Will Solana Rally Again? On-Chain Clues Sing

A brisk dash of dip-buying prevented deeper losses, stabilising SOL and delivering a 12% daily flourish despite the market’s perpetual sigh of uncertainty.

A brisk dash of dip-buying prevented deeper losses, stabilising SOL and delivering a 12% daily flourish despite the market’s perpetual sigh of uncertainty.

The United States, in a burst of cosmic brilliance, has given the green light to a new crypto-friendly national bank. Yes, indeed! In the second term of our dear leader Donald Trump, the regulators have decided to bless Erebor Bank with a national charter. One must wonder if this is a sign of deep trust in the unknown or simply a gamble in a game where the house always wins!

Apparently, this ETF is the answer to all your prayers if you’ve been dying to dip your toes into the “tokenized real-world assets market” without, you know, actually understanding it. Because who needs complexity when you can just hand your money over and hope for the best? Regulated, passive, and probably more exciting than your last Tinder date-what’s not to love?

//media.crypto.news/2026/02/Screenshot-2026-02-07-at-10.23.58.webp”/>

As expected, ZEC has not been immune to such a broader decline. In fact, the altcoin fell by approximately 16% over the last 24 hours, as if the market had finally discovered the secret to eternal suffering. Yet, on the one-hour charts, some signs of stabilization between $218 and $212 could be seen-though one might argue that this is merely the market’s version of a sigh of relief, barely audible over the cacophony of panic.

AltCoin Việt Nam notes that the weekly chart is not exactly forgiving. Despite cheaper prices, institutional ETFs have been notably cautious about piling into SOL in this zone. This is a mood swing compared with earlier phases when they were buying aggressively at loftier levels.

Since its release in February 2025, the value of PI coin – the cryptocurrency for the Pi network – has been steadily decreasing. Today, it hit a new low of $0.13 during trading.

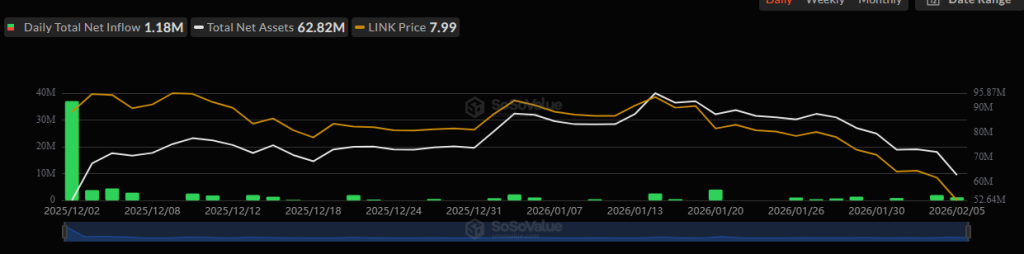

The Chainlink Reserve, that indefatigable juggernaut, marches onward, its coffers swelling to a princely 1.9 million LINK. Funded by the toil of off-chain enterprises and the whispers of on-chain usage, it stands as a monument to long-term sustainability-a beacon of hope in a sea of speculative despair. Yet, let us not forget its true nature: not a siren luring liquidity, but a silent architect of infrastructure.

After plummeting nearly 20% to its lowest point since November 2024 (I mean, who doesn’t love a good dramatic flair?), XRP bounced back like a rubber ball, climbing roughly 15% to flirt with the $1.30-$1.40 range. It’s as if the coin said, “Hey, look at me! I’m not dead yet!” all while the rest of the crypto market looked on with mild concern, like a parent watching their child get back on a bike after a nasty fall.

Well, slap my knee and call me surprised! Bitfarms (BITF), those erstwhile bitcoin miners, have decided to trade in their pickaxes for slide rules and join the AI gold rush. They’re packing up their maple syrup and heading south, rebranding as Keel Infrastructure – a name that sounds like it belongs on a ship captained by a man with a wooden leg and a penchant for tall tales.