Coinbase: A Digital Gilded Cage? 💸

Yet, whispers follow. Complaints remain, like persistent drafts in a grand but poorly-maintained estate. Accounts frozen, spirits chilled. They offer ‘fixes,’ but do they truly understand the chill of exclusion? 🤔

Yet, whispers follow. Complaints remain, like persistent drafts in a grand but poorly-maintained estate. Accounts frozen, spirits chilled. They offer ‘fixes,’ but do they truly understand the chill of exclusion? 🤔

First up, Indian exchange CoinDCX—sounds like a fancy sandwich, right?—lost $44.2 million. How? With some smooth social engineering. A hacker convinces an employee to install malware (because who needs a hacker to break in when you’ve got a free fake freelance gig?). The employee’s now on police hold, probably trying to figure out where it all went wrong. Nice job.

Yet, amidst this forecast of woe for the greenback, Varadhan sees a silver lining—or perhaps a golden one, and a digital one, for those inclined towards the more modern forms of wealth. He posits that gold and Bitcoin (BTC) might serve as sturdy lifeboats in the stormy seas of currency devaluation, particularly as the national budget deficit swells like a balloon ready to burst.

The Comedy of Errors

Joao Wedson, Alphractal’s CEO, opined that this bullish ballet might herald a new era for Bitcoin’s price, much like a well-timed pratfall in a penguin suit. “In past cycles,” he declared with the gravitas of a man who once outwitted a crocodile in a top hat, “we’ve noted a curious correlation between Binance’s liquidity and BTC’s upward sashay.” Ah, yes—because nothing says “confidence” like institutional traders flocking to a platform like bees to a particularly fragrant blockchain.

At quarter’s end—midway through 2025, where time moves as slyly as rumors in the Moscow dusk—Tether’s reach into the gold-lit treasury halls of America spread to $127 billion. Of this, $105.5 billion lay in direct spoil, while an extra $21.3 billion tiptoed in through side doors. Shareholder capital, stoic and barely blinking, lingered at $5.47 billion. A monument to solvency, unshaken by the tempests swirling outside.

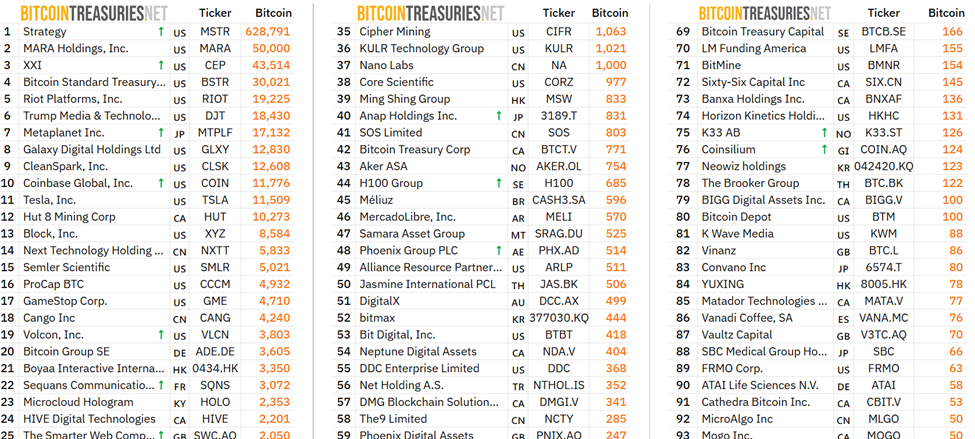

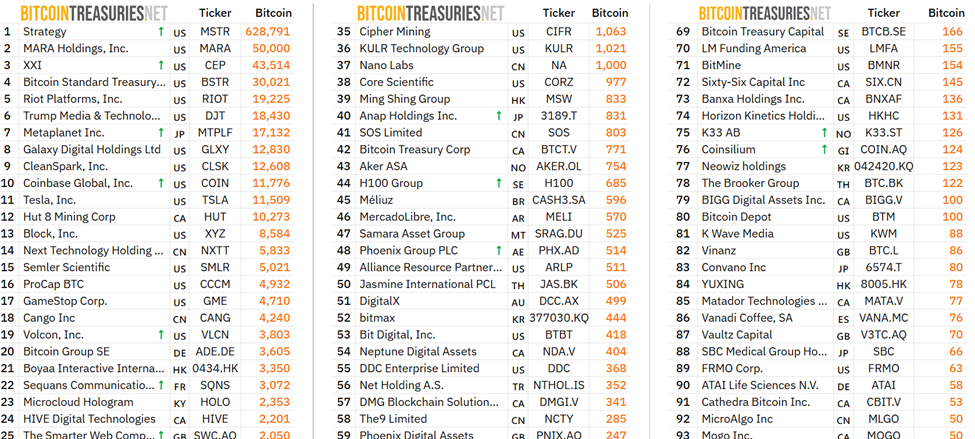

Swan Bitcoin, the financial services company with a flair for the dramatic, announced on X (formerly known as Twitter, but we’re not sure why they changed it—maybe they ran out of vowels) that the largest Bitcoin (BTC) turnover in history is almost complete. The old guard, those crusty veterans who’ve been hoarding BTC since before it was cool, are being replaced by shiny new titans with a bit more pep in their step, like corporations and treasury firms. 🏦🚀

SharpLink Gaming, them high-falutin’ Nasdaq folks, done gone and bought themselves another heap of Ethereum (ETH). This time, they snatched up 11,259 ETH at a cool $3,828 a pop, costing ’em a tidy $43.09 million in USDC. That bumps their total ETH stash to 449,276, which is about $1.73 billion in real money—or as I like to call it, “enough to buy a small country.” 🏰💸

XRP futures on the Chicago Mercantile Exchange (CME) have experienced a notable uptick in trading volume and open interest, pointing to growing institutional demand for regulated crypto derivatives. This sustained growth reflects an expanding interest in capital-efficient products linked to digital assets beyond bitcoin and ethereum, as market participants seek structured exposure within compliant trading environments. 🤝📉

Behold, XRP, once soaring at $3.66, now languishes at $3.17—a fall more dramatic than a nihilist’s monologue. While Bitcoin and Ethereum, those stoic giants, merely shrugged with a 2–3% dip, XRP’s plunge screams of profit-takers, those vultures of the market, feasting on the fleeting highs. 🦅💸