When XLM Dances with Chaos: A Tale of Volatility, Breakouts, and Blockchain Drama 🎭💸

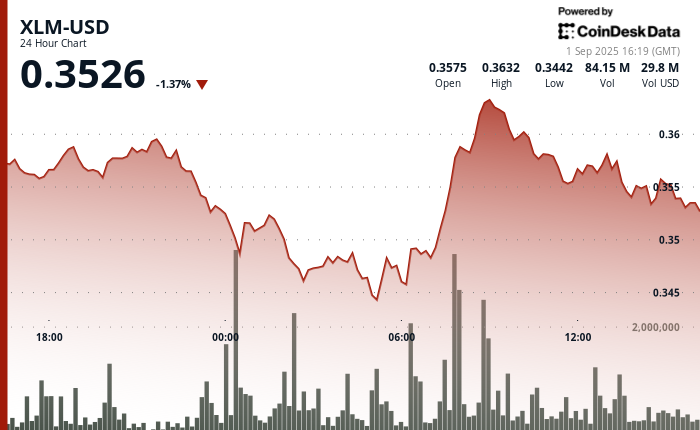

Oh, how Stellar’s native token endured its little drama! For 24 hours, it traded in a cruelly tight 5% range between $0.34 and $0.36. The day began calmly enough-perhaps too calmly-but then came the late-evening selloff. Like a sudden storm, it knocked poor XLM from its lofty perch at $0.36 down to $0.34. How poetic! 🌩️💔