Bitcoin Drama: Bulls Cry, Bears Feast! 💸📉

CoinGlass reports over $2 billion in futures contracts liquidated-long traders, ever the optimists, bore the brunt with $1.6 billion lost. Mon dieu! Such folly!

CoinGlass reports over $2 billion in futures contracts liquidated-long traders, ever the optimists, bore the brunt with $1.6 billion lost. Mon dieu! Such folly!

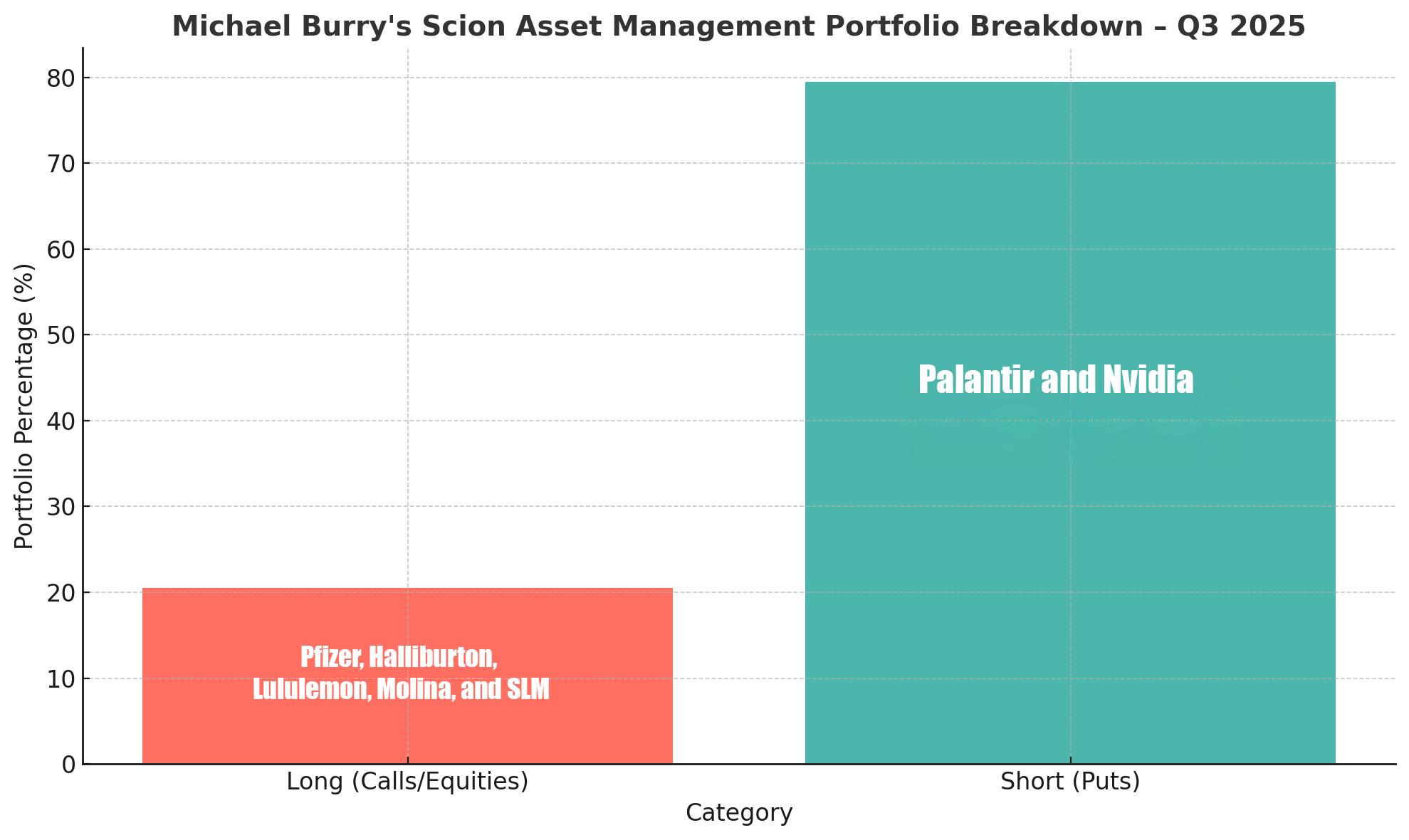

The latest 13F, a document as revealing as a confessional, unveils a portfolio steeped in paradox-bearish gambles on AI’s gilded idols, while new bullish ventures bloom in the realms of health care and energy. A classic Burry, one might say, a man who, like a prophet in the desert, scorns the crowd’s fervor and dares to wager on the abyss. 😏

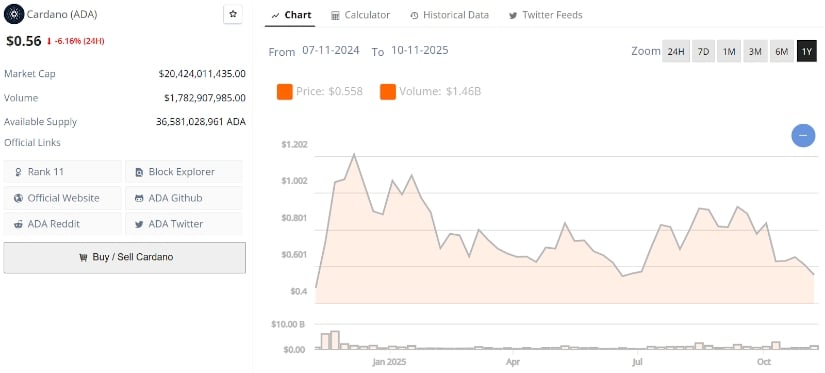

ADA’s currently lounging at $0.56, which, let’s be honest, is about as appealing as a soggy biscuit. A 6% drop in 24 hours? That’s not just selling pressure – that’s full-on investor melodrama. Market cap’s hovering around $20.4 billion, with daily volume topping $1.7 billion, meaning people are either panicking or just pretending they know what they’re doing. (Spoiler: They don’t.)

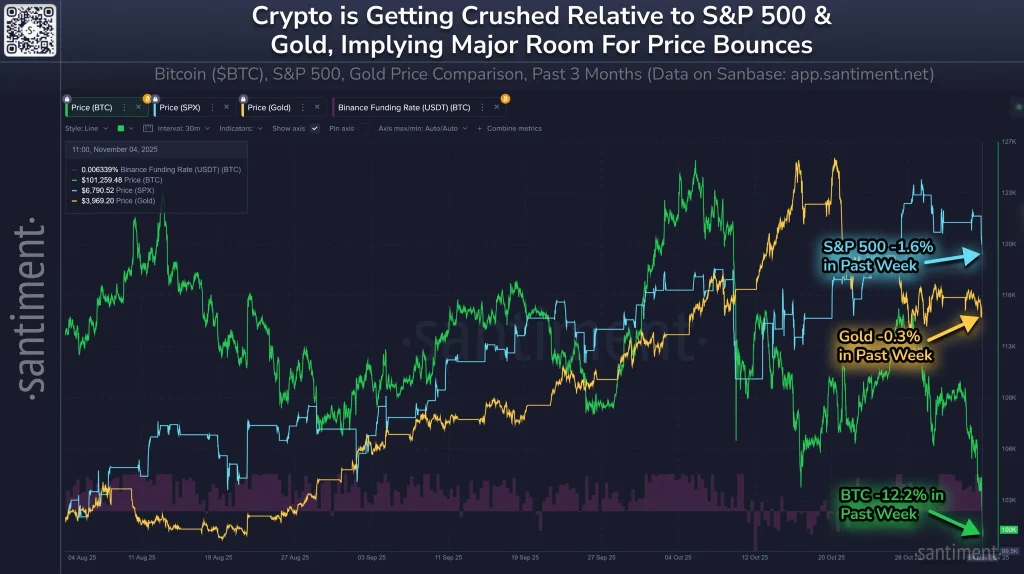

According to Mr. Wall Street’s extensive analysis (read: he’s been staring at charts until his eyes bled), the recent price stagnation and sudden drops are just a fancy institutional tango. 🕺 Yep, those big boys are apparently “accumulating” while we mere mortals panic-sell our avocados to buy the dip. The result? Bitcoin’s eventual climb back to $120K is as inevitable as a hangover after a bottle of Chardonnay. 🍷

Solana’s price is balanced on a fence thinner than a preacher’s patience in a saloon. The $155.83 level? That’s where the bulls dig in their boots, yellin’, “This far, no farther!” But the 50-day MA’s rollin’ over like a tired hound, and the 200-day? Gone fishin’. 🎣 Technical indicators? They’re as confused as a screen door on a submarine. 🚦

Sjuul, the oracle of charts, has spoken: Hyperliquid is stuck in a lower-high, lower-low pattern-basically, the financial version of a never-ending spiral down a drain. 🌀 Every time it tries to break free, it’s rejected like a bad pickup line at a robot bar. The chart is a masterpiece of misery, with momentum fading faster than a hitchhiker’s hopes on the Magrathea Expressway. 🚀

In a Monday memorandum addressed lovingly to the US Office of the Comptroller of the Currency-a bureaucratic beast that approves or kills banking dreams-the ICBA declared a vigorous “strong opposition” to Coinbase’s daring application. Their main concern? The “untested” nature of crypto custody-a term that makes you wonder if they believe the blockchain is some sort of mythical creature hiding in the shadows. Plus, they worry Coinbase might “struggle to turn a profit” during crypto downturns-because, of course, when the market dips, everything must fall apart, including dreams of financial revolution. 💸

Mere days after Trump feigned ignorance of the crypto titan-“CZ? Sounds like a vitamin,” he quipped-he erased his anti-money laundering convictions with the stroke of a pen. 🖋️💨

While the market’s having a meltdown, Bitcoin’s doing the cha-cha slide into Binance. The world’s largest exchange is now the hero we didn’t know we needed. According to our data wizard, CryptoQuant, Binance’s BTC reserves are booming. Meanwhile, other exchanges are watching their balances vanish faster than your patience during a bear market. 🧙♂️

And just to spice things up, Bitcoin, that brave little engine, flirted dangerously close to the $100k mark on Tuesday, only to scoot back like it saw a ghost. The whole crypto circus is in full swing, it seems.