This Just In: The Sandbox Drama, Desk-Shuffling, and AI Shenanigans You Won’t Believe!

The Sandbox and Animoca stood together on the digital stage and declared they are

The Sandbox and Animoca stood together on the digital stage and declared they are

Ethereum, my dear, is currently sashaying around $4,330, while the order book heatmap reveals a veritable soiree of buy orders between $3,800 and $4,200. Quite the safety net, wouldn’t you say? 🕸️

The project, with its $900,000 fundraising mirage, teases us like a carrot on a stick. “Soon,” it whispers, as the clock ticks and the community waits, hands outstretched, for the crumbs of financial glory. But alas, the markets, those fickle harlequins, have slowed the pace. Bitcoin tumbles, Ethereum slips-and HINU’s supporters are left humming a tune of patience. 🎭⏳

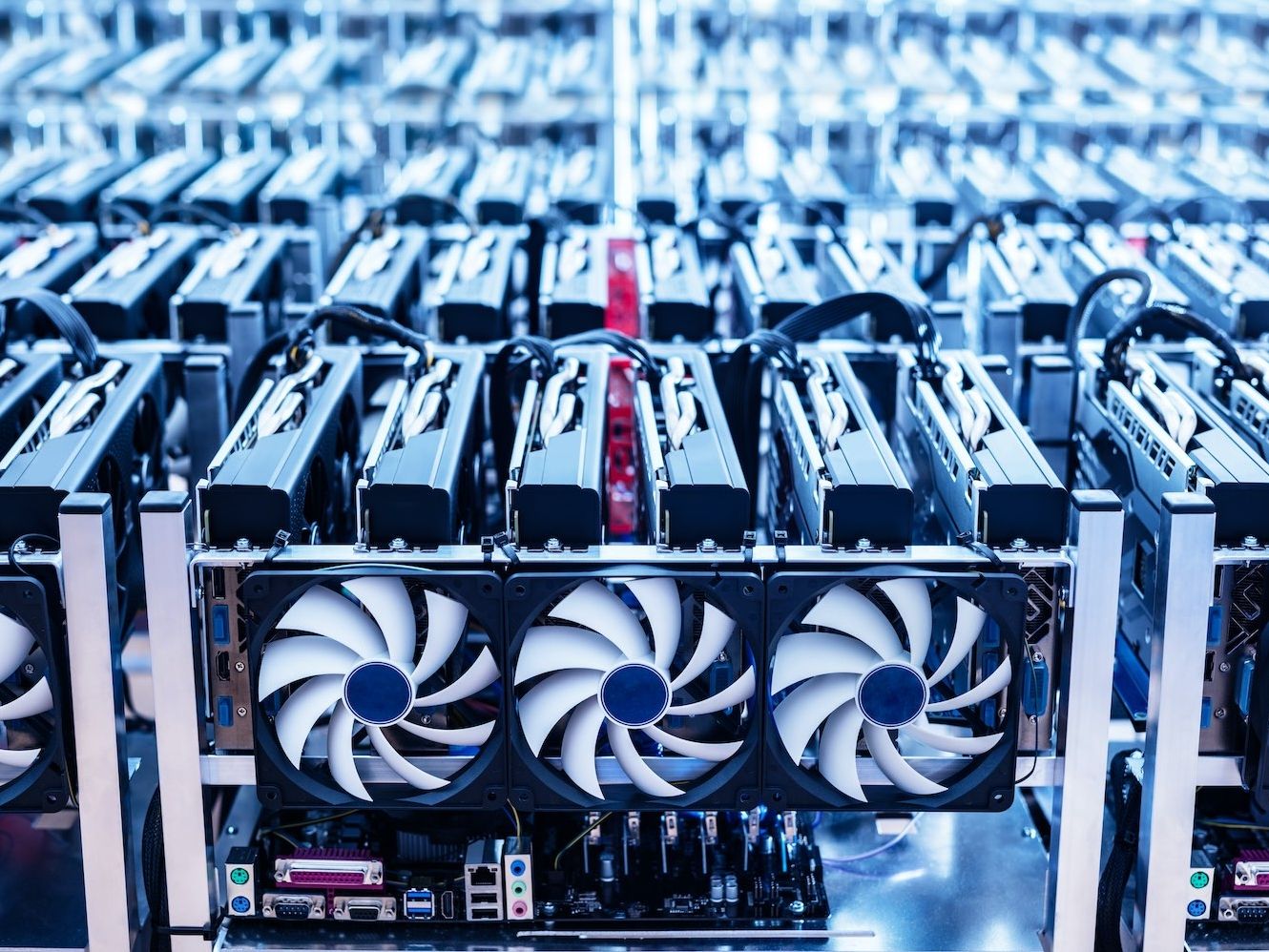

For those of you who think “hashrate” sounds like something you’d order at a dodgy diner, let me explain: it’s the amount of processing power thrown at the Bitcoin network through mining. Think of it as the collective brainpower of a million gnomes hammering away at their computers. And why does it matter? Well, it’s like the moat around Bitcoin’s castle-the bigger the hashrate, the harder it is for the dragons of insecurity to get in. 🐉⚔️

But wait, there’s more! Their total assets under management (AUM) jumped 26% to $3.46 billion, despite a cheeky $126 million slipping out the door in XBT. Apparently, Bitcoin and Ethereum decided to flex their muscles, rising 29% and 37% respectively. Take that, inflation! 📈

So, what’s the big deal? IREN (because acronyms are fun) just reported a fourth-quarter haul that shows it’s not just mining bitcoin, but also dabbling in artificial intelligence like it’s the next big thing. According to Canaccord Genuity, the stock is set for a big boost, with the price target skyrocketing by a whopping 60%. That’s more than most people’s yearly raise!

With the flair of a Shakespearean tragedy, Unicoin submitted its defense to a New York federal judge this week. The company accuses the SEC of mangling its words, turning optimistic forecasts into outright falsehoods, and ignoring clear warnings about risks. It’s almost as if the SEC mistook Unicoin’s investor materials for poetry rather than prose. 📜🔥

Let’s take a moment to appreciate Polkadot’s resilience. While other cryptos are busy throwing tantrums over market conditions, DOT is out here proving itself to be tougher than your grandma’s meatloaf. Not only did it reclaim $3.75 like a champ, but it’s also got some serious fundamental wind beneath its wings. Apparently, tokenizing real-world assets isn’t enough; now they’re building entire innovation valleys in Paraguay. Can we all agree that “Asunción Innovation Valley” sounds like the name of a luxury spa resort? 🕶️

During its mid-year results conference (a gathering so formal it probably had PowerPoint slides older than your grandmother), PetroChina’s board casually dropped a bombshell: they are “monitoring developments” regarding Hong Kong’s shiny new Stablecoin Ordinance. And not just monitoring-they’re planning feasibility studies on using stablecoins for cross-border payments. Oh, how modernity creeps up even on the most traditional of industries! One can almost imagine the CFO, quill in hand, furiously scribbling notes while whispering to himself, “Stablecoins… could this be our ticket to digital immortality?” 🖋️✨

Alas, the broader trend, as observed through the daily chart, remains decisively bearish. This elusive creature, Bitcoin, has yet to conquer the lofty heights of $116,000, its repeated attempts met with scorn, reinforcing a pattern of declining peaks and troughs. The waning trading volume, akin to a dwindling supply of tea at a society event, suggests a dearth of fervor among buyers and an air of indecision among traders. The support at $108,717, a recent low, now stands as a critical threshold. Should Bitcoin breach this with vigor, it may herald a continuation of its melancholic descent. 🕯️