Bitcoin’s Grand Return: A Financial Frolic Worth $333 Million! 🤑

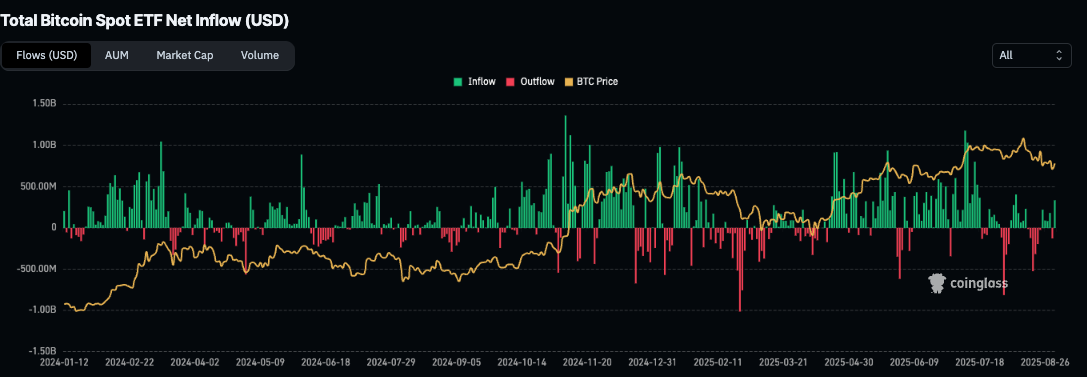

Institutional parties of no small consequence have reopened their wallets towards Bitcoin (BTC) with renewed vigour. On Tuesday, the 2nd of September, Spot Bitcoin ETFs recorded an impressive $332.7 million in net inflows, as reported by the reputable CoinGlass. Such a figure constitutes the most substantial single-day increase since mid-August, putting previous doubt to shame.