Cardano (ADA) is plummeting like a Soviet-era satellite re-entering Earth’s atmosphere, down nearly 10% in 24 hours and a staggering 29% over the past week. Since its grand inclusion in the U.S. strategic crypto reserve, ADA has nosedived 39%, leaving bulls scratching their heads and bears feasting on the carnage.

Indicators like BBTrend and DMI are painting a grim picture, with sellers firmly in the driver’s seat. If this downward spiral continues, ADA might just test key support levels, though a miraculous reversal could send it soaring toward resistance zones. But let’s not hold our breath, shall we? 😏

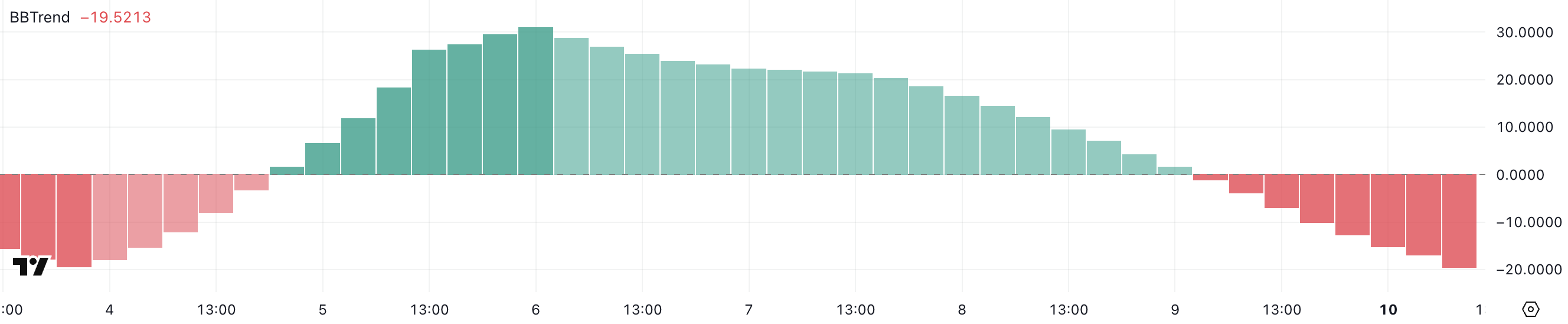

ADA BBTrend: The Bearish Symphony Plays On

Cardano’s BBTrend indicator is currently at -19.52, continuing its descent into the abyss. Earlier this month, from March 5 to March 8, BBTrend was all sunshine and rainbows, peaking at 31 on March 6.

But alas, the party’s over. The shift from positive to negative territory screams of a weakening bullish trend, with downside pressure mounting on ADA’s price. Traders are now glued to their screens, wondering if this decline will persist or if ADA can pull off a Houdini act. 🎩

BBTrend, or Bollinger Band Trend, is an indicator that measures price trends based on Bollinger Bands. It’s like a weather vane for crypto, showing whether an asset is in a strong, bullish, or bearish phase. When BBTrend is positive, it’s all green pastures and unicorns. Negative values? Well, that’s when the bears come out to play.

With ADA’s BBTrend now at -19.52, it’s a clear signal that bearish sentiment is intensifying. Unless buyers step in, ADA might just keep tumbling down the rabbit hole. 🐻

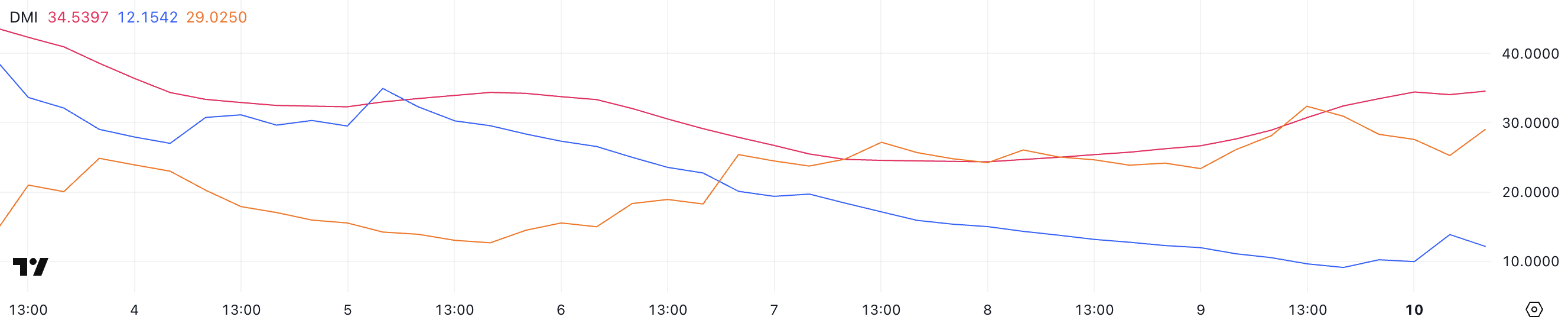

Cardano DMI: Sellers Are Having a Field Day

Cardano’s Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) has risen to 34.5, up from 26.6 yesterday. This increase suggests that ADA’s current trend – whether bullish or bearish – is gaining strength.

Given that ADA is in a downtrend, the rising ADX indicates that selling pressure is intensifying, making it harder for the price to reverse in the short term. It’s like trying to swim upstream in a river of molasses. 🍯

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 indicating a strong trend and above 50 suggesting an extremely strong trend.

Meanwhile, ADA’s +DI (positive directional index) has climbed to 12 from 9.6 yesterday but is slightly down from 13.8 a few hours ago, indicating weak bullish attempts.

At the same time, -DI (negative directional index) is at 29, lower than yesterday’s 32.3 but rising from 25.2 a few hours ago.

This suggests that while sellers still control the trend, some short-term pullbacks are occurring. If -DI remains dominant and ADX continues rising, ADA’s downtrend could extend further. It’s a bear’s world, and we’re just living in it. 🐻🌍

Will Cardano Fall Below $0.60? The Million-Dollar Question

Cardano’s EMA lines indicate that a potential death cross could form soon, signaling bearish momentum.

A death cross occurs when a short-term EMA crosses below a longer-term EMA, often leading to increased selling pressure. It’s like the grim reaper of technical analysis. 💀

If this bearish crossover happens, ADA’s price could decline further, with the $0.58 support level becoming a key area to watch. A breakdown below this level could trigger even deeper losses. It’s like watching a slow-motion train wreck. 🚂💥

However, if buyers regain control and ADA can reverse its trend, the price may rise toward the $0.818 resistance level. A breakout above that could open the door for further gains toward $1.02 and even $1.17 if momentum strengthens. But let’s be real – that’s a big “if.” 🤷♂️

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-11 02:24