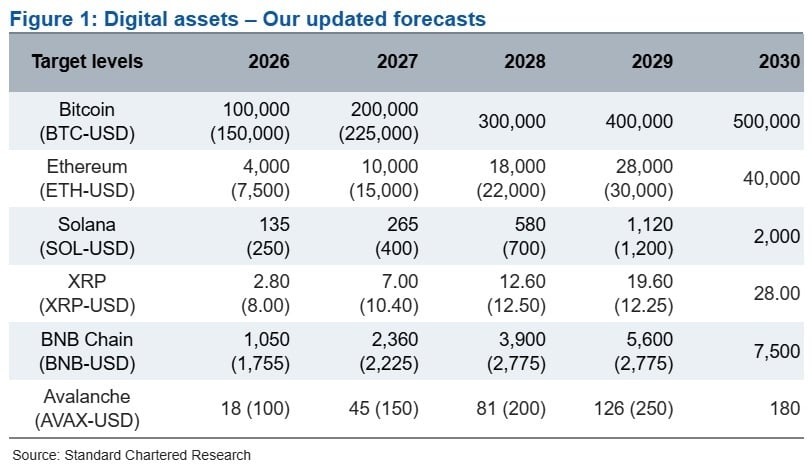

Is the Crypto Roller Coaster Heading Toward $50,000?!

Our dear Standard Chartered, in their infinite wisdom, have pulled back their lofty dog‑bane prices for the big digital hats: Bitcoin, Ethereum, XRP, and Solana. After all, nothing says ta‑ta to optimism like tripping over the next few months, right? They published this gloomy piece on February 12, slapping lower numbers onto those tokens and letting us know that near‑term capitulation appears to loom over the entire market.