Bitcoin’s Plunge: A Tragic Comedy in Three Acts 🎭💸

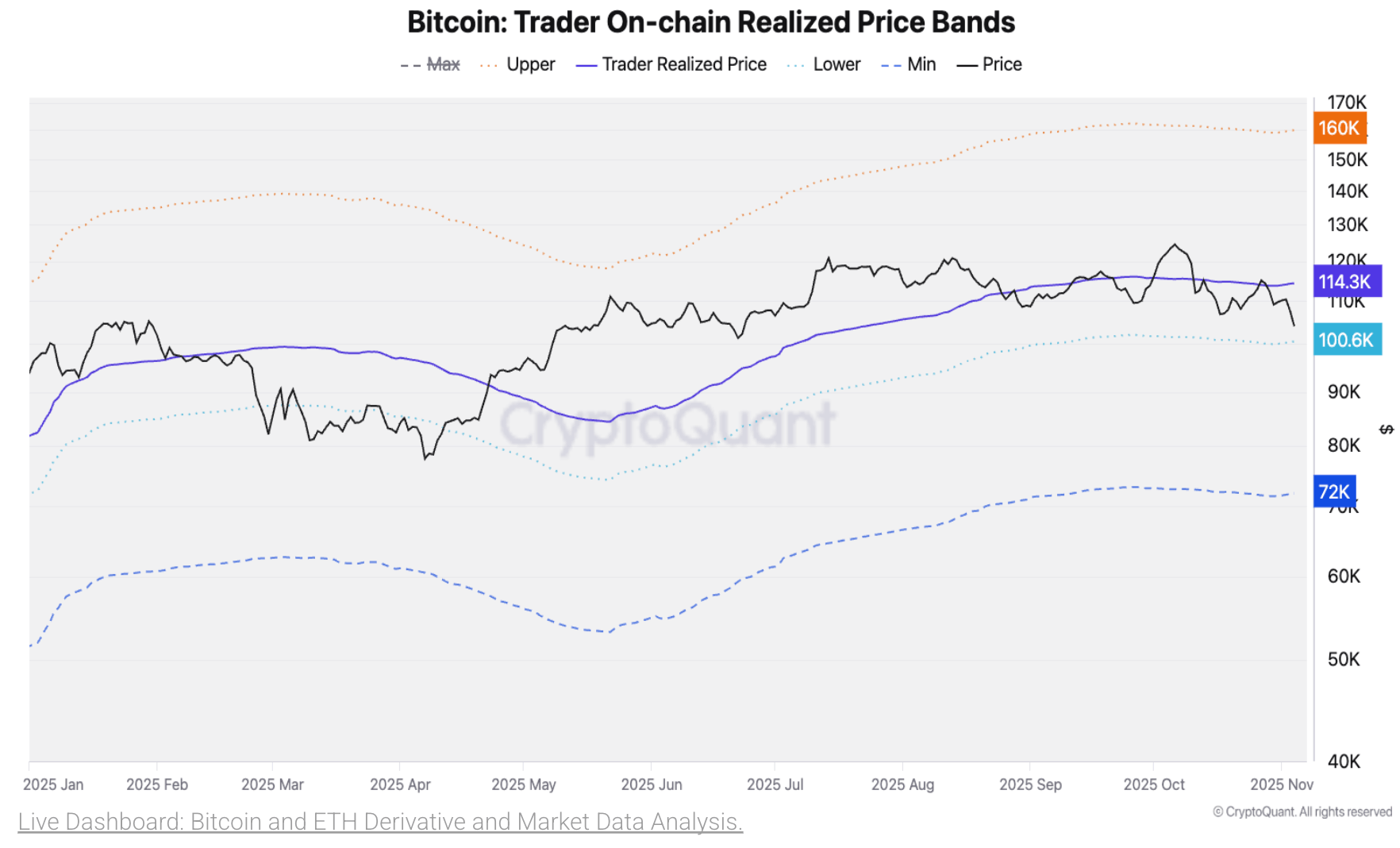

According to Cryptoquant’s latest missive, their Bull Score Index has plummeted to zero-a number as devoid of life as a society hostess’s heart. This, they declare, signals an “extremely bearish” posture, a phrase so dreary it could only be uttered by a man in a velvet smoking jacket, sipping absinthe. 🦹♂️💔