Ah, the tale of Cardano (ADA), a weary traveler on the tumultuous sea of cryptocurrency! This past week, it has plummeted more than 23%, languishing below the $1 mark for over a week. Yet, amidst this stormy weather, some glimmers of hope flicker in the technical indicators, hinting that the downtrend may be losing its grip.

As the winds of change blow, ADX readings reveal that the selling frenzy is waning, while the number of whale addresses continues to dwindle, suggesting that the big fish are offloading their treasures. With these signs, ADA might soon find itself testing the crucial resistance at $0.64. 🐳💸

Cardano’s Current Downtrend Is Fading

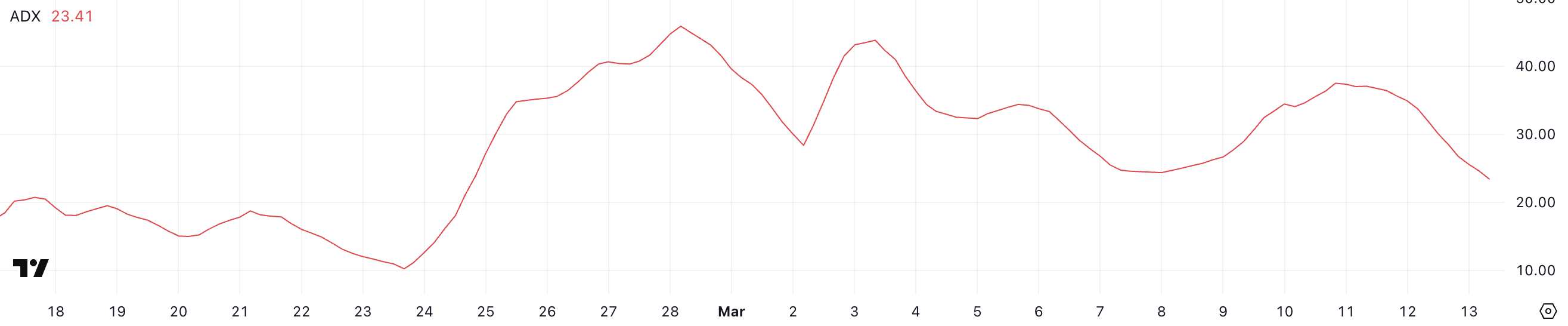

Behold! The Average Directional Index (ADX) of ADA has nosedived to 23.4, a far cry from the 34 it boasted just yesterday and the 37 of the day before. This ADX, a trusty compass for measuring trend strength, ranges from 0 to 100.

Typically, readings above 25 signal a robust trend, while those below 20 whisper of weakness or consolidation. A declining ADX, my friends, indicates that the current trend is losing its ferocity, even if the price continues its downward march.

With ADA’s ADX in freefall, it suggests that the relentless downtrend may be losing its bite. 🐍

Though Cardano remains in the depths of a downtrend, the ADX’s descent to 23.4 hints that the bearish momentum is slowing, though it hasn’t completely vanished into thin air.

If the ADX continues its downward trajectory and dips below 20, it would imply that the selling pressure is fading, possibly paving the way for consolidation or a reversal. But beware! For a true trend shift, ADA would need a surge in buying volume to accompany a rise in ADX, confirming a resurgence of strength.

If the ADX stabilizes at its current levels and begins to rise again, the downtrend could regain its ferocity, keeping ADA under the thumb of pressure in the short term. ⏳

ADA Whales Are Steadily Dropping In The Last Few Days

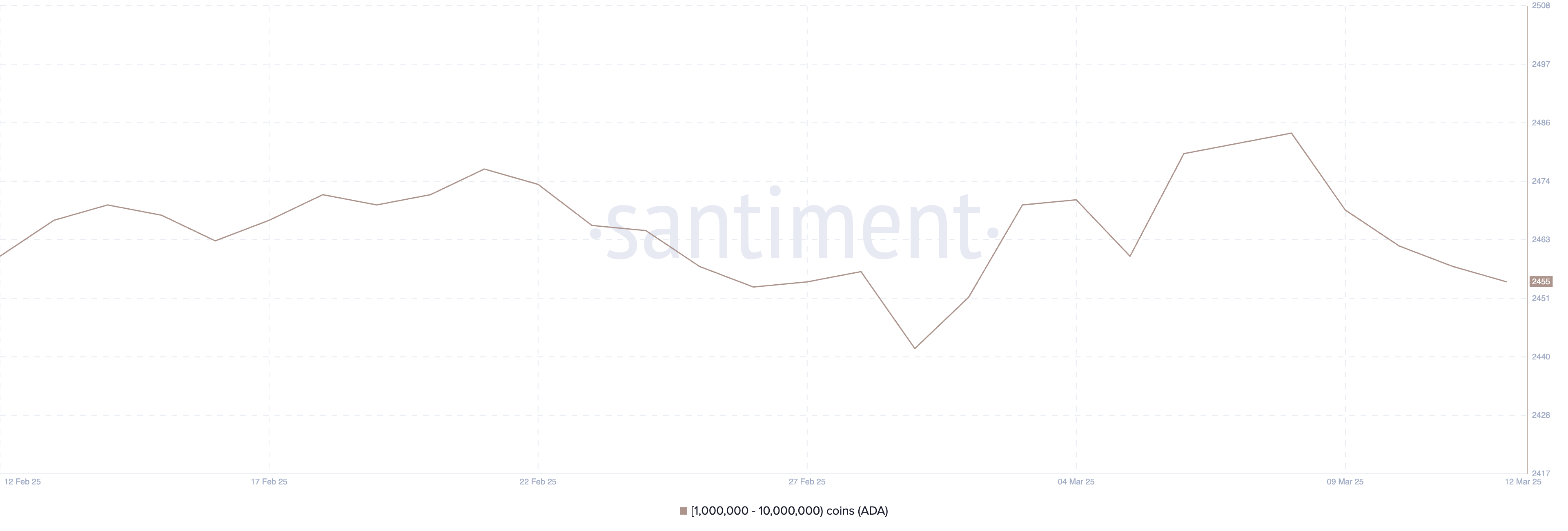

Lo and behold! The number of Cardano whale addresses—those hefty holders with between 1 million and 10 million ADA—has dwindled to 2,455, down from 2,484 on March 8.

This steady decline suggests that the big players have been shedding their positions like a snake shedding its skin. Tracking these whale movements is crucial, for these high-stakes investors often steer the ship of market trends.

When whales gather, it signals confidence in the asset, leading to price surges, while a decline in whale numbers suggests distribution, adding pressure to the market. 🐋💔

With ADA whale addresses now at their lowest since March 2, this trend could indicate a waning confidence among the large holders, despite Cardano’s inclusion in the US strategic crypto reserve.

If this pattern persists, we may witness increased volatility as smaller investors absorb the selling pressure. A sustained drop in whale holdings could also suggest that ADA lacks robust buy support at current levels, potentially prolonging its downtrend.

However, if whale numbers stabilize or begin to rise again, it could signal renewed accumulation, possibly helping ADA regain its footing. 🦈

Will Cardano Rise Back To $1 Soon?

ADA’s EMA lines reveal that Cardano is in a consolidation phase. The short-term EMAs linger below the long-term ones, but the gap is not insurmountable.

This suggests that bearish momentum is not the reigning champion, and a trend shift could occur if buying pressure mounts. If ADA can test the resistance at $0.75 and establish an uptrend, it could ascend toward $0.81.

A stronger bullish breakout could propel Cardano’s price higher, with potential targets of $1.02 and even $1.17

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Oblivion Remastered: How to get and cure Vampirism

- Does Oblivion Remastered have mod support?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DODO PREDICTION. DODO cryptocurrency

- Kingdom Come Deliverance 2: Top 5 Best Bows & Arrows

- Top Potential TGEs To Watch Out For in Q1 2025

2025-03-14 04:04