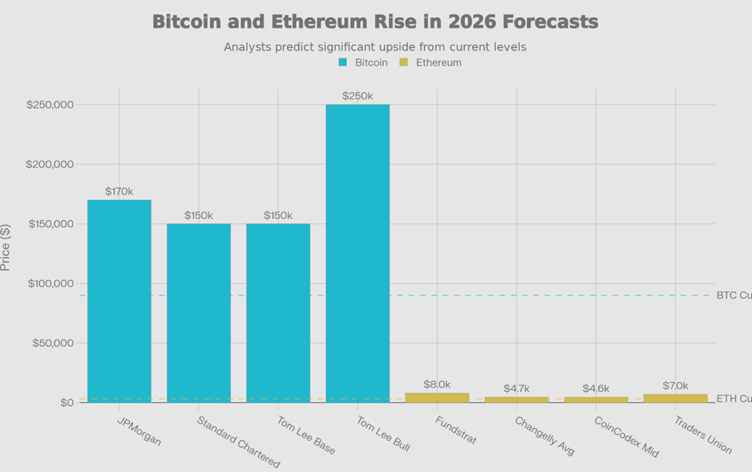

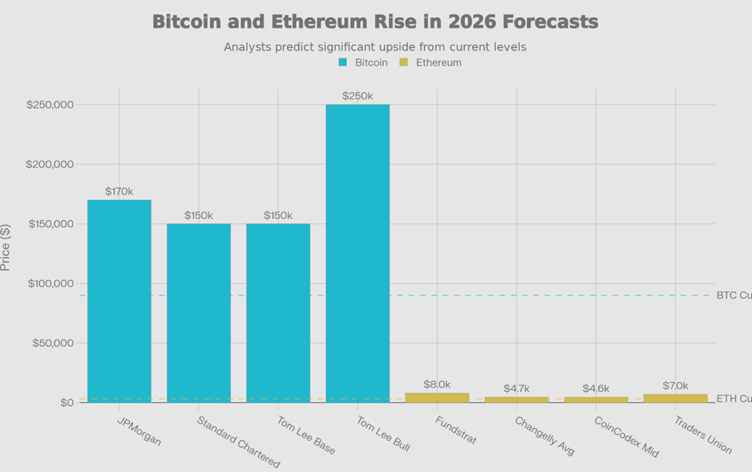

Bitcoin’s 2026 trajectory is a Rorschach test of institutional forecasts. JPMorgan, that paragon of wisdom, dreams of $170,000, while Standard Chartered dangles a $150,000 carrot. Tom Lee, ever the optimist, envisions a $150,000-$200,000 ballet, culminating in a $250,000 crescendo by year’s end. Yet, Fidelity, that cautious old soul, warns of a “year off,” predicting a $65,000-$75,000 slumber. Bloomberg’s bear case, meanwhile, imagines a $10,000 descent if liquidity tightens-a scenario as likely as a snowball’s chance in a sauna. Options markets, ever the gamblers, split their bets: $70,000 or $130,000 by mid-2026, and $50,000 or $250,000 by December. A volatile tapestry, indeed. 🎭📉