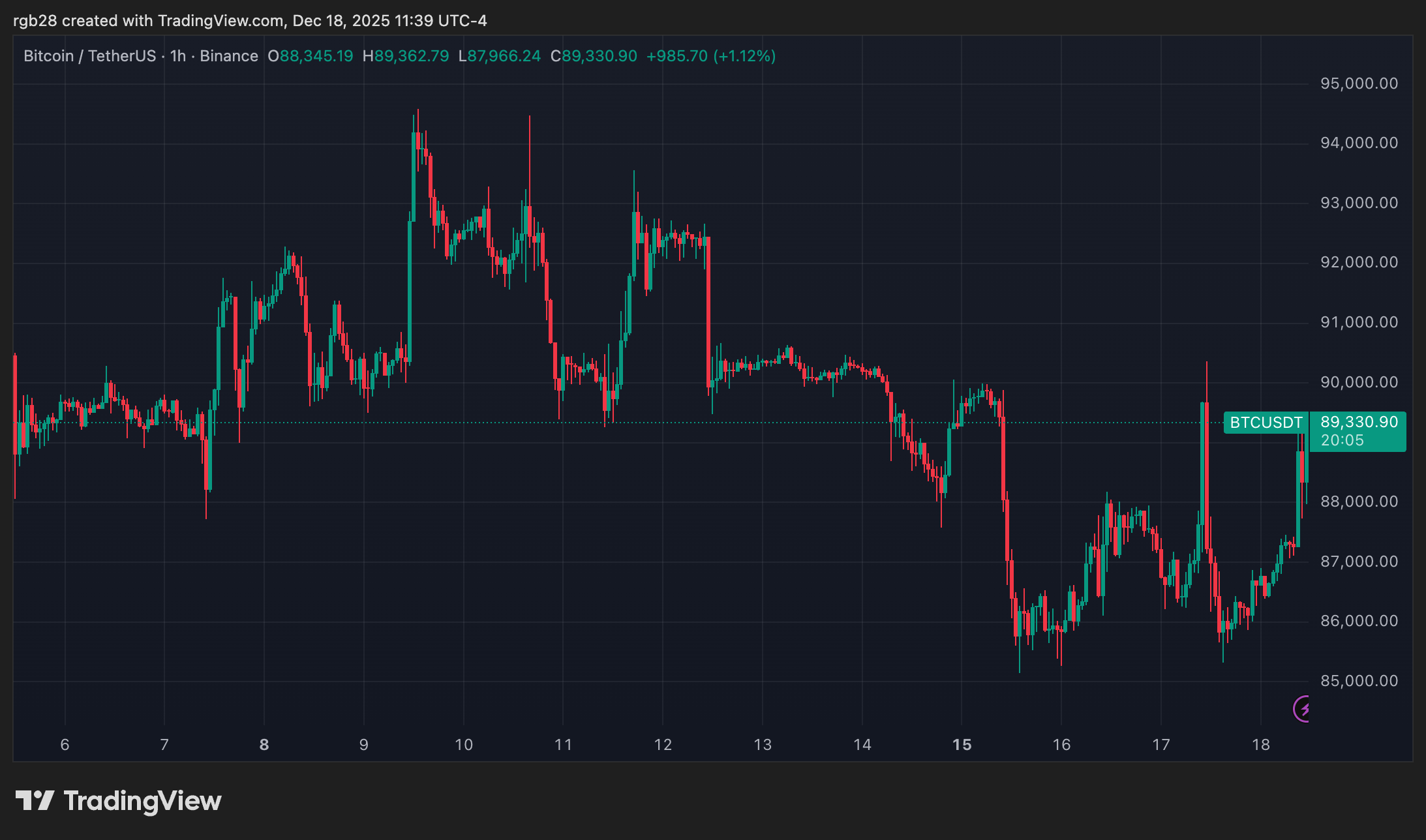

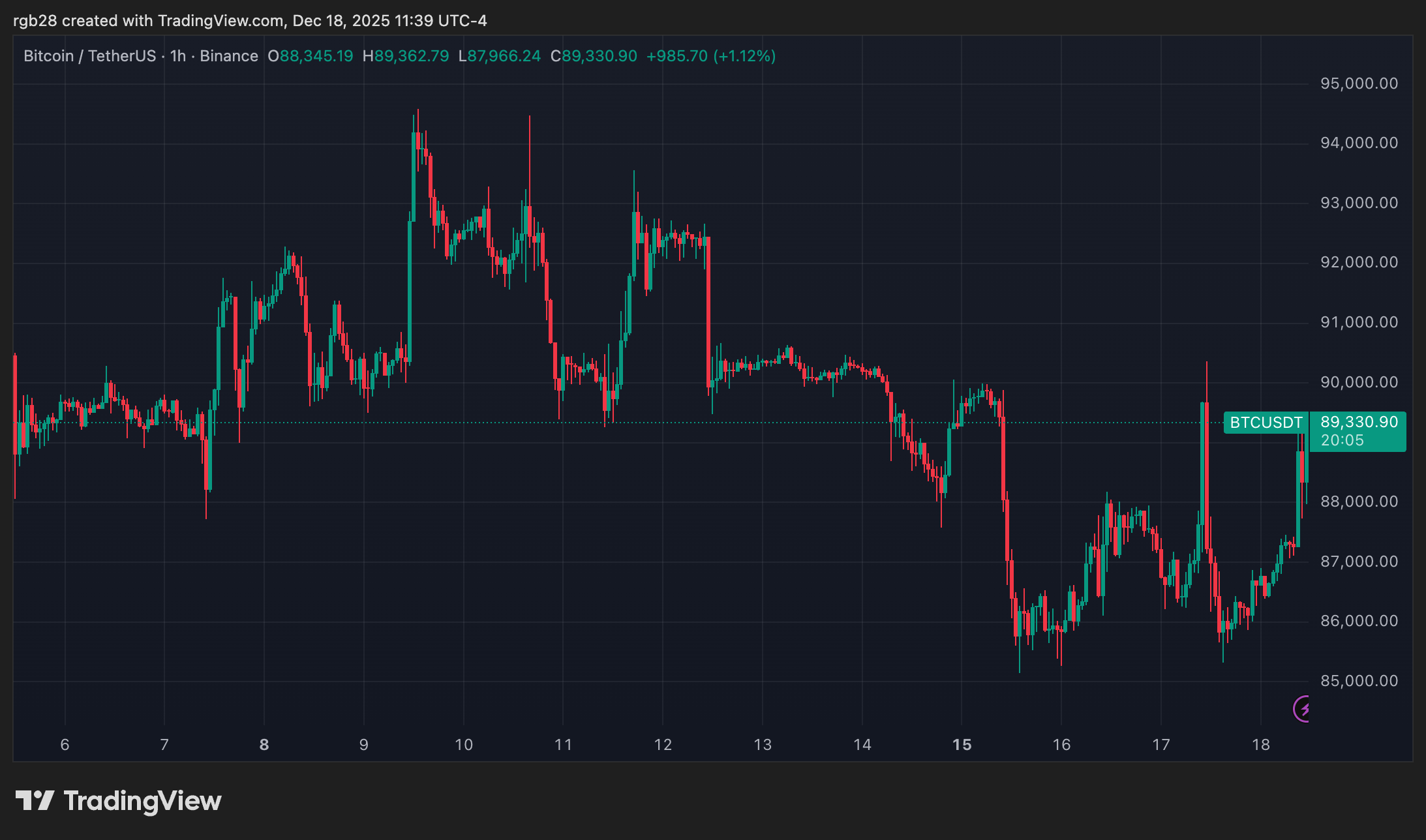

Thursday saw Bitcoin trying to burst through a key barrier after a modest 2.9% boost from the opening bell. But like a stubborn kid, it bounced off the $89,000-$90,000 plateau more times than a rubber ball in a playground, only to fall back to $85,145-a two-week low that feels as dramatic as a soap opera. The crypto hero attempted a comeback twice in a day, only to get politely rejected-no entry today, please. Market sage Ted Pillows (yes, that’s his real name) points out that despite the rollercoaster, BTC manages to cling above the $85,000 support, teasing a shot at the $90,000-$92,000 range-if it doesn’t give up first. But, beware-the moment it drops below that support, it could be headed down to revisit November’s lows, around $80,000, braiding its way into history’s repetitive tale. Ted suggests that Bitcoin’s recent antics might just be a rerun of its Q1 2025 drama, hinting at a possible tumble below current lows-because who likes surprises in the market, right? 😂