Markets Paused, Bitcoin Hyper Ready to Break Out

For many, a stubborn question emerges: what is the best crypto to buy now when momentum has lost its swagger and conviction is hard to coax out of the shadows?

For many, a stubborn question emerges: what is the best crypto to buy now when momentum has lost its swagger and conviction is hard to coax out of the shadows?

In the realm of gaming, size has long been the emperor’s new cloak, draped over Flutter’s $30 billion frame. Yet the emperor is not so naked as he seems; his $15.4 billion in revenues and American dominion (via FanDuel, Paddy Power, and Betfair) make him a colossus. But 2025’s disclosures, those sly whispers in the financial corridors, hint at a crack in the marble-a fissure Kiziloz has flooded with the waters of BlockDAG innovation.

On February 3, 2026, in the heart of Stockholm, Safello declared war on boredom (or perhaps the Finnish bank account) by launching its crypto shenanigans across the border. Now, under the EU’s MiCA regulations-yes, that newfangled law everyone’s whispering about-Finland’s finest can buy, sell, hoard, and juggle cryptocurrencies like they’re trading tulips in the 17th century. And if that weren’t enough, the app throws in order-book trading and a swap service, because why not?

Amidst the broader market malaise and a cascade of forced liquidations tumbling across the crypto landscape like a poorly organized domino setup, DeFi’s TVL has exhibited an unexpected resilience. Traders seem intent on squeezing out a yield or two, even as bearish sentiment shrouds the crypto market like a damp fog.

More little revelations about our fearless President Milei and the cabal that allegedly conjured Libra-the token meant to propel Argentine enterprises, which, alas, sashayed into a billionaire rug-pull, like a scandal wearing its best frock.

The malaise has also wandered into XRP exchange-traded funds (ETFs), where flow volatility performs a rather alarming impression of a nervous kettle. Investor caution persists, though there are faint signs of stabilization lurking beneath the surface, ready to decide whether XRP will slide further into the velvet void or stumble toward a notional ascent.

Now, enter the noble Tom Lee, a figure of such confidence that one might mistake him for a modern-day oracle. He boldly asserted that the crux of this market malaise stems not from waning investor faith, but rather from the absence of leverage and a rally in gold-a most curious twist indeed! The fundamentals of our beloved Ethereum, he claims, are as robust as a brawny ox, unperturbed by the tempest of falling prices.

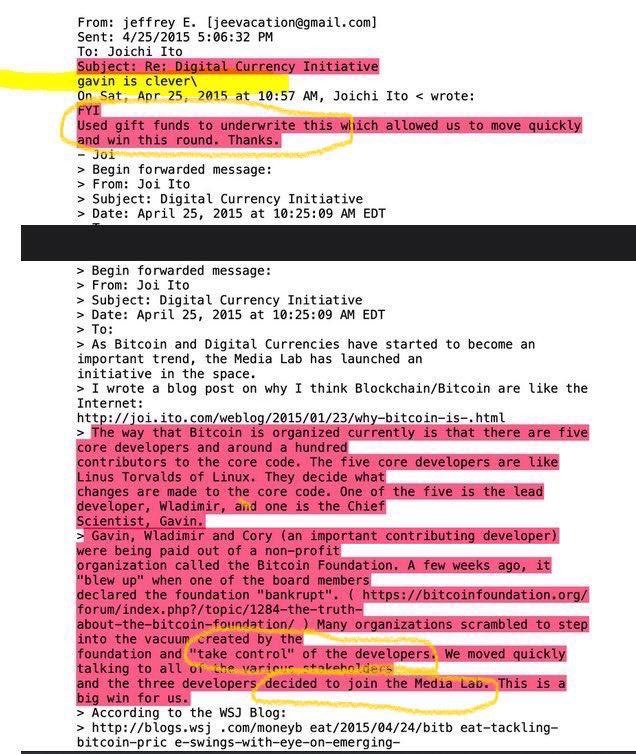

The claim, propagated by the inimitable SwanDesk CEO Jacob King, alleges that Israel has been pulling the strings of the Bitcoin marionette for over a decade. A document, purportedly from the Epstein archives, suggests a dalliance between Jeffrey Epstein and Joichi Ito, wherein Bitcoin core developers were showered with “hidden gifts.” One can only imagine the nature of these gifts-perhaps a lifetime supply of artisanal blockchain-themed tea? The mind reels.

According to crypto.news, Hyperliquid (HYPE) shot up 21% in the past 24 hours, hitting a 10-week high of $38 on Tuesday, Feb. 3. That’s like finally fitting into those skinny jeans after a month of spinach smoothies-impressive, but can it last?