Cash or Bitcoin? 🤔

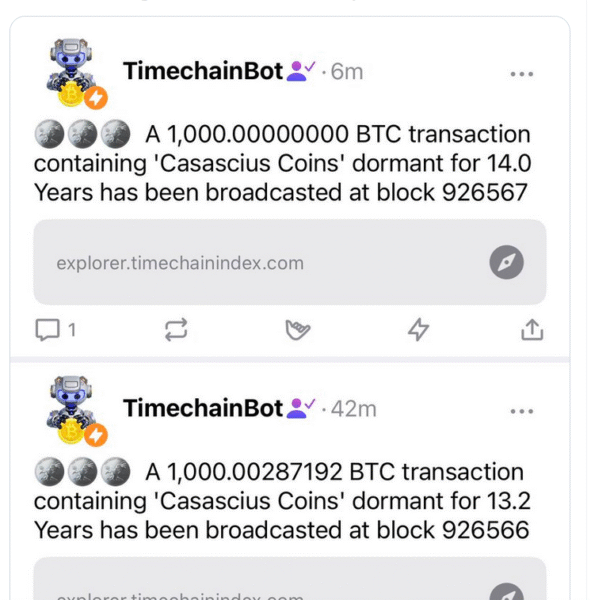

Two such coins, relics from a bygone era, have recently stirred to life. One emerged softly from its December 2011 peculiarity, the other from its October 2012 slumber. At their birth, Bitcoin was but a mere pup, priced whimsically at $3.88 and $11.69. Now, its worth has swollen almost beyond imagination, boasting returns that would give a modern-day Midas pause-more than 2.3 million percent! Ah, the allure of compound interest, what magic can match it?