NIGHT Price Soars 10% – Will It Conquer $0.1199? 🚀

Yet, our protagonist, NIGHT, dances to its own tune, leaping into the spotlight with a 10% surge-a rare spectacle in this sea of crimson despair. 🌟

Yet, our protagonist, NIGHT, dances to its own tune, leaping into the spotlight with a 10% surge-a rare spectacle in this sea of crimson despair. 🌟

While the price flounders, the network’s activity is as lively as a barn dance. Daily transactions? A whopping 900,000! And some days, they hit a million! It’s like the ledger’s throwing a party and the price is too shy to join. 🕺💃

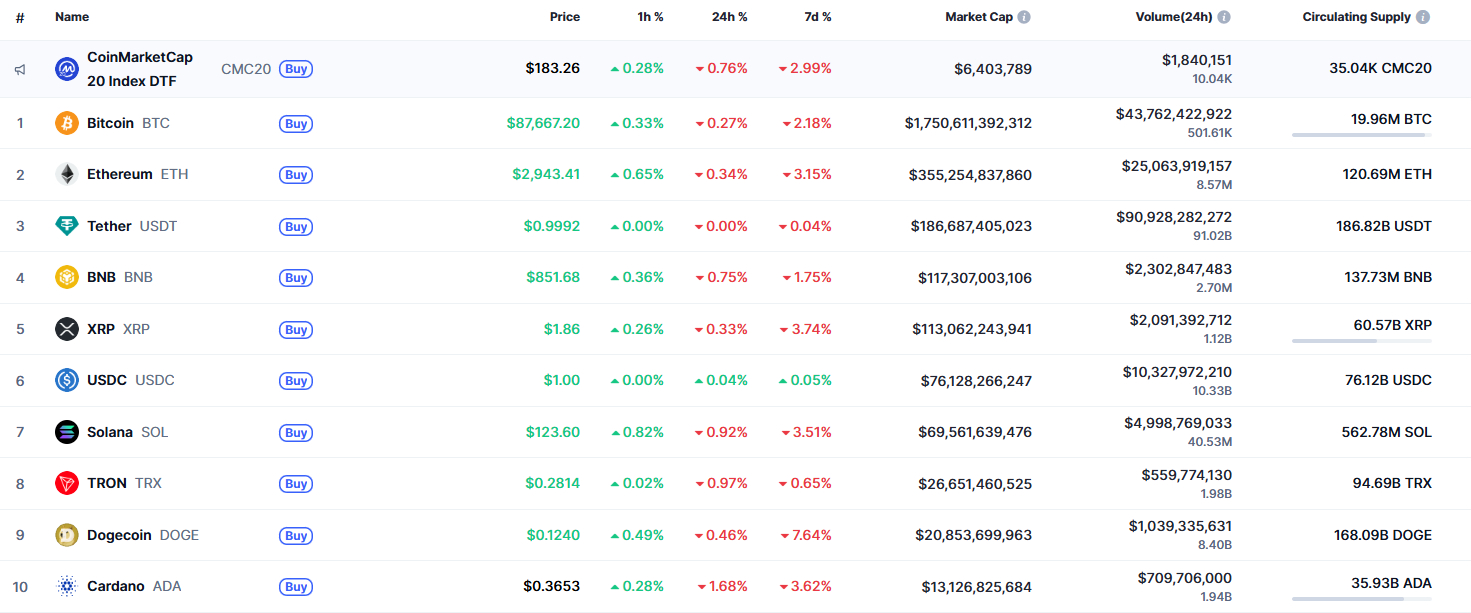

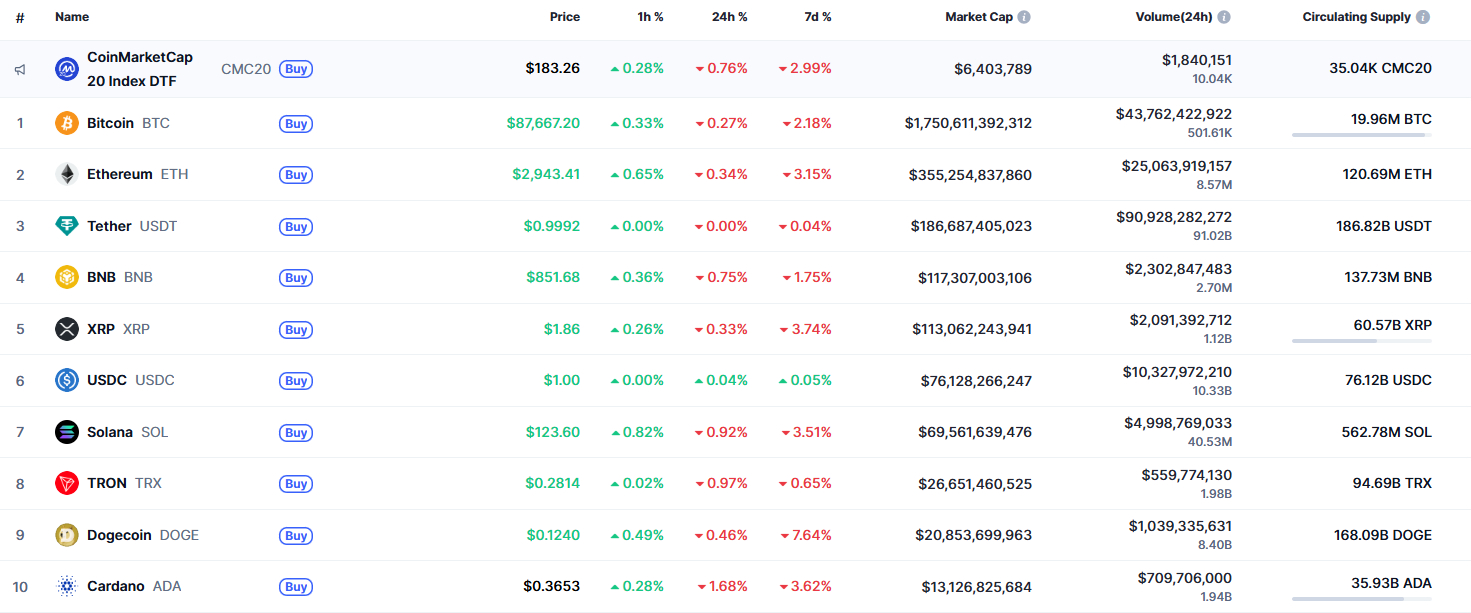

Behold, the theater of the absurd! Investors, those marionettes of the market, now find themselves at a crossroads, where sentiment, that fickle mistress, may dictate the next act. Months of stagnation, of reacting to the whims of macro news, have given way to a deeper, more sinister shift among the BTC faithful. The whales, those leviathans of lucre, stir once more, their bullish fervor unquenchable. CW, a seer of data and crypto, proclaims their return to the fray, their long positions swelling like the ego of a Dostoevsky protagonist. 🦈💰

A pullback isn’t necessarily the villain here, folks. It might just be the plot twist-like that moment in a thriller when everything seems lost, but it’s actually the setup for the grand finale. Could this be a mere reset, or are we looking at the dawn of a titan? Only time will tell. Or maybe just the charts. But hey, who’s counting? 😂

This company, so eager to proclaim its dominance, calls itself the world’s largest publicly owned ether treasury; second only to the bitcoin monolith of Strategy (MSTR)-a title both terrible and hilarious in its grandiosity. Imagine, an empire built on digital “magic” that makes mortal men weep.

According to the latest CoinShares report (you know, the guys who keep an eye on your money), crypto outflows reached $446 million last week. That’s slightly less dramatic than the $952 million that fled the week ending December 20. But hey, progress! 🙌

Two new wallets, born from the ether like digital phantoms, have executed a heist worthy of Hollywood. In the span of a single workday, they absconded with 26,241 ZEC (valued at $13.5 million) from Binance. As Zcash trills upward in the market like a caffeinated hummingbird, analysts squint at this maneuver with the suspicion of a librarian spotting a sticky note in a rare book. “Strategic repositioning,” they murmur, as if reciting a sacred mantra. Traders, meanwhile, sip their lattes and wonder if the next chapter will involve a Zcash moonwalk or a nosedive into the void. 🚀

What to know, darling? 🎭

As the allure of cryptocurrencies grows, so too does the burden of taxation, a matter of such gravity that even the most stoic of minds might find themselves in a quandary. 🤯

At the hour’s writing, XRP dances at $1.90, penned up like hogs at a fair between $1.85 and $1.91. Its monthly libations? A 13% drop-and a shade of red to rival a Sunday preacher’s collar. The trading volume? Well, it’s churned out 1.46 billion in the last 24 hours. That’s a lot of restless squirrels stashing nuts.