Mystical Movements in the Cryptocurrency Cosmos: XRP’s Chaotic Dance 📈

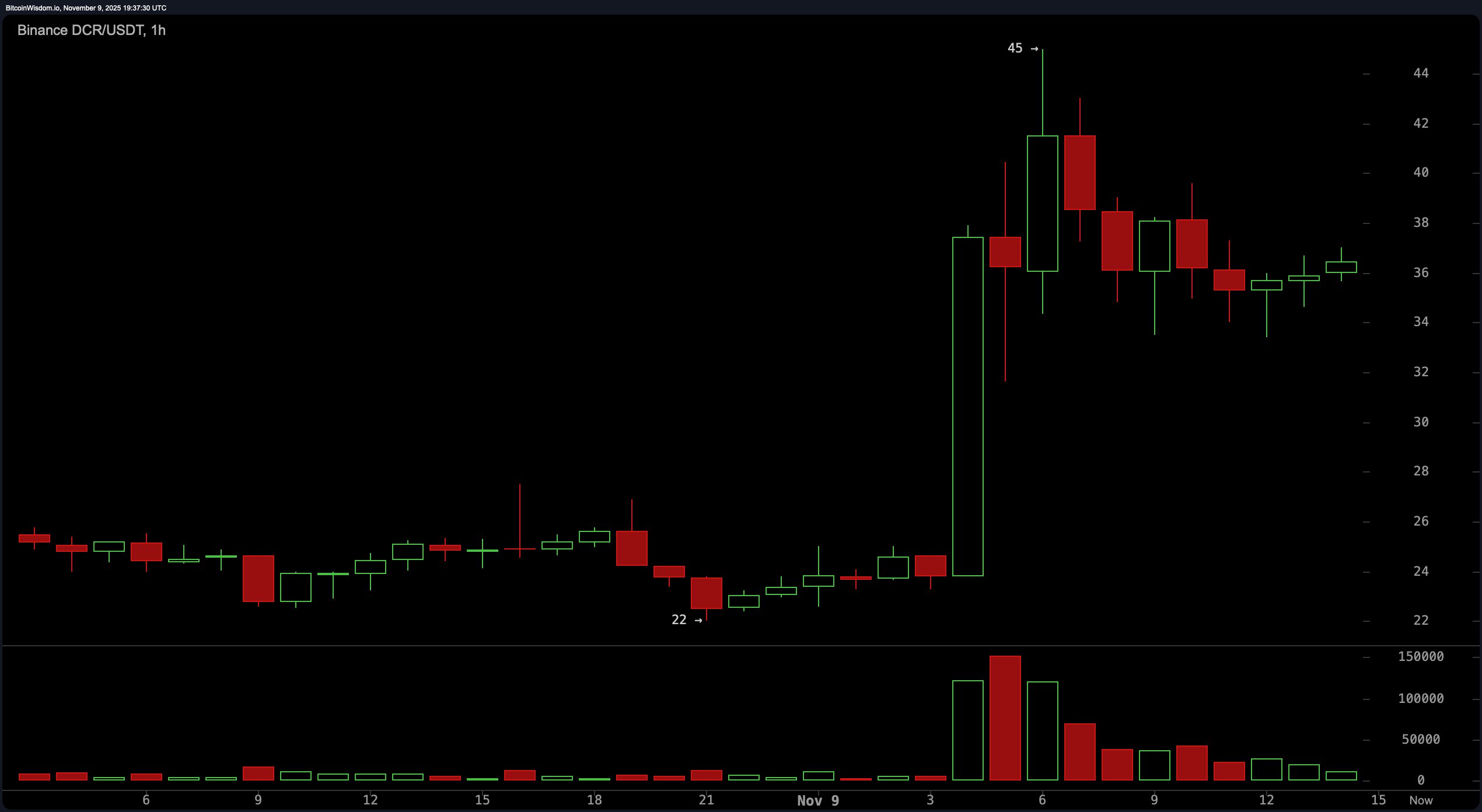

Akin to an early riser at a grand masquerade, XRP joined Bitcoin and Ethereum in starting a revival akin to an unexpected yet delightful encore. A clear triumph was secured above $2.35, and the 100-hourly Simple Moving Average was surpassed, as if the whole affair were an impromptu waltz.