BTC’s Chaotic Dance: Will Bulls or Bears Win? 🚀📉

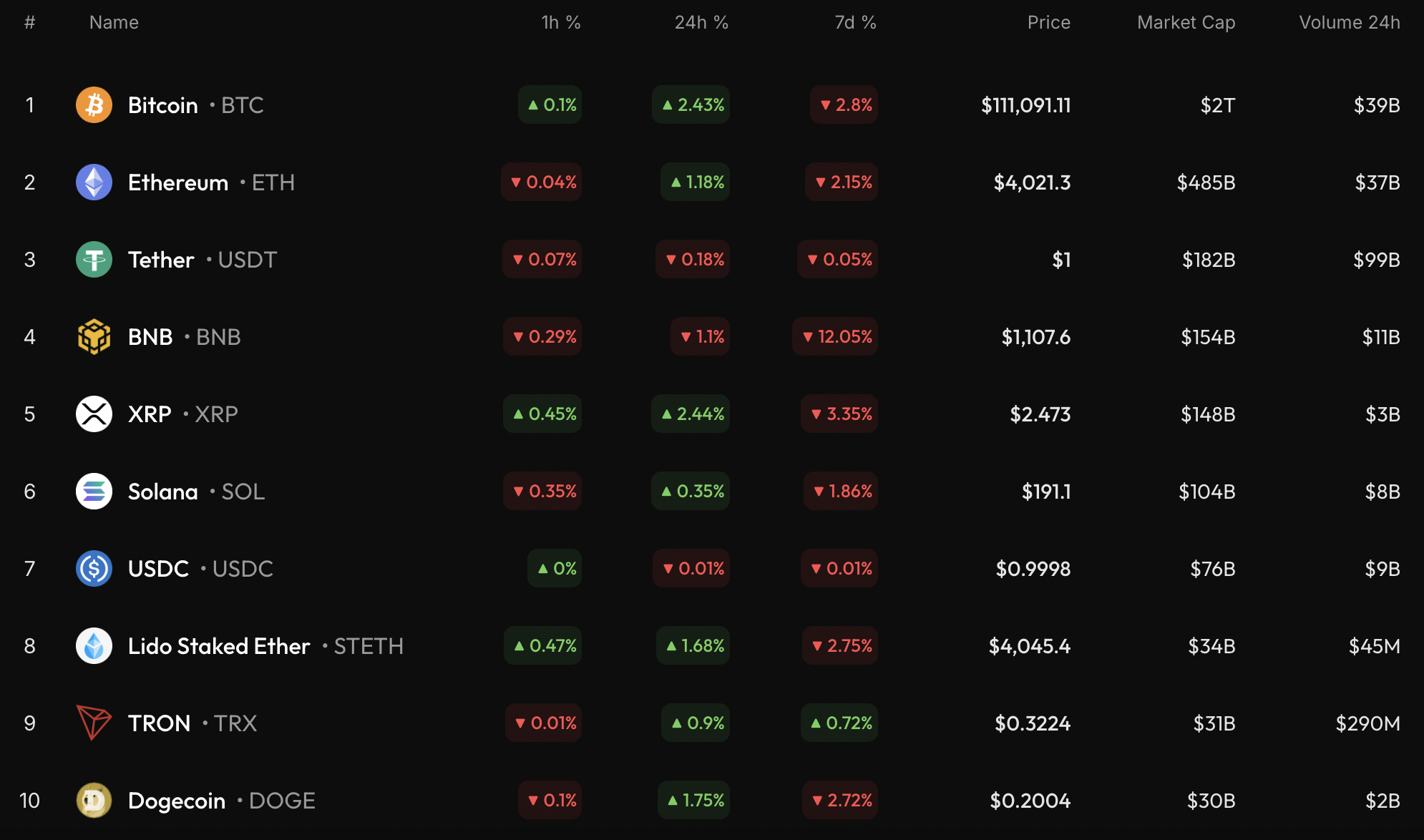

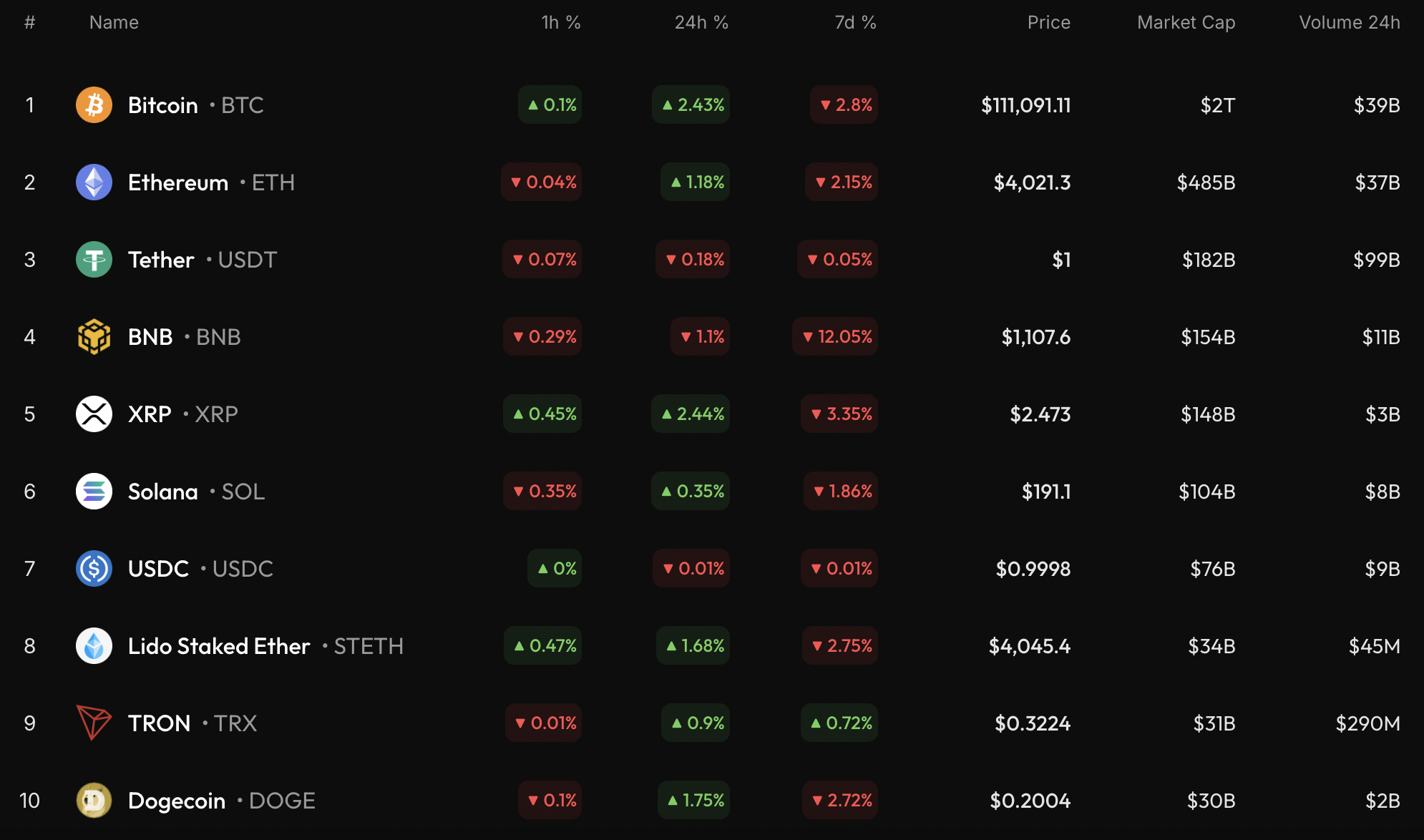

Bitcoin (BTC), that most capricious of financial paramours, has stolen the spotlight today, ascending by 2.43% with the enthusiasm of a man who’s just discovered he’s won a lottery he never entered.

Bitcoin (BTC), that most capricious of financial paramours, has stolen the spotlight today, ascending by 2.43% with the enthusiasm of a man who’s just discovered he’s won a lottery he never entered.

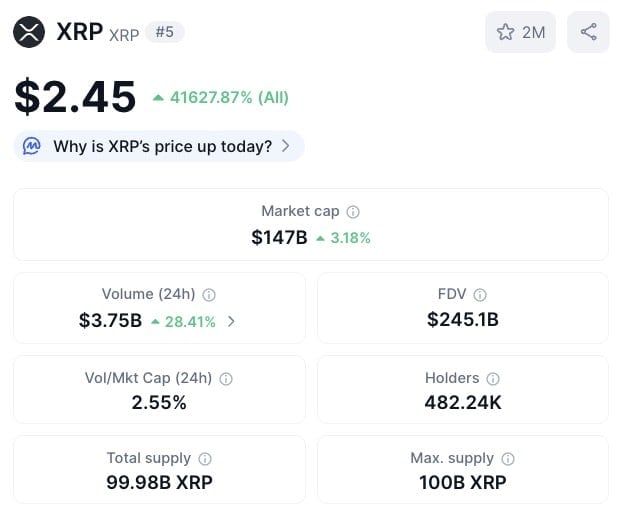

Hint: A golden cross has just popped up on the XRPUSD chart, which is basically the chart’s way of saying, “Hey, I’m feeling optimistic, maybe we’re trending upward real soon!”

Well, shucks, $XRP’s been sittin’ tighter than a frog in a sock between $2.34 and $2.39, just waitin’ to leap to $2.45. Reckon that’ll decide if it’s got the gumption for a major hoedown or not. 🤠

This whimsical fund promises to offer the fortunate few a window into the shimmering world of stETH-Ethereum, but with a posh, liquid twist, as curated by the Lido noblemen themselves. Who needs boring old cash when you can stake like a digital aristocrat? 🏰🚀

Last week, the winds carried away a hefty $513 million from crypto exchange-traded products (ETPs). A valiant streak of $9.1 billion was severed, Coinbase’s coins falling like autumn leaves-an impressive display of market gravity, or perhaps just a reminder that jumping on the bandwagon is always riskier than it looks. 🎢

stablecoins are becoming increasingly important for global economies. It may seem a bold claim, but I genuinely believe that countries’ economic success will soon depend on them. 🤯

This misfortune, like a cosmic jest, did not afflict only Coinbase but also spared no other-Snapchat, Amazon, Reddit, Hulu, Xbox-all succumbed to the same shadow of chaos. Men’s reliance on this single celestial body of cloud was laid bare; their confidence, like a house of cards, trembling at the whisper of disruption.

The Democrats’ spicy DeFi regulation idea has everyone from crypto bros to Republicans clutching their pearls. Who knew decentralized finance could centralize so much petty drama?

Crypto is so unthinkably huge at the moment, a nearly $4 trillion industry that’s aiming for world domination. 🧠💣