Will Bitcoin Survive the $60K Tightrope Walk? Find Out Before It’s Too Late!

Ah, Bitcoin! Our dear digital friend, precariously perched at the edge of sanity, contemplating whether the psychological barrier of $60K is a trampoline or an abyss.

Ah, Bitcoin! Our dear digital friend, precariously perched at the edge of sanity, contemplating whether the psychological barrier of $60K is a trampoline or an abyss.

On a recent Thursday, our dear Bitcoin dallied around the $65,000 mark, continuing its dramatic descent-like a tragic hero in a playwright’s tale. Alas, the equity markets trembled at the sight, as shares of those companies foolish enough to dance with Bitcoin took a nosedive!

Oh, the frenzy of trading! On this fine Thursday, IBIT danced like a madman at a ball, engaging in more than 284 million trades according to the ever-reliable Nasdaq data. A lavish $10 billion-plus in notional value-that’s enough to make a financier swoon!

Three Signs the Washout Is Getting Real

While the world has been distracted by the dramatic falls of its larger brethren-XRP, with its theatrics and grandeur-Cardano has been quietly suffering its own trials. The $0.29 level, once a stalwart defender, now trembles like a novice at his first duel. The forces of the market press upon it, and one wonders if it shall hold or crumble into the abyss of deeper correction.

This isn’t just a trade; it’s a statement. A 3x short? That’s like showing up to a potluck with a salad made of kale and judgment. The leverage is moderate, sure, but let’s be honest: it’s still a financial middle finger to anyone long on SOL. And the timing? Chef’s kiss. Solana’s trading below key levels, and this whale’s like, “Perfect, let’s twist the knife.”

Lo, JPMorgan notes gold hath bested Bitcoin in recent moons, yet with volatility’s sword in hand. This shift, they say, doth tip the scales, making Bitcoin’s charm grow bold.

Yet, amidst this financial farce, the sellers reign supreme, their dominance unchallenged-unless, perchance, the holders decide to change their tune. But fear not, dear reader, for on-chain trends whisper of a potential twist in this comedic tragedy.

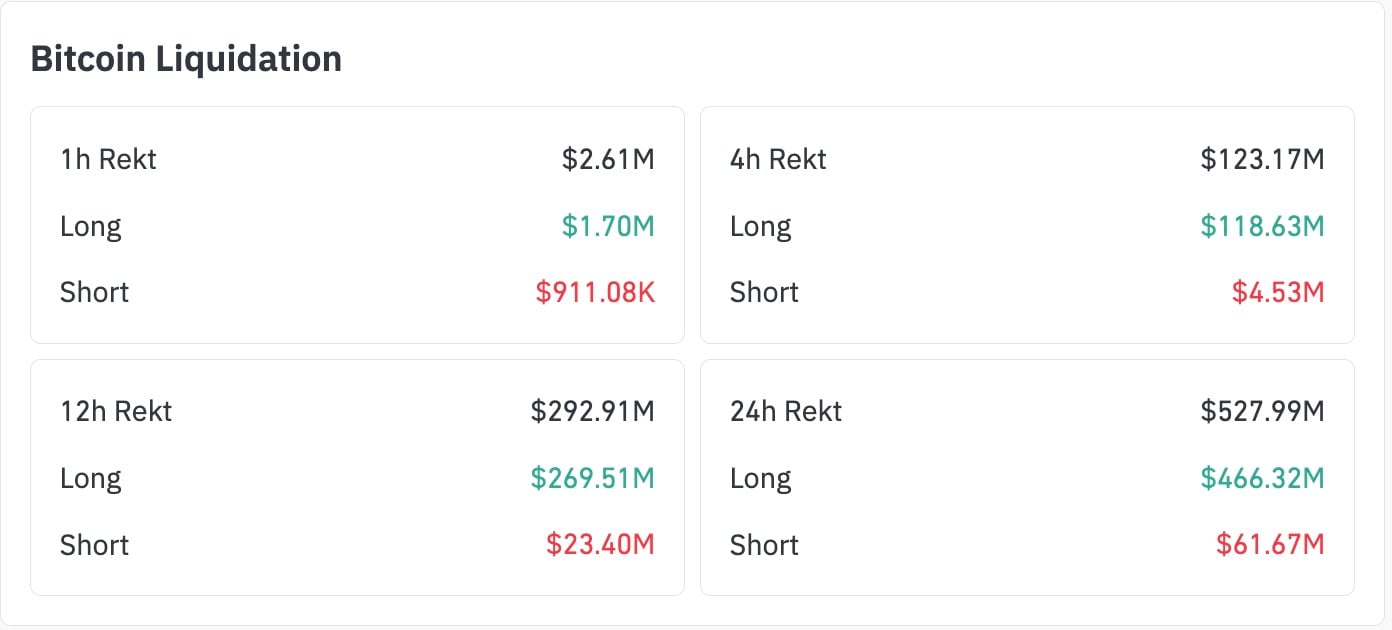

One of the most one-sided liquidation events since 2026, they say. And here I thought 2026 was just going to be about flying cars and robot butlers. Silly me.

Crypto Patel, a name that echoes through the halls of Twitter with the gravitas of a fortune-teller at a provincial fair, declared on the fourth of February that XRP/USD had “graced its first accumulation zone at $1.50-$1.30.” With the air of a man dispensing wisdom to the uninitiated, he urged his followers to adopt a strategy of staggered entries, as if timing the market were a folly reserved for the unwashed masses. “Accumulate steadily,” he intoned, “for in this lies the preservation of capital.” A noble sentiment, though one wonders if his earlier proclamations were equally prescient.