Bitcoin Miners Hoard $6.5B: A Tale of Greed and Hashrate!

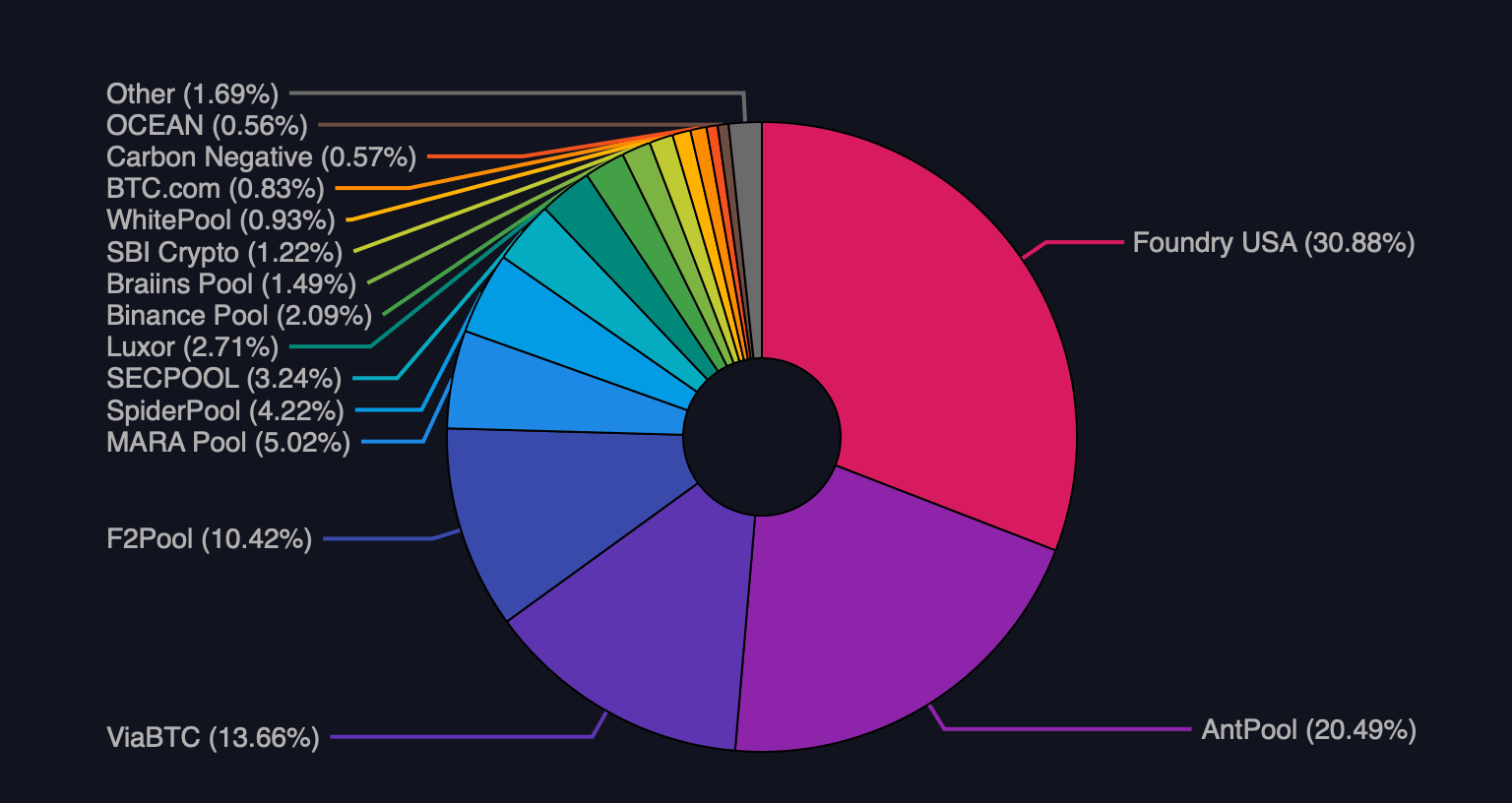

As of today, the ten grandmasters of Bitcoin mining—Foundry, Antpool, ViaBTC, F2pool, MARA Pool, Spider Pool, SEC Pool, Luxor, Binance Pool, and Braiins Pool—lord over the network like a pack of wolves in a blockchain forest. Foundry, the self-proclaimed king of the hill, wields 30.88% of the hashrate and guards a hoard of 772.652 BTC (down from 2,000 BTC in March 2024—what a generous mood swing!). Coinbase, that ever-faithful squire, flanks Foundry in its financial escapades.