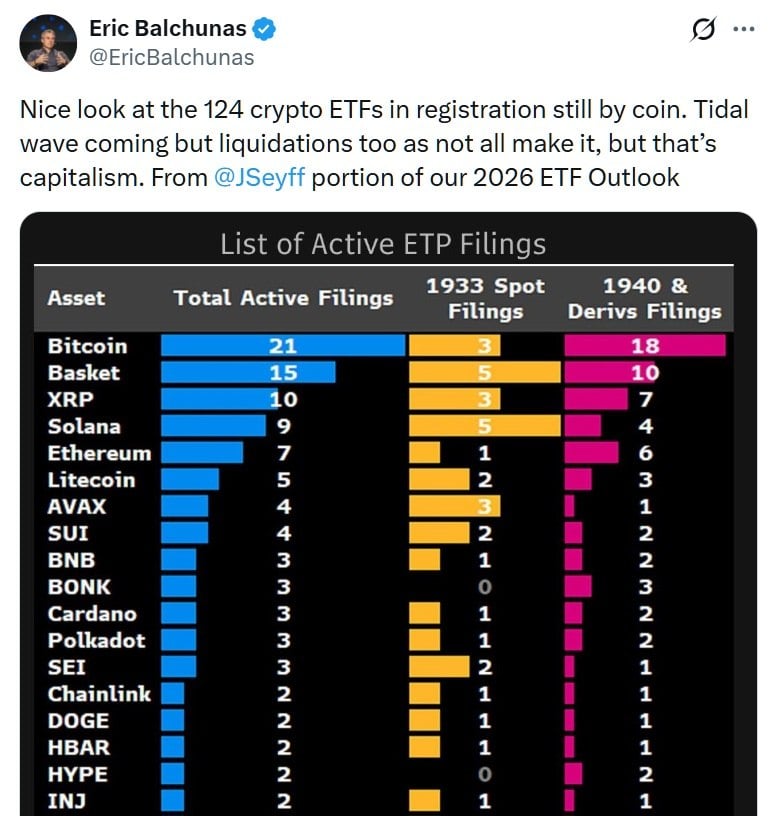

Crypto ETF Chaos: 124 Filings & a Liquidity Bloodbath 😈

Crypto exchange-traded funds (ETFs) remain a major focus in the digital asset market as Bloomberg ETF analyst Eric Balchunas shared on social media platform X on Dec. 11, highlighting the scale of active crypto exchange-traded product (ETP) registrations. His post centered on the growing number of filings and the competitive landscape forming around them.