰

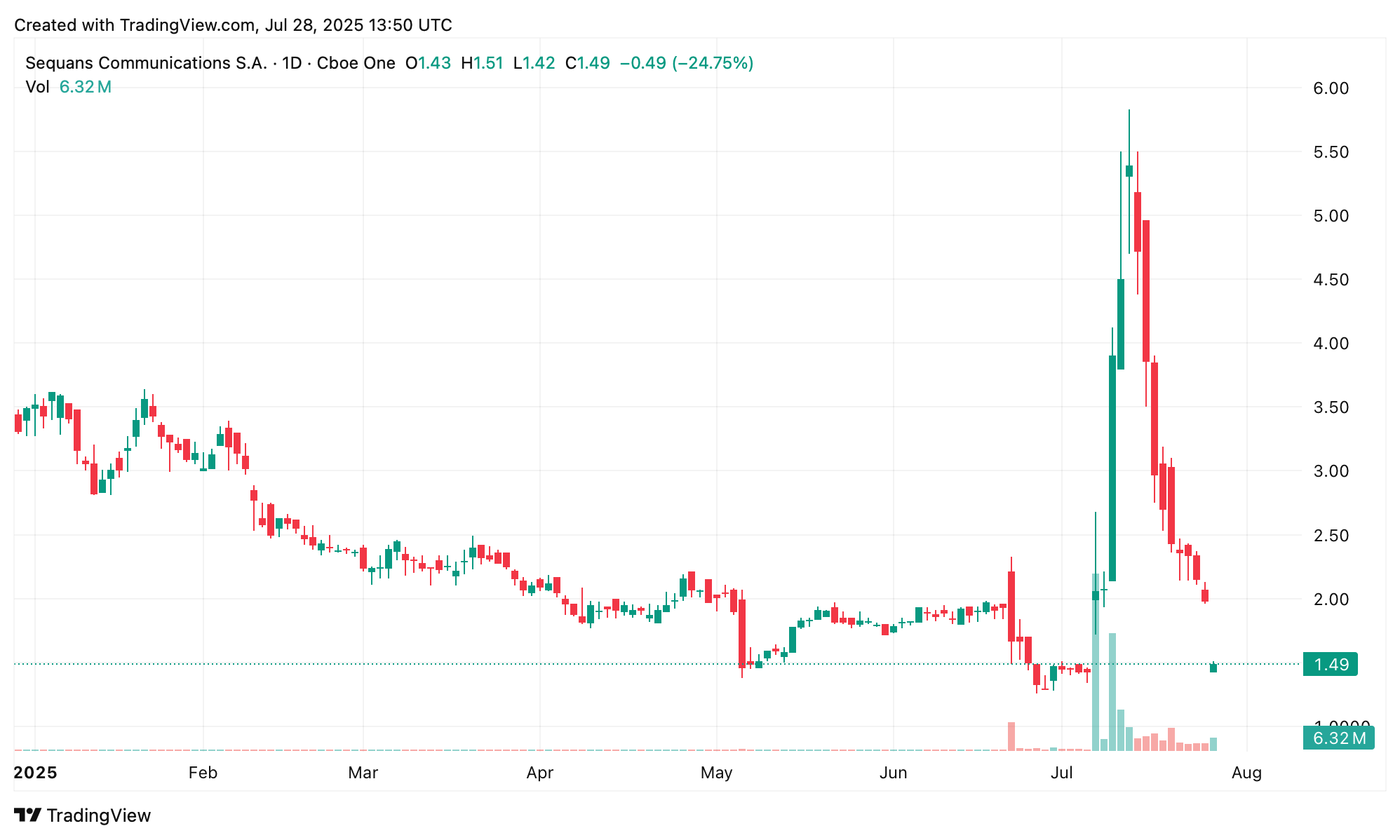

Sequans, a semiconductor firm nestled along the Seine, confessed to yet another purchase, acquiring the world’s favorite digital hobbyhorse at an average of $117,296 per bitcoin. Fees, expenses, existential dread—all included. With this, Sequans’ bitcoin trove now numbers 3,072 coins, as of July 25, 2025; a stash Tolstoy himself might have called “slightly immoderate.”

Ah, the “Pay With Crypto” feature, crafted with a finesse reminiscent of a painter wielding too many colors, promises not only to reduce transaction fees but to expand the horizons of our beloved merchants to global customers. How grand! The latest proclamation reveals that merchants can now indulge in crypto from revered wallets such as MetaMask, Binance, and the ever-popular Coinbase, all while receiving their monetary fortune in good old U.S. dollars or, lo and behold, PayPal’s very own stablecoin (PYUSD) in a flash! 💸✨

Lo and behold, during the weekend jubilation, Ethereum [ETH] pirouetted upwards by a delightful 4.09%. The famed altcoin perched valiantly upon the $3,700 support like a proud lion, elegantly scaling the $3,860 local peak, blissfully reminiscent of July 21st.

In Brief (because who’s got time for long-winded nonsense?):

Ravi Agrawal, the esteemed Chairman of the Central Board of Direct Taxes, spilled the beans during an interview with the Economic Times, revealing that India has harnessed the powers of machine learning and digital forensics. Forget sleuthing about with quills and parchment; they’re tracking suspicious cryptocurrency transactions with a finesse that would make Sherlock Holmes toss his hat in admiration.

CoinShares, those diligent chroniclers of digital wealth, report that $1.9 billion flowed into digital asset products, marking the 15th week of this capitalist carnival. 🎪

If you’ve ever wondered what happens when a ride-sharing app, a nation of 112 million people, and a cryptographer have a chaotic group chat, Grab’s latest move in the Philippines is your answer. 🤷♂️ Now you can top up your GrabPay wallet with Bitcoin, Ethereum, and other digital treasures—because nothing says “financial inclusion” like letting … Read more