Crypto Wars: Will CEXs Survive or Be Eaten by DEXs?

This dance matters. Will the CEXs rise as grand banking cathedrals or crumble under the nimble feet of DEXs, custody-free and lightning fast?

This dance matters. Will the CEXs rise as grand banking cathedrals or crumble under the nimble feet of DEXs, custody-free and lightning fast?

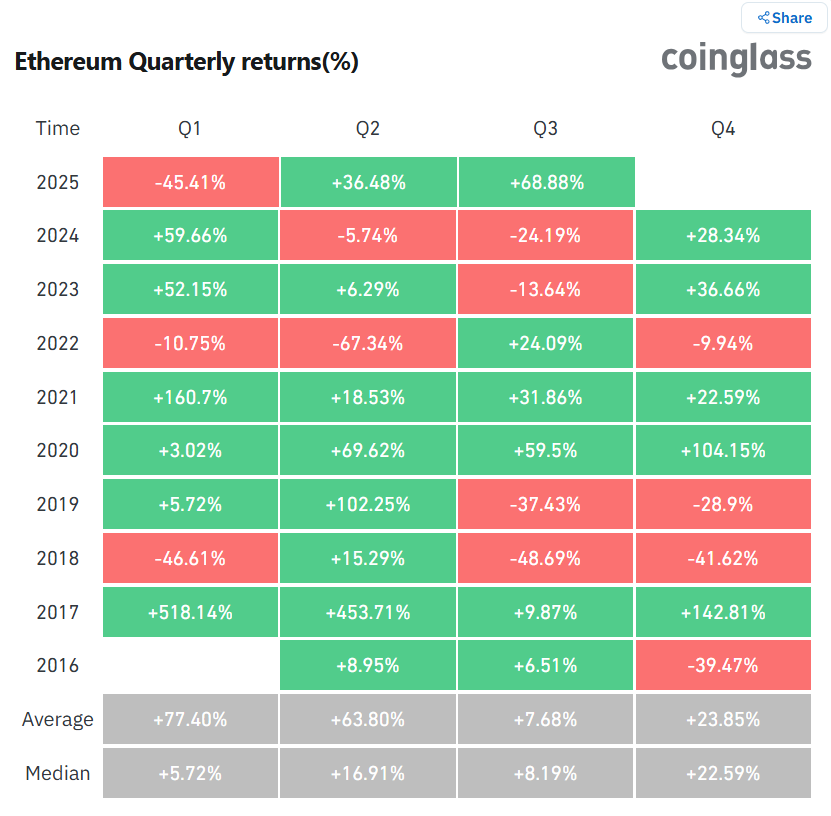

Investors will be closely watching October, a month that historically hasn’t favored the token. Still, shifting market conditions and institutional activity could alter the expected trajectory this year. Or maybe it’s just a case of “hope springs eternal,” even if the moon’s made of green cheese. 🌕💸

Add emojis where appropriate. Use sarcastic remarks, maybe compare the SEC to a magical creature. For instance, “Chairman Paul Atkins declared crypto a top priority, as if it were a secret ingredient in a wizard’s potion. 🧙♂️”

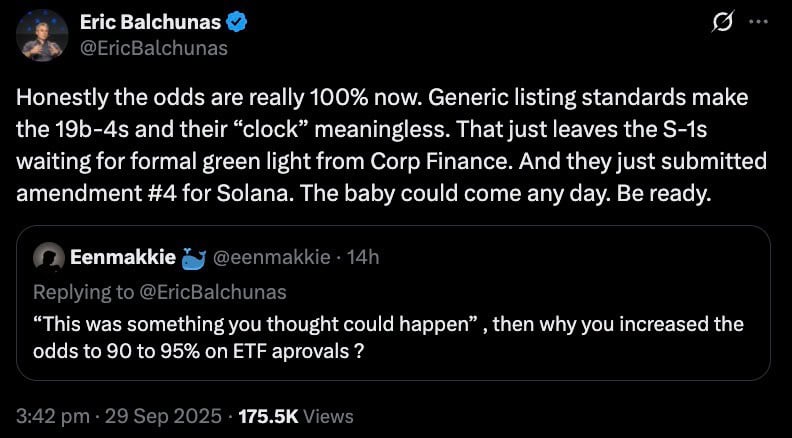

“I have never been more convinced of the need for clarity in this crypto quagmire. It is as if the very locomotive of market structure has derailed and left the station!” exclaimed, with palpable outrage, our dear Brian Armstrong, CEO of Coinbase, on a platform known as X, which, ironically enough, seems to be where all the profound discussions take place nowadays.

Yet, while he speaks with prophetic fervor, the banks are arriving like leeches, eyes gleaming with anticipation of yet another handout-this time at the expense of your eagerly awaited rewards. How clever of them to want to abolish your rights! 😂

This curious move could fling open the doors for investors far and wide to acquire stakes in Animoca Brands, a Web3 concern with a finger in more than 600 blockchain projects. A veritable octopus of ventures, if you will, minus the ink. 🦑

AvaTrade’s sage oracle, Kate Lyman, muses with an air of sober gravity, “This shutdown is no mere Washington charade but an uncertainty that spills into global markets, shaking even the elusive cryptocurrency realm.” Ah, uncertainty! The shadow that makes fools and wise men alike squirm.

Recall, if you will, the year of our Lord 2020, when this very spirit of Ethereum danced such a vigorous jig in Q3 that Q4 blossomed in a magnificent 104% surge-almost theatrical, non?

The SEC, in their infinite wisdom, alleges that this meteoric rise was fueled by anonymous social media promotions. Apparently, someone with a Twitter handle like @CryptoWizard69 whispered sweet nothings about QMMM’s plans to establish a $100 million diversified crypto treasury, complete with investments in Bitcoin, Ethereum (ETH, $4,158, because who’s counting?), and Solana (SOL, $206.6, still cheaper than a night out in London). 📈💸

On September 30, Republic proclaimed its plan to tokenize Animoca Brands’ equity, promising global access within a framework that pretends to be compliant. Animoca, a collector of over 600 Web3 investments, brands itself as a maestro who uses tokenization and blockchain to hand over digital property rights to investors, as if ownership could be measured by melody and ledger lines. 😄🪙

Chainlink declared it had wrought a clever mechanism, permitting banks to speak in the tongue of tokenized investment funds through Swift-the venerable interbank message-post that underlies much of the established financial order. One imagines a telegram machine suddenly whispering blockchain secrets.