Why XRP Might Be Dancing to a Sad Tune Soon – A Witty Look

Like a shy debutante, XRP has modestly waltzed up by a mere 0.47% since yesterday-still waiting for its big break.

Like a shy debutante, XRP has modestly waltzed up by a mere 0.47% since yesterday-still waiting for its big break.

According to the esteemed CoinGlass (which sounds like a shiny, collectible ornament, but is apparently a serious crypto tracker), over a day, investors committed an eye-watering $1.44 billion USD worth of DOGE in futures contracts. That’s enough to rebrand a small country or, at least, almost enough to buy another yacht. This surge indicates an enthusiasm that’s been missing since the days of feathered hats and flapper dresses. Apparently, the speculative appetite for DOGE is back, perhaps fueled by a cocktail of optimism and the enduring charm of internet doggos. 🐕🦺

Сегодня, 26 декабря 2025-го, TrustWallet – вроде бы как безопасность и спокойствие крипто-мира – подвергся нападению. Злодеи внедрили JavaScript – вроде бы как казалось, что это аналитика – а на деле, они крали ваши страшные тайны и посылали их в Лабиринт Акинактора. Репутация? Забудьте! 🚨

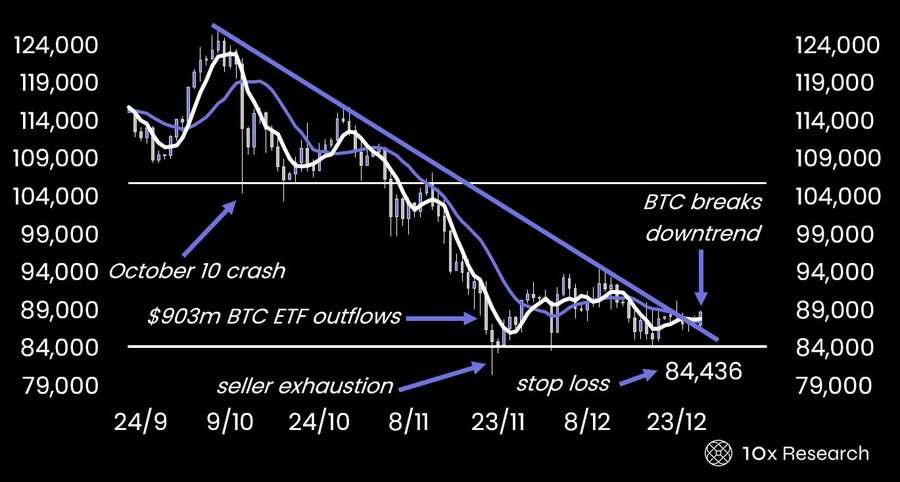

According to the cheeky folks at 10x Research, Bitcoin has suddenly decided to throw a confetti-filled party and break out of its shell. Yes, it’s doing a little happy dance and might just be heading for a multi-week rally, aiming to hit a jaw-dropping $110,000 if the good vibes keep rolling. Fingers crossed-it’s a rollercoaster, and nobody’s got a seatbelt! 🎢🤡

At the hour of this scribbling, the Shiba Inu trades at $0.0000072, a mere shadow of its former self-down 0.41% in 24 hours and 2.41% weekly. Yet, lo! A glimmer of hope: volume stirs, rising 20% to $98.98 million. Traders, those restless souls, still dabble, though their hearts seem heavier than a Christmas goose. 🍗

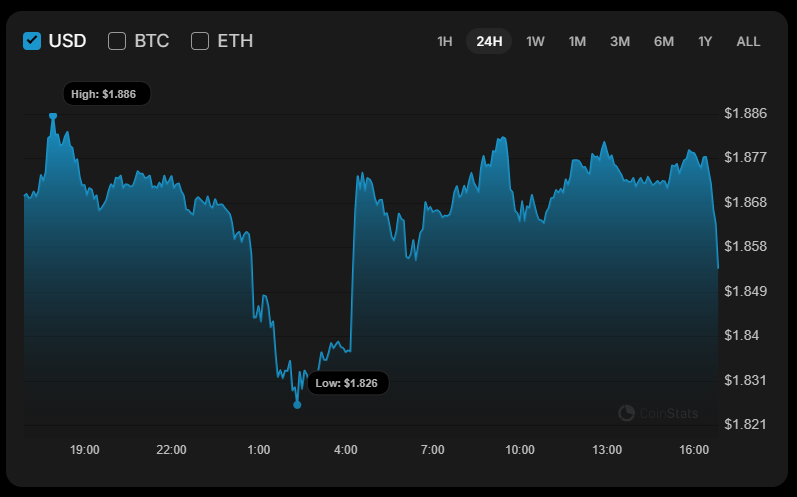

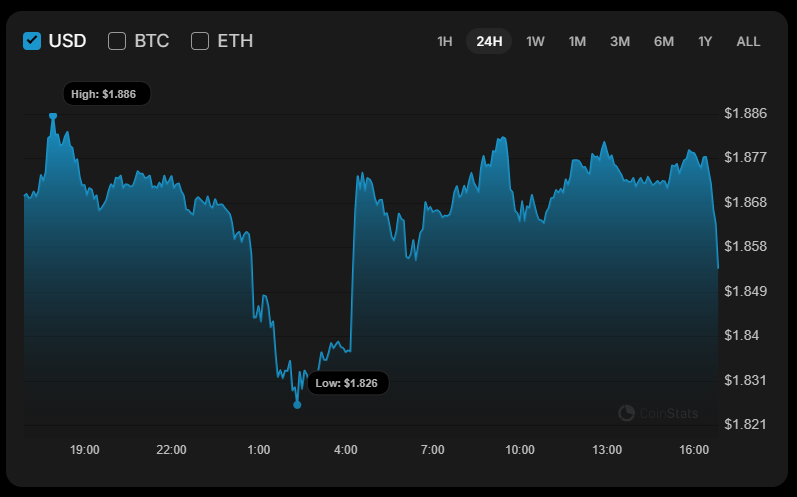

But hold your horses-its token? Oh, that’s a different story. The summer saw XRP soaring like a kite in July, hitting $3.65 and making everyone believe it was all downhill from there. Now? It’s trading below $1.90, which isn’t exactly a holiday miracle-more like a sad clown’s punchline. And those new XRP ETFs? They’ve been about as helpful as a screen door on a submarine. Down more than 20% since they arrived, like bad news at the holiday feast.

On the 4-hour chart, Solana is still stuck below a descending trendline, keeping things bearish. But hey, look at this fancy reversal wedge pattern! It’s like a sandwich with no filling-tightening range, but sellers are still in control. Progress!

The U.S. Department of Justice, with solemn visage, doth proclaim that Brooke McDonough, a sprightly 35-year-old from Arizona, hath been found guilty of embezzlement, money laundering, and other financial mischiefs. A jury, with eyes wide and jaws agape, hath sealed her fate! ⚖️

Apparently, this isn’t some casual weekend doodle on a napkin. No, no-our esteemed Mr. Hoskinson is tirelessly scribbling 80 to 100 pages daily about technical wizardry, fueled by coffee, Eurodance remixes, and what he charmingly calls “some serious effort.” And the cherry on top? The unassuming tease: “2026’s body is not ready.” Oh, the suspense! 📚☕

As the curtain rises on 2026, Ethereum prepares for a tumultuous journey, cautioned by Cowen’s prophetic insights. He posits that the broader market conditions may shackle any significant ascension for the second-largest cryptocurrency.