BNB’s Historic Crash: What’s Next?

After dropping 89% from its October 2025 high of $1,400, BNB is now trading between $628-$629. That’s like, “Oh, we’re just getting started!”

After dropping 89% from its October 2025 high of $1,400, BNB is now trading between $628-$629. That’s like, “Oh, we’re just getting started!”

In a fresh tale from the CryptoQuant frontier, our trusty trader CryptoOnchain reported a great washing away of the Bitcoin derivatives market over yonder at Binance, the grandest crypto exchange this side of the Mississippi. The magic words here are the Estimated Leverage Ratio (ELR), which has seen a drop faster than a hot potato in recent weeks.

The grander narrative, however, is a tale of tepid cooling-no implosions, thank heavens-where buyers, like overzealous chaperones, guard technical levels with the fervor of a Victorian maiden clutching her corset. Long-term momentum, though, lingers in the shadows, a specter refusing to be exorcised by short-term tremors.

In the wake of this frenzied activity, the data reveals a spectacle most grotesque: 1.6 billion XRP, a sum so vast it boggles the mind, hath been bound to the altar of futures contracts. A 2.56% increase in open interest, they say-a mere trifle, yet enough to stir the hearts of the faithful. But is this a sign of resurrection, or merely the death rattle of a dying beast? Ah, the irony! The more they stake, the deeper they plunge into the abyss of uncertainty.

Meanwhile, funding rates remain slightly positive, indicating neutral-to-bullish positioning in perpetual markets. Technically, Bitcoin continues to print controlled lower highs and higher lows, keeping the path open for a potential move toward $80,000. A move that’s about as likely as a pig flying, but hey, stranger things have happened.

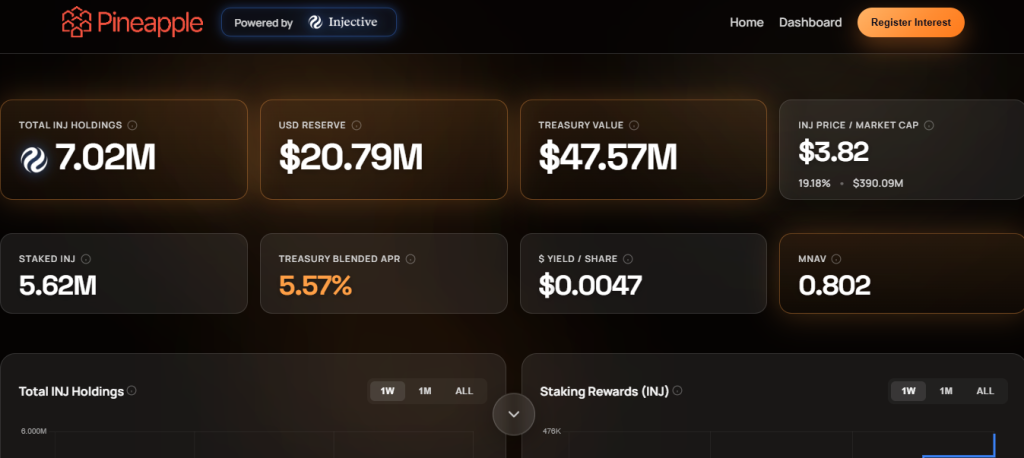

Pineapple Financial (NYSE: PAPL), that paragon of fiscal audacity, has escalated its INJ acquisition spree, splurging $2 million on February 19, 2026, under its market cash purchase program. One might call it a treasury play, but let us call it what it is: a Shakespearean love affair with Injective’s ecosystem. This is no fleeting infatuation; it is a marriage of conviction, sealed with $20.79 million in reserves. The DAT dashboard whispers of 7.02 million INJ tokens-proof, if one needed it, that Pineapple’s heart is not merely in the game, but buried in it.

The acquisition spree? A masterclass in brand repositioning. Hidden Road became Ripple Prime (because “prime” sounds less like a brokerage and more like a Netflix tier). Rail added stablecoin rails. GTreasury cracked corporate treasuries. Palisade? Now it’s just a fancy wallet. All while the OCC gave them a conditional charter in December 2025. “Conditional” meaning, “We’re not sure what we’re doing either.”

Here’s the Bridget Jones-esque saga: Maria Mercedes Diaz Ortiz, thinking she was just depositing a check like a normal human, dropped her husband Jose Maximiliano’s six-figure compensation into her account. Jose, by the way, had already legged it back to Mexico, but not before endorsing the check like a responsible adult. Seems straightforward, right? Wrong.

So, no more new tokens, but hey, you’ve got a whole year to redeem your CNH₮ before it turns into digital confetti. Tether promises a “reminder notice,” which is basically the crypto equivalent of your mom texting, “Are you still alive?”

And so the question gnaws at every trader’s mind: is this the abyss, or merely a pause before the fall? Five signals, each a thread in the tapestry of fate, now converge to decide the answer. Will the market find redemption, or is this the prelude to eternal damnation?