In my recent research, I’ve observed an impressive surge in the value of Cardano (ADA) over the past few days. This upward trend has led to a significant increase in realized profits for many investors. Consequently, some large-scale holders, often referred to as “whales,” have been motivated to sell their ADA tokens, aiming to secure these profits.

Based on this analysis, there’s a possibility that Cardano might lose some of its recent progresses in the coming days. Here’s why.

Cardano Whales Take Profit

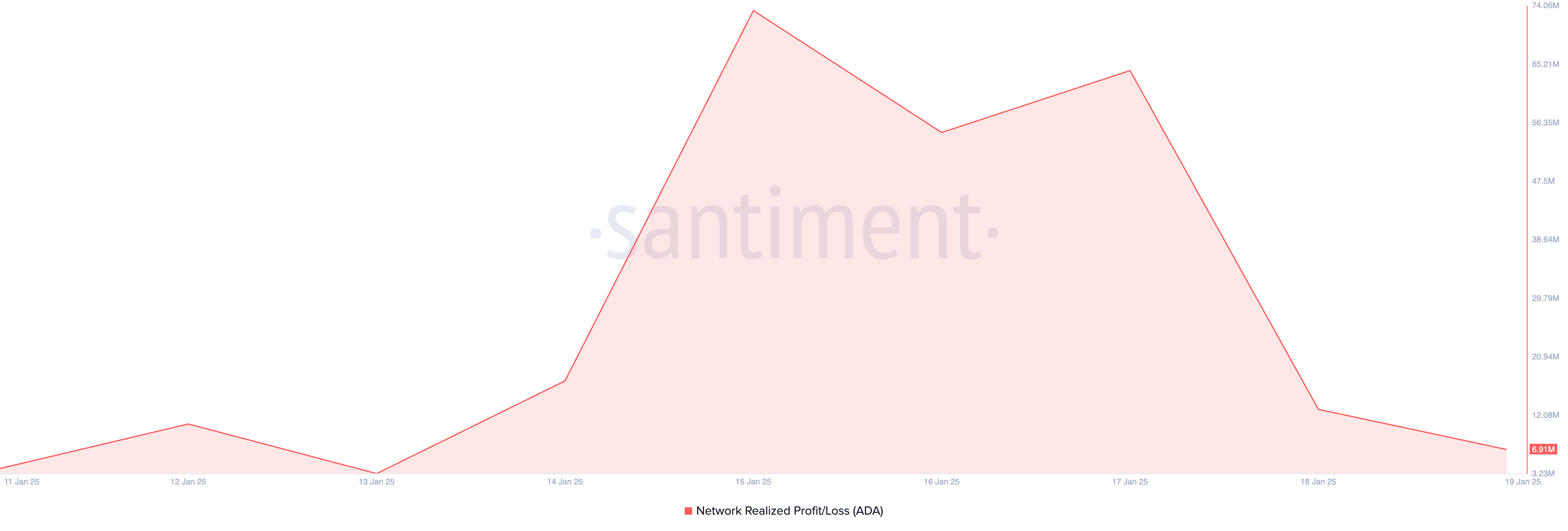

Recently, the increase in Cardano’s price over the past several days has resulted in an uptick in real earnings for its owners. To clarify, these real earnings peaked at a weekly high of approximately $73.33 million on January 15, as the value of ADA approached $1.15.

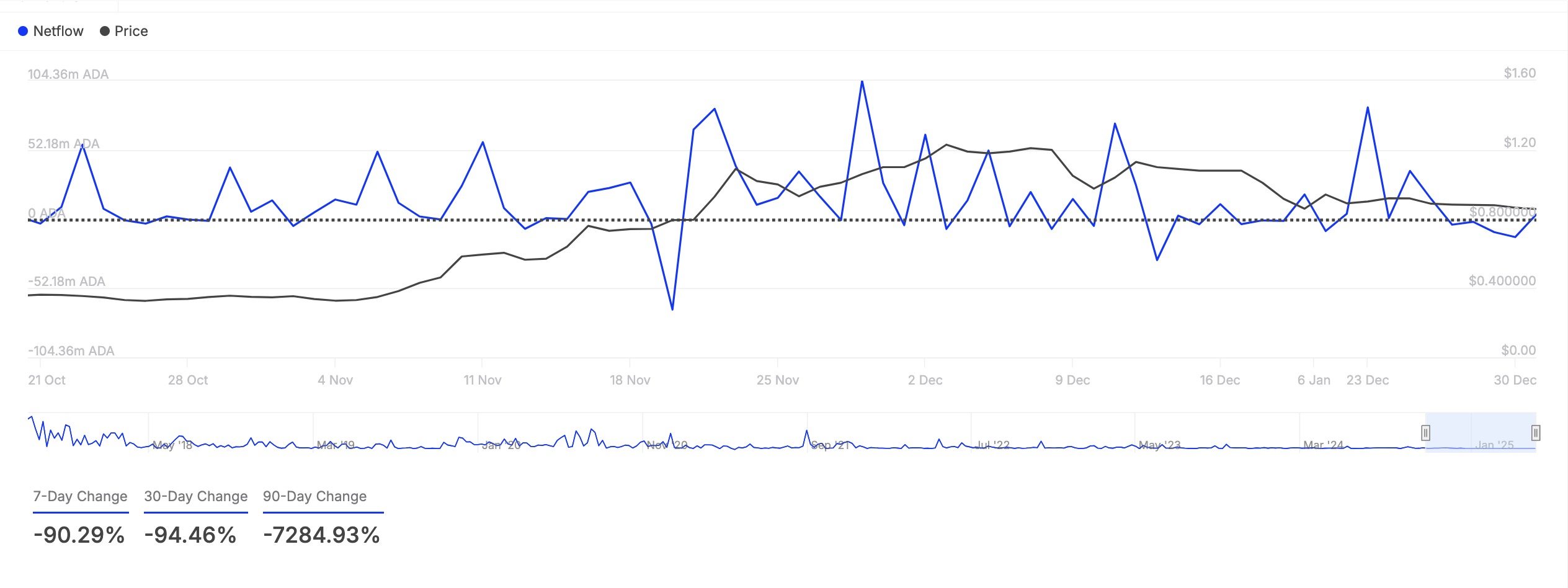

The significant rise in actual earnings from ADA has prompted a surge of coin dispersal among big ADA holders, as indicated by the substantial decrease in the outgoing transactions of large holders (their netflow). Over the past week, this netflow has dropped by approximately 90% according to IntoTheBlock.

In simpler terms, “Large holders” refer to digital wallets identified as ‘whales’ because they possess over 0.1% of a given asset’s total circulating coins or tokens. The netflow of these large holders indicates the variation between the amount they sell versus purchase during a particular timeframe.

As an analyst, I’ve observed that a surge in the net flow of a particular asset suggests it is being transferred to large wallets, often referred to as ‘whale wallets’. This movement indicates accumulation, meaning these whales are buying up the asset. For instance, this has been seen with ADA. Conversely, when there’s a decrease in net flow, it implies that large holders are offloading their assets. This could be a sign of an upcoming price drop or a change in market sentiment.

ADA Price Prediction: Breakout Retest Fails, Reversal Likely

Examining the ADA/USD daily price chart shows that an earlier breakout attempt was unsuccessful, causing the coin to return to a symmetrical triangle pattern which it had previously exited.

If a second try at breaking out fails for an asset, it means that the price couldn’t hold the breakout point, suggesting fragile support. This indicates that the upward trend in ADA may be reversing. If the downtrend persists, the price of ADA might drop to $0.94.

Conversely, should the overall market’s outlook become more optimistic, there’s a chance that Cardano’s (ADA) price might surpass the top boundary of the symmetrical triangle. This upper line currently serves as a resistance level around $1.03.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-01-20 01:11