IREN & WULF: Billion-Dollar Debts, 6% Gains, and a Dash of Drama!

Artificial intelligence and high performance computing (AI/HPC) miners continue to surge pre-market, like overzealous actors in a West End play. 🚀

Artificial intelligence and high performance computing (AI/HPC) miners continue to surge pre-market, like overzealous actors in a West End play. 🚀

This Chicagoan oracle, with the solemnity of a man predicting the fall of empires, insists stablecoins shall not merely nudge the B2B world but *replace* it, while also sneaking into consumer commerce like a cat burglar in velvet slippers. 🐾

Because apparently, having a free-for-all in the crypto space wasn’t as charming as it sounded. This new oversight is like putting the cookie jar on a high shelf-suddenly, those shady dealings seem a tad less appealing. Boosting investor confidence? That’s the goal! 🍪

Yes, you read that right. A 175-year-old French bank (that’s basically history at this point) with over €150 billion in assets – more than some countries’ entire economies – has decided to dip its toes into the wild world of crypto for what we assume are reasons ranging from innovation to boredom.

Japan’s esteemed securities overseers, ever vigilant against the vulgarities of market misconduct, now cast their discerning eye upon the chaotic realm of crypto. Henceforth, the art of insider trading shall be met with penalties most severe, aligning these digital trinkets with the decorum of stock market etiquette. One might almost suspect they wish to make the industry *respectable*.

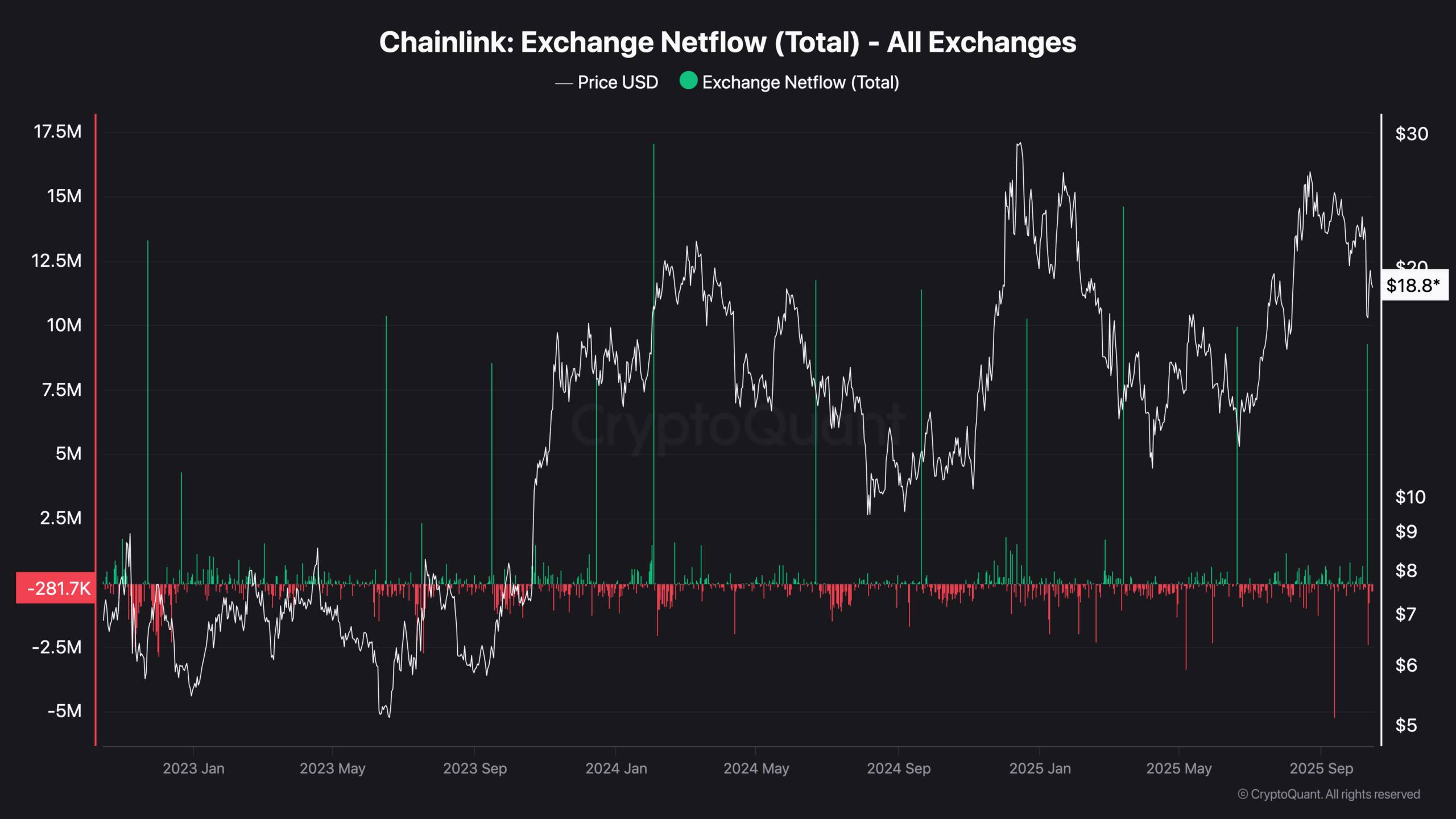

At this fleeting moment of scribbling, LINK pirouettes near $19, a 2% ascent in the last 24 hours, yet still trailing by over 13% from the week’s fickle fancies. One must chuckle, dear reader, at the stock market’s eternal tango with gravity. 📉😏

According to SBF, his early reputation as a major Democratic donor shifted in 2022 when he started backing Republicans, a move that, one might say, invited the wrath of the political elite. 🕵️♂️

Ripple is putting up $200,000 for white hats to attack its new lending protocol, while Coinbase has announced a direct bet on India’s growing crypto economy via CoinDCX. A noble endeavor, if one can ignore the irony of paying hackers to test security. 🧠💥

Enter Captain Faibik, the crypto analyst with a name that sounds like a pirate but talks like a prophet. ⚓ He’s waving his hands frantically, shouting that this isn’t just a hiccup-it’s the beginning of a major correction! Late buyers, beware! You might just find yourselves trapped in a digital dungeon, while the big fish swim away with their treasure. 🤑

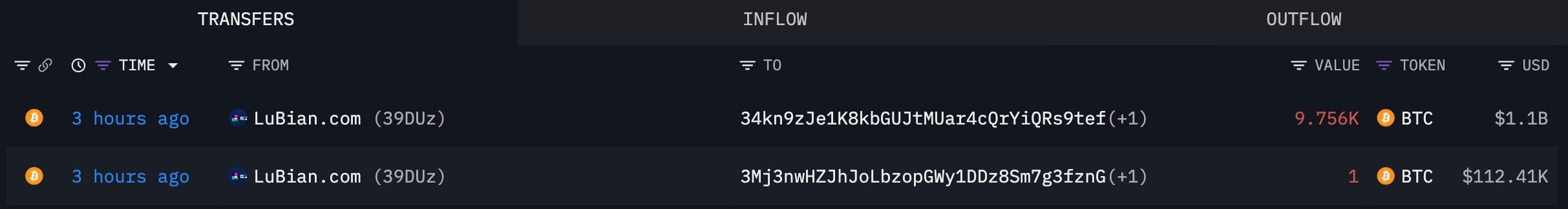

The magnitude of this transfer is not to be trifled with, for it constitutes more than two percent of the daily global XRP turnover. One can scarcely imagine the potential consequences should even a modicum of this sum find its way into the open markets. The price, already a delicate creature, might well be sent into a most unseemly flutter. 🌀